The Triple Strategies Value Set

Three completely different groups of strategies, three completely different kinds of solutions, 17 DVDs & 3 Manuals - SAVE $700

The purchase page for the Triple Strategies Value Set is linked here.

It is easy to write about problems - but solutions, particularly fresh solutions, can be a different matter. The three financial education DVD sets above all are all quite different from each other, but each contains fresh types of practical, applied investment strategies for individual investors in uncommon times. The DVD sets are the result of 14 years of solutions development work.

Each is based on a different premise - and can serve different needs, situations and preferences - although none are contradictory or mutually exclusive. Ideally, the best of each can be taken for an individual's situation and desires, in combined strategies that work better than any of the individual components.

(The above video is from "Gold Out Of The Box, 2020s Edition". Brochure link here.)

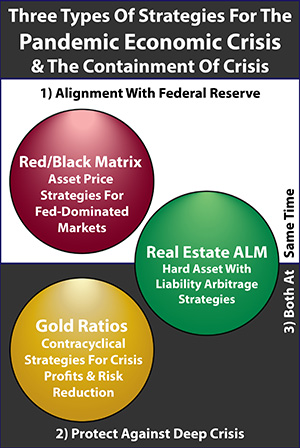

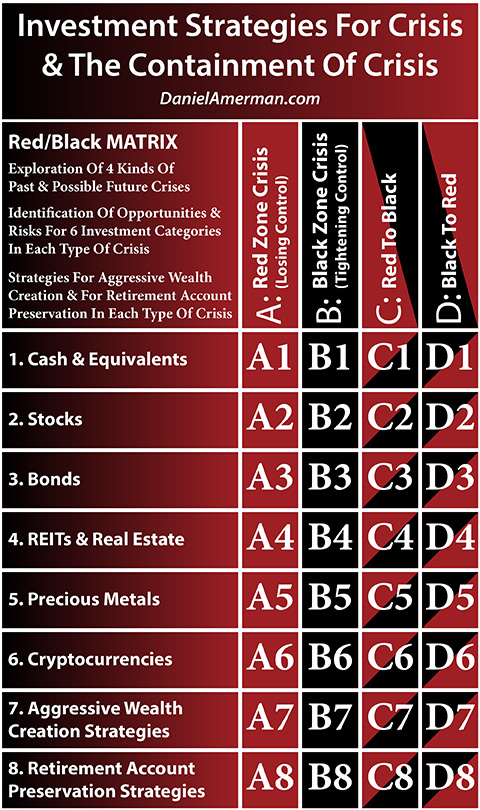

Investment Strategies For Crisis & The Containment Of Crisis

The brochure for the "Investment Strategies For Crisis & The Containment Of Crisis" is linked here. This set has the closest relationship to the current free book, the sign up page for which is linked here.

The fundamental premise of the series and the book, as introduced in Chapter One (link here), is that we are not in normal investment times, and we have not been so for almost 20 years.

Instead we are in a time of extraordinary and heavy-handed interventions by the Federal Reserve that are dominating investment prices and returns in all investment categories.

This produces extraordinary new profit opportunities - from nontraditional sources - for each of the investment categories, including stocks, bonds, real estate and precious metals, and this is particularly the case during times of transitions in the cycles.

This also necessarily a time of unprecedented dangers for losses that can greatly exceed what we might expect from the historical record or long term averages.

The dominant influence is Federal Reserve interventions, which are far from random - but deliberate interventions, that occur for specific reasons which can be understood in advance. This more or less sets on their head the theoretical assumptions underlying Modern Portfolio Theory and conventional financial planning. Almost the entirety of the "Investment Strategies For Crisis & The Containment Of Crisis" DVD set is the detailed exploration of a framework for identifying risks and opportunities in these very different markets.

As explained in much more detail in the DVD set brochure, most of the DVDs and manual are devoted to first exploring the top 24 matrix cells. These include the rows of cash, stocks, bonds, real estate, precious metals and cryptocurrencies. The price movements and potential timing for each of the asset categories is explored with each of the cycles and changes in the cycles, which are the columns. Taking this information, the bottom two rows of aggressive wealth creation strategies, and of defensive retirement account preservation strategies are developed and explored.

The Red/Black Matrix is updated every year with the annual overview DVDs. The 2020 Cycles Overview DVDs are linked here.

Creating Win-Win-Win Solutions Using Real Estate-Based Asset/Liability Management Strategies

The webpage devoted to the "Creating Win-Win-Win Solutions Using Real Estate-Based Asset/Liability Management Strategies" is linked here.

The second DVD set is a radically different set of solutions that are based upon what is my opinion arguably the largest difference between the "retail" or individual investors market, and the quite different strategies that are often followed by the institutional market.

Sophisticated institutional investors often love Asset/Liability Management (ALM) strategies for good reason, and these strategies are currently far more profitable than they should be - specifically because of the Fed's unnatural and heavy-handed interventions.

