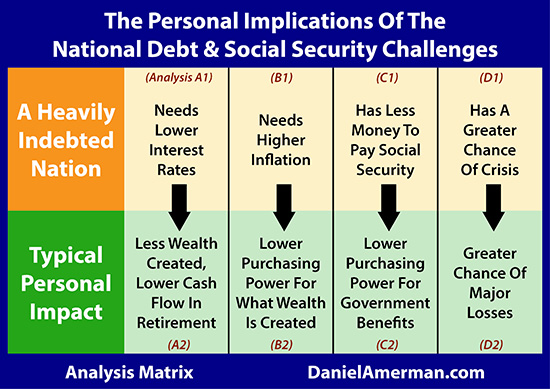

Analysis Matrix: The Personal Challenges Created By The National Debt

By Daniel R. Amerman, CFA

Tweet

As is shown in the first row of the matrix (the analyses are linked below), the sheer size of the United States national debt creates major challenges when it comes to interest rates, inflation, financial stability and the ability to make Social Security and Medicare payments in full.

As is examined in the second row of analyses in the matrix, each of those national challenges can directly translate to life-changing personal challenges as well.

Everything is interrelated, and the nation's financial problems are all too likely to create corresponding financial challenges for savers and retirees - whether they see the mechanisms for the transmission from the nation to individuals or not. Which creates major incentives to make retirement and other financial plans that are aligned with this environment - rather than ignoring it.

A1 Analyses: A Heavily Indebted Nation Needs Low Interest Rates

How Planned Fed Rate Increases Impact The National Debt & Deficits

Does The National Debt Supercycle Override The Normal Interest Rate Cycle?

A2 Analyses: The Personal Impact Of Low Interest Rates

Five Graphs That Explain How The Fed Creates Extreme Investment Price Movements

Can A Nation $20 Trillion In Debt Afford Higher Interest Rates & Will This Change Our Retirements?

How The National Debt, Interest Rates, & Inflation Can Change Investment Outcomes (Series Overview)

Individual Financial Decisions & The Investment Implications Matrix

How Do Low Rates & Inflation Work Together To Challenge The Foundations Of Retirement Investing?

B1 Analyses: A Heavily Indebted Nation Needs Higher Inflation

Higher Interest Rates May Force Higher Inflation Rates

B2 Analyses: The Personal Impact Of Higher Inflation

The Profoundly Personal Impact Of The National Debt On Our Retirements

C1 Analyses: A Heavily Indebted Nation Has Less Money To Pay Social Security

Two Sets Of Books & The $5 Trillion Perfect Crime

The Imminent Multi-Trillion Dollar Surge In Social Security & Medicare Costs

C2 Analyses: The Personal Impact Of The Squeeze On Social Security & Medicare

Making Optimal Social Security Claiming Decisions

Social Security & Medicare For Individuals Analysis Series

Game Theory & Retirement Choices - Should You Get Yours, Before Everyone Else Tries To Get Theirs?

The Social Security Inflation Lag Calendar - Partial Indexing Part 1

Out Of Money By December 12th - Social Security Partial Inflation Indexing Part 2

D1 Analysis: A Heavily Indebted Nation Has A Greater Chance Of Crisis

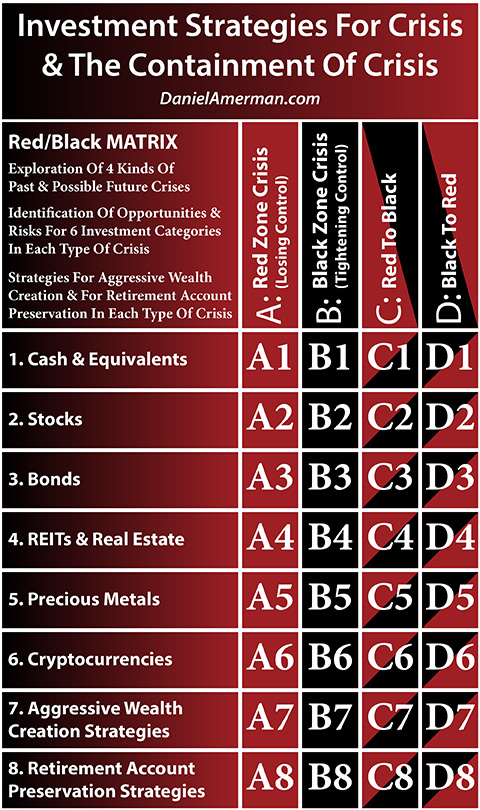

Analysis Series: Crisis & The Containment Of Crisis

The ABCs Of Popping A Third Asset Bubble

Bubbly Assets & Bumbling Surgeons

How The National Debt & Surging Benefits Will Transform Retirement Planning

D2 Analyses: The Personal Impact Of Potential Crises

Does The Containment Of Crisis Create Record Investor Wealth?

Pension Shortfalls Could Be 4X To 7X Greater Than Reported