Two Sets Of Books & The $5 Trillion Perfect Crime

By Daniel R. Amerman, CFA

The United States government quite openly maintains two sets of financial books.

In one set of books, we have the largest and safest savings account in the world. These savings are the Trust Funds, where $5.4 trillion of financial reserves are held for Social Security as well as federal civilian and military employee retirement programs. Everyone's mandatory payroll deductions were taken over a period of decades and invested in the safest of all securities - United States Treasury obligations, backed by the full faith and credit of the federal government.

This set of books reassures the general public that the money is there to pay them, because their payroll taxes were saved for them - and it would be absurd or even reckless to suggest otherwise.

There is a second set of books, such as those kept by the Congressional Budget Office (CBO) and the White House Office Of Management and Budget (OMB). In this set of books, which is used for estimating future budget deficits and national debts, only the $14.2 trillion in "publicly held debt" (which excludes the Trust Funds) is treated as being real debt, and the only real cash expense going out into the future is "net interest expense" - with that being interest paid to the public.

Because the Trust Funds are money that the government owes to itself, it would be absurd to treat one part of the government paying another part as real cash flow for the government as a whole, or one branch of government paying another branch interest payments as real expenses or income.

This is exactly what the CBO and OMB do with their budget projections. They net out the Trust Funds and net out the interest payments on the Trust Funds as not really existing.

The contrast is quite open and quite sharp. In the long-term projections from the Social Security Administration, the principal amount of the Trust Funds and the interest income from them are the source of security for the payments of benefits long into the future - they are the foundation that is necessary to maintain the financial viability of Social Security. Yet, the CBO and OMB don't even include the various trust funds as real debt in their main projections, or include the interest payments as an expense, they are more of a footnote.

The two sets of books contradict each other and cannot be true simultaneously.

If these two sets of books were kept by a private company, it would likely be treated as fraud. A $5.4 trillion fraud to be exact, which would be by far the largest in financial history. And the reconciliation of the books when the fraud was uncovered - would be extraordinarily painful for the investors.

The reconciliation of the two sets of books kept by the government is mandatory, it will be extraordinarily painful, it will likely transform both the investment markets and the retirement benefits for many tens of millions of people - and it is on the way.

The First Set Of Books

The purpose of the Trust Funds is to make payments for Social Security and other government retirement programs (primarily federal civil service and military retirees) at a time when tax revenues are no longer sufficient to do so.

As presented in the first set of government books, this is very similar to how individual retirement savings and pensions work. Workers save their entire careers through mandatory payroll tax deductions. Those savings are invested. When needed, the savings are drawn down over many years in retirement, to maintain a standard of living that would otherwise be unaffordable.

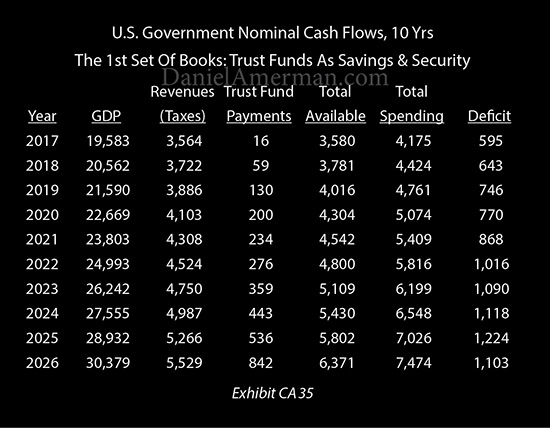

The numbers above show the anticipated drawdown of the Trust Funds. All Trust Funds are shown as being drawn down at the same pace as the Social Security Trust Funds in the CBO Long Term Outlook.

In fiscal year 2017, only $16 billion is taken from the Trust Funds. When this is added to total federal revenues of $3,564 billion ($3.6 trillion), this means $3,580 billion of cash is available. Federal expenses are $4,175 billion, and that means the annual budget deficit is $595 billion.

