The Homeowner Wealth Formula, Chapter One

How Homes With Mortgages Have Created Wealth Over The Decades

By Daniel R. Amerman, CFA, MBA

TweetAbout 65% of the households in the United States own the home they live in.

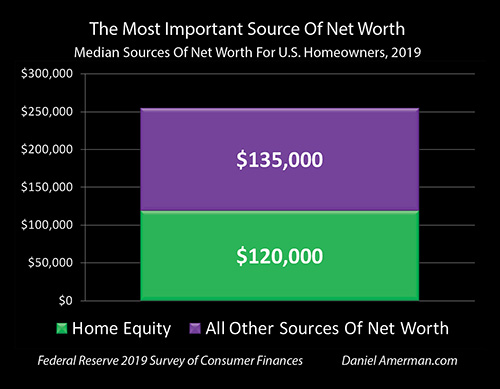

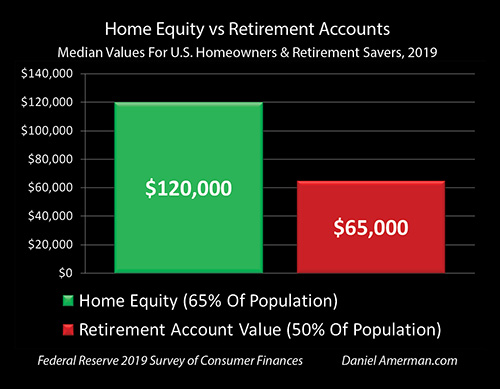

For these families and individuals, their single largest investment and their primary source of net worth is on average their equity in their home. According to the Federal Reserve's 2019 Survey of Consumer Finances, the median equity for those who own homes, the difference between the value of their home and their outstanding mortgage, is about $120,000. The median net worth for those same households is about $255,000.

This means that for the average family with a home, almost half of their net worth is in their home equity. The value of their home equity is about as important for them as everything else put together including stocks, bonds, retirement accounts, life insurance and money in the bank.

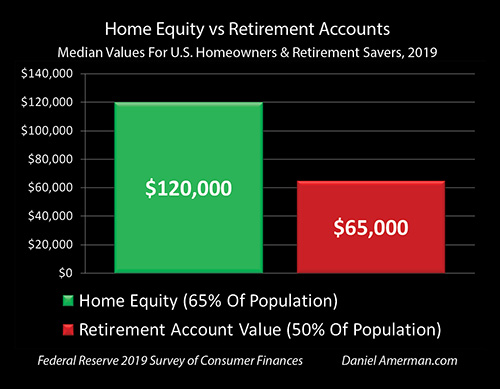

Other than homes, the next largest source of net worth is retirement accounts. Looking just at retirement accounts (and not pensions), about half of U.S. households have retirement accounts, and the median value of those retirement accounts is about $65,000.

This means that if we look at an average American family, when comparing their home equity to their retirement account - their homeownership is almost twice as financially important to them.

The comparison is even more stark when we take into account that there are millions more homeowners, who are 65% of the nation's households, than there are retirement account owners, who are 50% of all households. The 15% difference represents millions of homeowners for whom their home equity is everything and their retirement account savings are zero.

There are a tremendous number of books, articles, classes and other forms of financial education out there when it comes to investing in stocks, bonds and retirement accounts. But yet, even though their home is by far their largest investment for most families, with a much larger contribution to their net worth than any stocks, bonds or retirement accounts they may own - there is comparatively little financial education available when it comes to investing in home ownership.

This is unfortunate - because homeownership is not only the largest investment for most people, it can also be the single best investment opportunity most people will ever have. Indeed, the single most reliable source of wealth creation for average American families over the decades has not been stocks, bonds or gold - but simply owning a single family home with a mortgage.

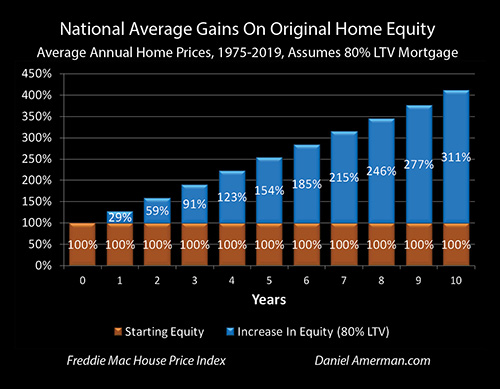

The average outcome for someone who purchased their home with an 80% loan to value (LTV) mortgage, and was in their home for three years - was to see their home equity almost double. Across the decades and for tens of millions of average homeowners, the collective homeownership experience was to keep their 100% starting equity and to see another 91% added, almost doubling their money in just three years.