Essentially, in the process of forcing interest rates to artificially low levels, even while trying to keep inflation higher, the Federal Reserve is on the most fundamental of levels redistributing wealth from asset-driven investors to liability-driven investment strategies. The unnaturally low levels for rates relative to inflation in a system flush with artificial liquidity create the fundamentals for liability driven arbitrage - even as the fundamentals for the traditional buy and hold cash flow driven asset strategies for individuals are effectively annihilated in after-inflation and after-tax terms.

This is a massive redistribution of wealth. It is far from theoretical, but has been ongoing for many years now. If one wants to understand why private equity funds have been thriving, why many corporations have issued debt even while also funding stock buybacks, and why so many single family and multifamily housing units have been bought by investment firms on a national basis since 2010 - the liability driven arbitrages that is the result of the Fed's heavy-handed interventions are among the major reasons why.

In most cases, individuals do not have the ability to access the attractive and low cost liabilities that the Street firms rely upon. The Federal Reserve has created a fundamentally unfair playing field, where the financial firms have both the knowledge and funding sources, and individual investors by and large have neither, which then acts to redistributes wealth on a highly inequitable basis in the artificial environment that has been created by the Fed.

There is an exception when it comes to access to quality liabilities, and that can be found with real estate investment. With that access, what is missing is knowledge - and that is what is provided by the five wealth strategies found in the "Creating Win-Win-Win Solutions" DVDs.

* Using ALM to create wealth during normal times from low rates of inflation. This is a "mind-blower" for many people who no formal background with ALM (including many long-time real estate investors), and it has also been a major source of institutional profits over the last decade. High rates of inflation are not needed with ALM strategies, and this completely reverses the usual dilemma with asset-driven strategies of background rates of inflation crippling real returns over time in after-inflation and after-tax terms. Instead, inflation is turned into wealth, and the higher the inflation, the greater the after-inflation returns.

* Using ALM to turn very low and below market interest rates into an increasing and compounding cash flow that grows even greater with still lower interest rates. This completely reverses the usual dilemma with asset-only strategies when it comes to very low interest rates, which is a wiping out of the usual single most reliable long terms of building wealth, that of compounded interest and other compounded cash flows. Using ALM strategies, the lower that rates go, the greater the monthly cash flow to the investor (all else being equal).

* Using ALM to turn much higher rates of inflation into much higher returns even on an after-inflation basis. This ability to not only keep up with inflation, but thrive with inflation, is a very rare ability that far exceeds what can be done with TIPS or the like, and creates the ability to reach out and offset losses from other portfolio assets, instead of just keeping even with one segment while the other categories are all hit by sharply rising inflation.

* Using ALM to survive financial crisis and get through the tough times, while effectively monetizing the destruction of the purchasing power of the dollar.

* Creating robust ALM strategies that are highly flexible with the ability to "dial back" risk on an individual basis as desired. The one form of ALM that is well known with individual investors is simple leverage, as in dialing the risks to the max to get the returns to the max - at the expense of potentially losing everything. Comparing simple leverage to robust ALM strategies is like comparing a kazoo to a concert piano - there are a wide range of notes that can be played, with many different ways of reducing different risks while still maintaining a robust ability to thrive in a variety of future market and economic scenarios.

The 5th and 6th DVDs of the set are entirely devoted to demonstrating one such strategy, showing step by step why it works like it does - using a great deal of detail in the row by row cash flow and equity analysis in nominal and real (inflation-adjusted) terms - and stress testing how it performs in a wide variety of future scenarios, ranging from participating in outsized gains from prosperity to surviving all-out financial crisis and eventually emerging with a larger net worth than ever.

What the Asset/Liability Management strategies represent is what could be called a second pillar, or a second leg to a stool, when compared to the other 2 DVD sets. This is a completely different way of identifying and taking advantage of the pervasive and quite unfair fundamental distortions to the systems that have been created by the Federal Reserve.

However, this set is by far the least concerned with the Federal Reserve or its actions. The "Creating Win-Win-Win Solutions" set does not focus on the Federal Reserve playbook, or the Red/Black Matrix framework, or understanding such things as reserves based monetary creation. Instead, this is an intensive and focused group of tutorials that will walk people step by step through what will be for most readers an entirely different approach to investing, that also just happens to be a way of aligning one's interests with what the Federal Reserve has been doing in a way that is nearly impossible to do with pure asset-only investment strategies.

Gold Out Of The Box, 2020s Edition

What could be called the third pillar or the third leg of the stool is the "Gold Out Of The Box, 2020s Edition" DVD set and manual, (which also ships with the 2 DVDs from the 2010s edition of Gold Out Of The Box). This set is completely different from the other two DVD sets, with entirely different sets of strategies and solutions, and the brochure is linked here.