By 2020, the pace is picking up, $200 billion of the national savings is used to make retirement benefit payments, and this keeps the national deficit down to $770 billion (instead of $970 billion).

As the Boomers age, the cost of the government retirement programs surges upwards at a rapid pace, far exceeding anything that we have seen to date (as analyzed here.) By 2026 these extraordinary expenses require the Trust Funds to be drawn down at a rate of over $800 billion a year. This is necessary, to keep Social Security payments being made in full, while still keeping the annual deficit down to about $1.1 trillion.

(These exhibits are excerpted from the research report "How The National Debt & Surging Benefits Will Transform Retirement Planning". A full description of the research report is linked here. Key assumptions for the CA and CB scenarios shown herein include a 2% real long term economic growth rate, a 2% increase in average interest rates, and a 3% long term average inflation rate.)

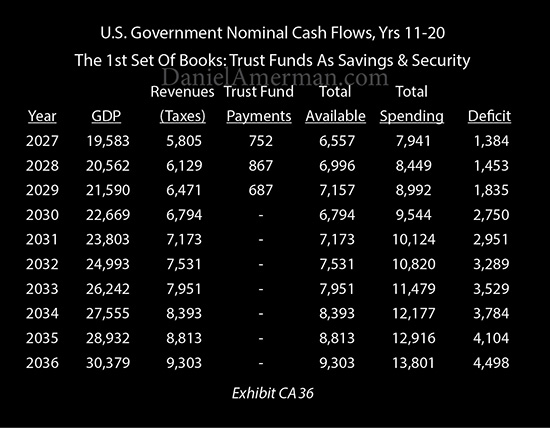

Very high redemptions of the national savings creates the cash to allow retirement benefits to be paid in full right up until the year 2029 - and then they run out. The national deficit almost doubles from near $1.5 trillion in 2028, the last year that the Trust Funds can support full payments, to almost $2.8 trillion in 2030, the first year that the savings are entirely depleted. This depletion and the blanks in the "Trust Fund Payments" column means that payment of full retirement benefits from that point forward would lead to an annual budget deficit of $3 trillion by the year 2032, and $4 trillion by 2035 (based upon the current tax structure).

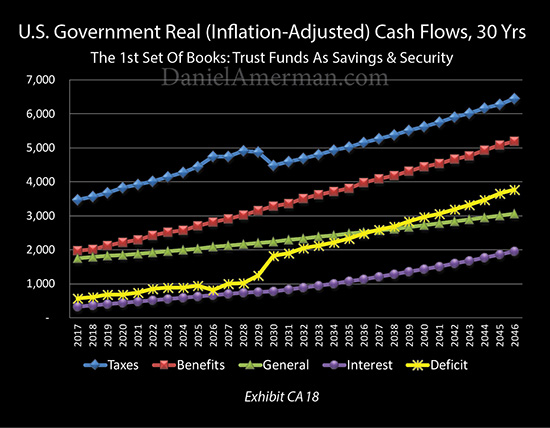

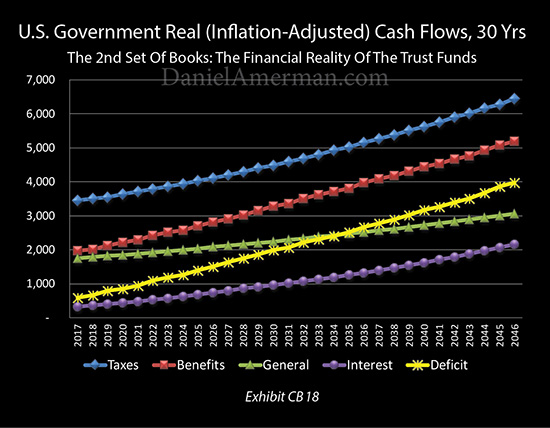

The importance of the Trust Funds can be starkly seen when we look at real (inflation-adjusted) government cash flows above. The problem is what we have known was coming for decades - the red line of benefits surging upwards as the Boomers retire and age in retirement. This would lead to an explosion in the yellow line of deficits - but the blue line of government revenues jumps upward as well, as the Trust Funds are redeemed. This extra cash then holds the yellow line of the deficits down - until the cash runs out.

The depletion of the Trust Funds is boldly obvious in the graph above. When the cash runs out, the blue line of cash available plunges down, the yellow line of annual deficits jumps up, and from there forward is pulled upwards by the continuing increase in the red line of retirement benefits.

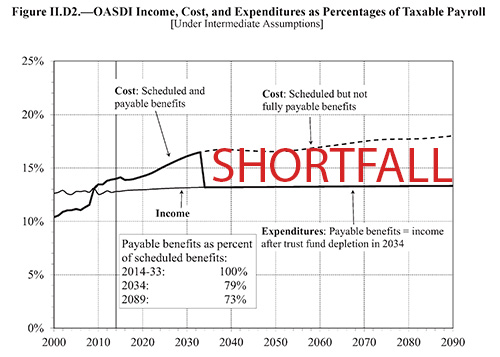

The dependence of Social Security upon the Trust Funds in the first set of books, and what happens when they run out, is also boldly obvious in the government graph above. It is excerpted from the 2015 Trustee Report for Social Security (only the word "SHORTFALL" was added). After the Trust Funds run out, there is a top line that says "Scheduled but not fully payable benefits", and a lower line that says "Payable benefits." Everything is paid in full until the savings run out, and then a major and obvious financial gap is created.

(The year for depletion is 2034 above, because the Social Security Administration uses even more optimistic economic assumptions than the CBO, which creates larger assumed tax revenues, and slows down the depletion of the Trust Funds.)

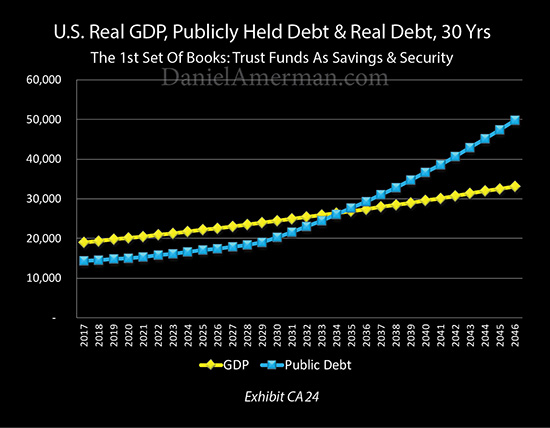

Another dramatic and obvious benefit from the Trust Funds can be seen in the graph above of the size of the U.S. economy versus the publicly held national debt (which was $14.17 trillion as of the end of the 2016 fiscal year).

Even with the increase in retirement benefits, the Trust Fund savings makes it possible for the public debt to hold almost steady, rising at a very slow rate in inflation-adjusted terms. When the savings run out - the turn in the line is boldly obvious, and the national debt soars from that point forward.

Whether we are looking at deficits, the national debt, or other measures, every one of the exhibits above has two things in common.

One commonality is that the crucial importance of the Trust Funds is boldly obvious. It should be. This is $5.4 trillion. This is decades of mandatory payroll tax savings for tens of millions of people. The spending of the $5.4 trillion when the people get their money back should be unmistakable.

The other commonality is that the Trust Funds only last for so long, and then things get bad. That's life - there simply aren't enough savings. But at least, through our years of mandatory contributions, we have bought ourselves some time. Looking from 2017 forward, then while the exact date may vary depending on the assumptions - we are covered for a good long time. The real problems are far away and we have a "grace period" of sorts before that time.

The Second Set Of Books

There is a second and quite different set of books that the government openly keeps.