There are several different levels to the DVDs, as reviewed in the brochure. Rather than just looking at gold as money, or gold as a means of keeping up with inflation, multiple different uses and strategies are explored in the DVDs, some of which are potentially far more profitable and useful for investors than merely keeping up with inflation or acting as a stable store of value

A core part to the "Gold Out Of The Box, 2020s Edition" DVDs does relate to the free book and the "Investment Strategies", and that is the role of the Federal Reserve, although the details are quite different. What the DVDs and supporting manual tackle head on is what has most distinguished gold in the last decade from previous decades, and some mysteries that have been created along the way.

For many years there was a quite reliable relationship between the levels of inflation and the inflation-adjusted price of gold - but that completely broke down in the aftermath of the financial crisis of 2008. Why?

Any student of monetary history - as quite a few gold investors are - knows that neither central banks nor governments should be able to "print" and spend money on a massive scale without triggering fast rising rates of inflation. This has been tried many times, under many different pretexts and it just can't be done.

Except that the Federal Reserve seemed to be doing just that in the 2010s - creating and spending trillions of dollars of new money, and effectively funding a good bit of the growth in the national debt along the way, even while massively distorting markets. How are they "succeeding" in breaking the rules, and can they continue to get away with it?

Again, there is a great deal of detail in the brochure which won't be repeated here, but the DVDs dive deep into the very heart of what the Federal Reserve has been doing (much deeper than the other DVD sets), and explain exactly what the Fed has been doing and how it appears to break the rules. (It really doesn't break the rules, which is where the limits come from, and why the 2020s are likely to be so very, very different for precious metals than the 2010s were.)

The following are some of the topics that are explored in the DVD set and companion manual (much more information is available in the manual):

Chapter 1) Gold As Money Or A Stable Store Of Value

Chapter 2) Hidden Gold Taxes

Chapter 3) Unlocking The Full Inflation-Fighting Powers Of Gold

Chapter 4) A Larger Source Of Gold Profits: Profiting From Asset Deflation

Chapter 5) The Extraordinary Potential Profits From

Contracyclical Hedges

Chapter 6) Maximum Value: Cycles, Counter-Cycles & The

Robust Hedge Ratio

Chapter 7) The National Debt & Financial Repression

Chapter 8) Using Gold To Take Unfair Advantage Of Financial Repression

Chapter 9) The “Magic Money Trick” That Dominated Gold Prices In The 2010s

Chapter 10) How The Surging National Debt Is Already Threatening The “Magic Money Trick” In The 2020s

Chapter 11) How The Cashing Out Of The Social Security Trust Funds - On Top Of The National Debt - Is Likely To Finish Off The “Magic Money Trick”

Chapter 12) The Three Way Collision & The Extraordinary Hidden Dangers Of The “Magic Money Trick” To Global Stability

Chapter 13) Central Banking Judo - Using An Archaic Physical Asset To Take Unfair Advantage Of Out Of Control Central Banking Powers

Chapter 14) Taking Maximum Advantage Of The

Opportunities Created By The Three Skews

The "Gold Out Of The Box, 2020s Edition" set also contains the two DVDs from the 2010s edition as well. A description of the 2010s edition is below:

Gold Out Of The Box presents a radically different approach to crisis investing, with detailed strategies for large & small investors. Topics covered include:

- Understand why gold is often a poor investment when purchased for the most common reason – as a means of profiting from monetary inflation

- Uncover gold’s “hidden talent” and learn why precious metals may be one of the best investments in the world for profiting from asset deflation during crisis

- Learn the quite different investing strategy involved in using precious metals for asset deflation arbitrage, rather than as a monetary inflation hedge

- Challenge your beliefs – and learn new perspectives and tools for turning gold into a once-in-several-generation wealth creation opportunity during a time of crisis

- Study the “1/3 Strategy”, a multi-component, dynamic strategy that is focused on simultaneously profiting from monetary inflation AND asset deflation while maintaining large crisis reserves for safety

- Take a third, leave the herd, and aggressively go for the peak asset deflation arbitrage that can potentially turn a once-in-several-generation crisis into a multigenerational wealth creation opportunity

- Take a third, leave the herd, and set up a monetary inflation arbitrage that may radically outperform many “conventional” inflation hedges

- Take a third, leave the herd, and set up liquid safety reserves that are intended to get you through a crisis of a magnitude that could devastate those following widely recommended conventional strategies

- Watch a detailed illustration of setting up an initial “1/3 Strategy” position, and follow how the components shift over a multiyear period with the different stages of a severe monetary & economic crisis

Disclaimers

Please note that the DVDs and companion manual are of a strictly educational nature, rather than the rendering of professional advice. The future is uncertain, and there are no guarantees or promises of success or particular outcomes. As with any financial decisions, there is a risk that things will not work out as planned, and with hindsight, another decision would have been better.

The DVD set and printed manual will not include specific investment, legal or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the specific results of the application of the general educational principles contained in the DVDs and the written materials, either directly or indirectly, are expressly disclaimed by Daniel Amerman.