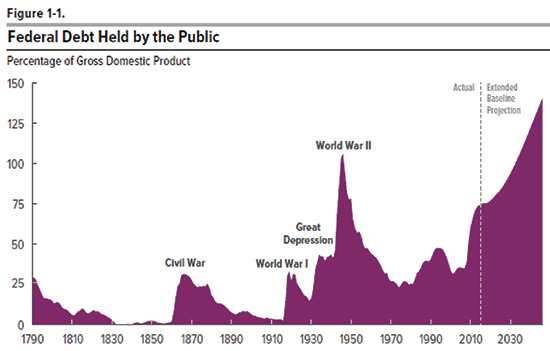

The above graph is from the Congressional Budget Office Long Term Outlook. The first item to note is that the federal debt is shown as being "only" about 75% of the size of the U.S. economy, and our current near $20 trillion total debt is over 100% of the size of the economy. The reason is that the debt is shown as being so much lower is that the CBO doesn't count the $5.4 trillion that the Trust Funds have invested in U.S. Treasury obligations as being real debt - or real assets.

Indeed, it is not just assets, but interest payments. All the CBO interest payments are run on a "net" basis, with the net meaning that interest payments to the Trust Funds are netted out and ignored.

And as can be seen above, when the CBO looks to the future (even with quite optimistic economic assumptions) they show fast rising deficits, and a smooth and unbroken growth in the national debt.

The necessary and obvious major distortion that the cashing out of the Trust Funds caused in every one of our prior graphs - doesn't exist in the CBO's set of books. As far as their numbers show - the spending down of the Trust Funds has no effect whatsoever on deficits or the debt. It is as if the foundational security for our future Social Security payments - doesn't even exist.

The White House Office of Management and Budget keeps a very similar set of books. The Trust Funds are ignored when it comes to being real debts - or real assets. Interest expenses are always net, and interest payments to the Trust Funds are netted out and ignored. The deficits and the national debt are projected to increase very rapidly with the aging of the Boomers - and there is not even a hint of any impact from the Trust Funds being cashed out.

The reason why is explained in a White House fiscal year 2017 budget document:

"However, issuing debt to Government accounts does not have any of the credit market effects of borrowing from the public. It is an internal transaction of the Government, made between two accounts that are both within the Government itself. Issuing debt to a Government account is not a current transaction of the Government with the public; it is not financed by private saving and does not compete with the private sector for available funds in the credit market. While such issuance provides the account with assets—a binding claim against the Treasury— those assets are fully offset by the increased liability of the Treasury to pay the claims, which will ultimately be covered by the collection of revenues or by borrowing. Similarly, the current interest earned by the Government account on its Treasury securities does not need to be financed by other resources."

For those who like to read the above in its original context, it is on pdf page 3 of the document linked below.

https://www.whitehouse.gov/sites/default/files/omb/

budget/fy2017/assets/ap_4_borrowing.pdf

The federal government itself knows full well - and always has known - that the Trust Funds are an "internal transaction" that the government has made between two of its own accounts. The so-called $5.4 trillion in Trust Fund assets are "fully offset by the increased liability of the Treasury to pay the claims, which will ultimately be covered by the collection of revenues or by borrowing."

Yes, the Trust Funds do exist on a legal level - but only as claims on the U.S. Treasury. They are an IOU that the government has written to itself, with no assets to back it up. To get the cash to pay the claims, then the government either needs to raise taxes or borrow more money. And in the same amounts as if the Trust Funds didn't exist in the first place.

We need to keep in mind that the assets did used to be there. They were created with our money, our decades of mandatory payroll tax deductions that we were told were being put into savings to help fund our retirements. The problem is that our money is long gone. The government spent it as soon as the funds were received, and the real assets were replaced by paper IOUs, with nothing to back them up - other than the taxing and borrowing power of the government in what used to be the distant future.

In many ways the Trust Funds can be viewed as a classic case of financial fraud. Savers put money in over a period of decades, and they receive statements showing them their savings. In the set of books that is shown to them, they have genuine financial security, and their retirements will be funded for years and even decades to come.

There is a second set of books that reflects reality (and keeping a second set of books is always quite deliberate). In this set of books the money is long gone. And future budgets make no allowances for giving the money back, except by getting money from other people.

The $5.4 trillion in the Trust Funds would be the largest financial fraud in history except for one factor - this is being done by the United States government. So it isn't actually illegal. There are many things that governments can do quite legally which others can't, and keeping two sets of books for the explicit purpose of deceiving taxpayers (and retirees) is one of them.

The Perfect Crime

The real cost of a financial fraud does not occur when we are paying in our savings. But rather it is felt when we try to take them out - and they aren't there. This is just as true for our nation with the Trust Funds as it is with a more conventional private fraud.

None of us have experienced this yet. But we will be, and soon. However, the form will be different with a government "fraud" than it would be with a private fraud.

With a private fraud, when "the jig is up", the money just isn't there, and it is lost. And some might think that the Trust Funds not being quite real means that they won't be paid out, and there might some major and obvious default, where Social Security and other government retirement programs are unable to make payments in full.

That easily understandable type of loss is highly unlikely, however

Instead, every dime of the Trust Funds is likely to be cashed out exactly on schedule with the money from the redemption of the U.S. government securities going to the retirees just as promised.

So what is the problem? Was there a crime at all?

To answer this, let's consider the nature of a perfect crime:

1) Take money from the victims, claim to save it, and spend it instead.

2) Eventually pay them back in full - by taking more money from the victims, and using their own money to make the payments to them.

3) Do this in a manner that is just complicated enough that the victims will never catch on to what is happening.

If we substitute "people of the United States" for the word "victims" - then we have a near perfect description of how the Trust Funds for Social Security and federal employee retirement systems actually work. This is indeed a "perfect crime."

Keep in mind that everything is easy when we are paying the money in - and that is what has happened for the nation so far. We have been paying the money in, and in one set of books, those kept by Social Security and the other government retirement funds, the money is still all there.

The painful part is when we try to get our money out - and it isn't actually there at all. That hasn't happened yet, not on a significant scale. It is when the Trust Funds are actually redeemed that the pain for the nation will begin.

When this happens - and it will be starting very soon - then the cost will be staggering. As one would expect with a $5.4 trillion "fraud."

With the government, the money isn't there - but it can be borrowed. Indeed, absent some sort of meltdown event, it must be borrowed - and at a pace like we have never seen before - so that every dime from the $5.4 trillion in the Trust Funds can be paid out exactly on time, or there could be severe political consequences.

The cashing out of the Trust Funds will transform the national debt - and necessarily change the investment markets as a result, including bonds, stocks real estate and precious metals.

It will change the retirement benefits you are likely to receive for the rest of your life. It will change the earnings on your savings, how much you can save for retirement, and what you can spend in retirement. It will likely change your day to day standard of living in retirement.

Calculating The Cost Of The Deception

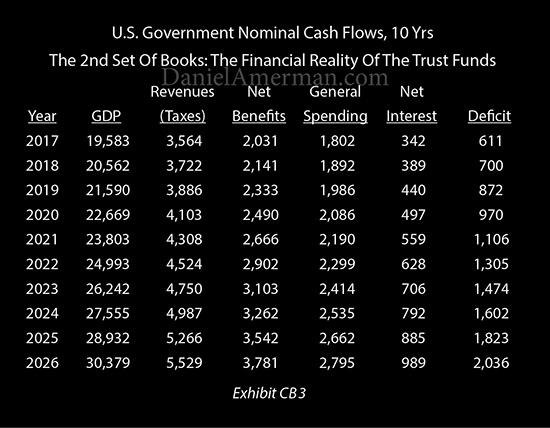

To understood the cost, let's take a closer look at the second set of books, such as those maintained by the Congressional Budget Office (CBO) and the White House Office Of Management and Budget (OMB), which is illustrated above in Exhibit CB3.

The government already spent the money that supposed to go into the Trust Funds, all that is left is a claim by the Social Security Administration (and others) on the Treasury Department. When the claim is presented, there is no outside source of funds, there are no real assets. So the deficit rises, and the cash to pay the claim is generated by selling additional U.S. Treasury bonds to the public - just as if the Trust Funds didn't exist at all.

When viewed graphically, we can see economic reality, which is that there is no bulge in the blue line as outside assets generate additional cash, and that means there is no depression in the yellow line of annual federal budget deficits. Instead the deficits soar upwards with the increase in retirement benefits right from the very beginning - because there are no real savings.

The true cost of the government taking our savings while claiming it wasn't, is the additional borrowings that are necessary to redeem the Trust Funds. Dollars that would not need to be borrowed if there were actual assets there, as we are assured there are.

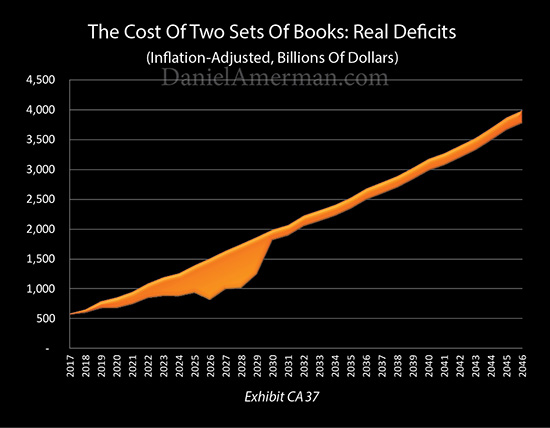

The cost of reconciling the two sets of books is the orange area in Exhibit CA37 above, which is the gap between the yellow deficit lines in the preceding individual graphs.

The bottom of the shape is formed by the annual federal government budget deficits (inflation-adjusted) with the first set of books, and the Trust Funds being real assets (Exhibit CA18). If there were savings in the sense that any ordinary person understands them to be - assets to be tapped - then the deficits are kept down for so long as the savings last.

The top of the shape is formed by the yellow line of the annual deficits with the economic reality of the second set of books (Exhibit CB18). This is the same methodology used by the CBO and OMB, and in this case, because there are no real savings, every bit of the payments to retirees from the Trust Funds is financed by new borrowings - which radically increase the real level of the national debt, as well as the interest expenses on that debt.

The area in-between is deficits that will occur, but that would not have occurred if the Trust Funds had actually been invested in real assets. This is the true cost of the "fraud" - it is the increase in debt, and the interest payments on that new debt.

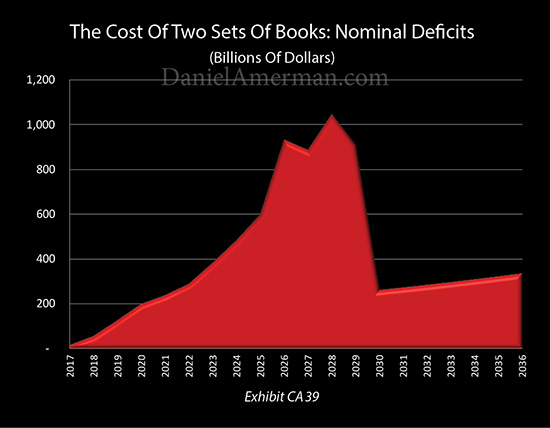

Exhibit CA39 above shows the same relationship in a different way. We now see the deficits in nominal terms with no adjustment for inflation - and the amounts are startling. By 2026 the difference in the deficit is up to $900 billion a year (this is different from CA3 because of interest expenses, as further explained below). By 2028 the increase in deficits peaks at over $1 trillion per year, in the last full year before the trust funds deplete.

In recent years it has become easy to be a bit "jaded" with the number of a trillion dollars. There are already so many trillions of dollars being thrown around in different areas - are these particular increases really that significant? Will they impact the average person?

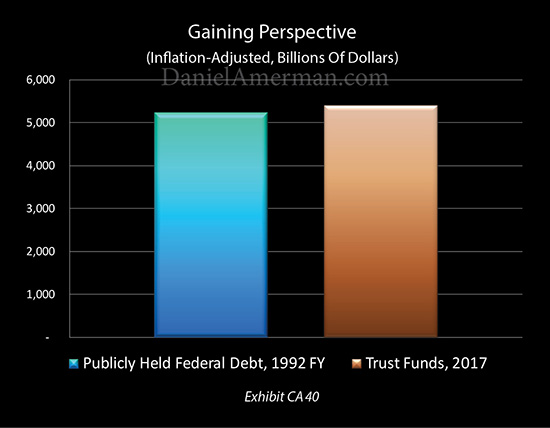

Exhibit CA40 places things in perspective. By 1992, the federal debt held by the public - the amount financed by external investors - had reached $3.1 trillion. This represented over 200 years of federal borrowing. However, the dollar was worth substantially more 25 years ago than it is today. When we adjust for inflation (CPI-U), the total publicly held debt in 1992 was equal to about $5.2 trillion in today's dollars.

The amount of the Trust Funds is currently about $5.4 trillion. As they are redeemed and bonds are sold to pay retirement benefits, external investors will have to be found for that entire amount.

What that means is that even after adjusting for inflation, the government will have to raise more new money to cash out the Trust Funds than the total publicly held federal debt outstanding in 1992 - after over 200 years of previous deficits and borrowing. With all the deficits outside of the Trust Funds occurring on top of that.

That is a fantastic sum of new money that needs to be raised - from something or somebody - in what is usually projected by the government to be somewhere within the next 10 -16 years (with the dates varying depending on the agency and the assumptions).

However, government economic projections tend to be quite optimistic. If a recession were to happen in the next few years, that would depress tax revenues and accelerate the depletion of the Trust Funds, which means the money must be raised much sooner. And if something worse were to occur, such as a trade war or financial crisis, the deficits - and the need to raise cash - could leap upwards at any time.

Multiple Layers Of Costs

Something that may not at first glance make sense in Exhibits CA37 and CA39 above, however, is why the orange and red areas of the graphs keep on going to the right. Once the Trust Funds have been spent - shouldn't they stop?

The problem is that trillions of dollars in new external debt will be taken on. And interest payments have to made on that new debt. Which increases the annual level of deficits. Which then further increases the national debt, and so forth. We will be paying the price of the "fraud" every year for the rest of our lives, even long after the Trust Funds have all been redeemed.

These annual interest payments mean there will be that much less money available for the payment of Social Security and other retirement programs, as well as Medicare, into the indefinite future. Which means there is a good chance that unfortunately (and ironically), the cost of the Trust Funds having been spent instead of invested will ultimately take the form of a reduction in retiree standards of living for decades to come.

Spending what should not have been spent may therefore invert what the public has been told in two distinct ways. One is that borrowing to redeem the Trust Funds will accelerate financial problems for the nation, rather than acting as a buffer against such problems. And over the longer term, retiree standards of living are likely to be decreased rather than increased, with this potentially being true for the rest of our lives.

But the federal government is quite unlikely to ever point that out, and the general public is unlikely to ever understand this. Instead they will see three distinct things presented to them.

One of them is that the Trust Funds are real, they are fully invested in the safest investments in the world, and these investments will indeed be successfully cashed out in full. There will be no default, the trillions in savings will cover many years of paying benefits to retirees, and it would be ridiculous to suggest otherwise.

Entirely separately, there will be a fantastic surge in new external federal borrowing that comes out of nowhere in the coming years and transforms the markets, while also likely turning many of the assumptions that traditional retirement financial planning is based upon upside down. Who could have known? It will just be the situation.

And also entirely separately, once the Trust Funds have been redeemed, the servicing of that massive new external federal debt will be reducing the amount of money available to pay federal retirement programs for decades into the future. We will be taking the net interest costs paid to outside investors today, and adding on top of that the equivalent of the entire debt costs that the government was paying 25 years ago. That financial squeeze could be painful when it comes to daily standards of living for retirees - but it will just be reality, and who could have known?

Paying The Piper

The Trust Funds "fraud" is one of several reasons why the future within a five to ten year horizon must behave in a way that is quite different from the past. (There are powerful investment implications for the next several years as well.)

The 2010s to date may have seemed strange compared to previous decades - but we are still just getting started. The quantitative easing and creating trillions of dollars out of thin air, the lowest interest rates in history, and the resulting run-up in stock and real estate prices - those were all unprecedented and even bizarre, but they were also just the warm-up.

Many people are anticipating that normality will be returning to the markets as the financial crisis of 2008 continues to recede into the past. And if it weren't for the increase in the national debt, the coming surge in retirement benefit payments - and the unwinding of the Trust Funds "fraud" - they would hopefully be correct.

Just one piece of the puzzle is what we have reviewed in this analysis. The real meaning of the Trust Funds - which is the direct opposite of what the federal government assures the public - is that the Treasury Department will be developing a voracious appetite for new cash over the coming years, to an extent that none of us have seen in the past. They have to get that money from somewhere. Or somebody.

Simultaneously, the rapidly increasing total national debt held by the public will make the financial viability of the United States ever more dependent on keeping interest rates very low.

So, the government will have a record need for new cash - which usually involves paying higher interest rates - even as its ability to pay existing interest rates is going the other direction.

This toxic relationship has been "baked" into the Trust Funds ever since the decision was made to use them to finance the national debt instead of making genuine investments, but we have not yet seen the price. Because until recently, the eventual high cost for the nation seemed far in the distance.

That is no longer the case, and the time is now approaching rapidly when "the piper must be paid".

Paying the piper for the Trust Funds by itself - as the need for new funding surges while the ability to make interest payments to investors in exchange for that funding declines - will transform the bond markets. It has to. This will likely dramatically change stock market prices and returns. Even as powerful incentives are created for the government to increase the rate of inflation.

Real estate prices may go to a place that we have never seen before. And there is a very good chance that retirement account regulations will change as well, in ways that may lead to increased funding for the government.

Mysteries Versus Quantifiable Knowledge

For most people, the reconciliation of the two sets of books is likely to lead to a long series of surprises over the coming decade and beyond.

The unfortunate part is that this is not some dark and unknowable mystery. Rather, the redemption of the Trust Funds is a quantifiable process. Using the tools of financial analysis, numbers and graphics can be used to fully identify what is happening, how the process works and what the relationships are.

Yes, this is complicated. Just trying to reason it out is very difficult to do, particularly for someone who is not a professional analyst. This is particularly the case because one could say that the whole purpose behind using two sets of books, each of which are highly complex, is to make it impossible for the public to understand what is happening.

But, starting with the analysis as a base - this can be entirely understandable. The $5.4 trillion redemption of the Trust Funds can be explained. It can be intuitively understood by people who have never taken a finance or economics course, as well as by financial professionals.

Whether the word fraud should be applied to the $5.4 trillion in purported savings that have already all been spent by the government is an individual decision, with strong emotional and political aspects. But the approaching reconciliation of the two sets of books is not about emotions or politics.

Reality just is what it is. And reality is that the nation will be going through a quantifiable and understandable $5.4 trillion financial process that because of its sheer size is likely to influence and change investment markets and results in almost all categories. Most people will be "flying blind" as this happens when it comes to their investment and retirement choices - and are unfortunately, likely to end up paying the price for that.

***************************************************

Read Chapter One Of "The Homeowner Wealth Formula"

Read Chapter One Of "The Eight Levels Of Homeowner Wealth Multiplication"