The national average homeownership experience between 1975 and 2019 was for home equity to triple in the first seven years of owning a home.

If we go out to ten years, then the national average experienced by the nation was for homeowners to see their home equity increase by more than four times, for homes with 80% LTV mortgages.

If we want to understand how almost half the net worth of about two thirds of the population came to be in home equity - those numbers are why. The collective homeownership experience has been that - on average - to be a homeowner with a mortgage is to set in a motion a formula for building wealth via home equity that will grow to dominate all other sources of net worth.

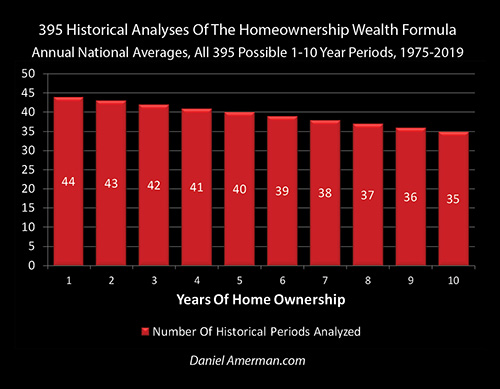

These average homeownership experiences are not simply based on long term averages, but on almost four hundred individual analyses, of almost four hundred different homeownership periods.

What year someone bought, and how long they were in their home produced major differences over the decades - so the research behind this book is based on looking at the national averages for every possible 1 to 10 year homeownership period between 1975 and 2019, including the best years and the worst years.

There were 42 possible three year ownership periods, ranging from 1975-1978 to 2016-2019. National average home price changes (and mortgage amortizations) for each three year period were individually analyzed, and when all 42 possibilities were averaged together - the average outcome for all the tens of millions of homeowners, across all the states and all those decades, was to see their home equity almost double.

For ten year homeownership periods, there were 35 of them, ranging from 1975-1985 through 2009-2019, and including every ten year period in-between. The national average homeowner experience was to see home equity quadruple in the first ten years of homeownership, assuming an 80% LTV mortgage was used to purchase the home.

What detailed analysis of decades of the average American homeownership experience proves is that a very powerful and unusually reliable flow of wealth is the natural result of simply being in the position of being a homeowner with a mortgage. It should also be noted that while the specific and detailed research is about homeownership in the United States, the results of the research and the general principles for creating wealth with a home and mortgage do apply to homeowners around the world.

When we understand this natural flow of wealth, then the somewhat surprising relationship shown above becomes not just logical but expected. Setting up a retirement account is a matter of willpower and discipline. Consistently contributing to the retirement account with all that happens in life can be difficult. Becoming informed about and making good investment decisions for the retirement account is also not easy for many people.

In other words - every step can be difficult. Because each step is difficult, a lot of people don't set up retirement accounts, or consistently contribute to them, and even when they do - the national average amount of retirement savings is probably not as high as most would like it to be.

On the other hand, simply wanting to own and live in a nice place, perhaps a three bedroom home with a yard and a back deck, that is in a good school district - creates a natural flow of wealth that is itself a built in savings plan, even if that is not the reason why the home was purchased in the first place.

Making this much better is that homeownership comes with a natural formula for building wealth also built in, the Homeowner Wealth Formula, with that formula being the subject of this book.

When a homeowner is out in their garden, or entertaining on the patio, the natural result of being in that position is to have a wealth building machine creating net worth for them in the background. If there are children in the home, and they are at the ages where the family room floor is getting covered in toys - the natural result of owning that family room is to have entered into a surprisingly sophisticated and profitable investment strategy that can produce results that are almost impossible to get through most retirement account investments.

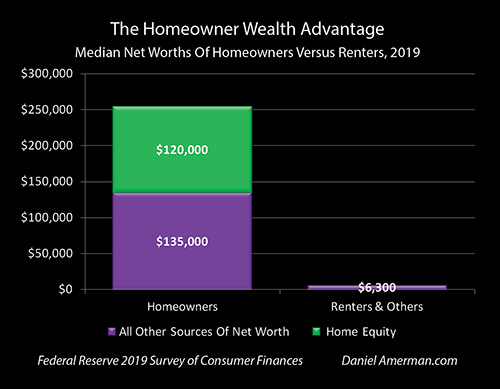

An even starker and almost shocking demonstration of the potentially life changing financial benefits of homeownership for the average person can be seen in the graph above. According to the Federal Reserve's 2019 Survey of Consumer Finances, the median net worth for the 65% of the population who are homeowners is $255,000, and the median net worth for the 35% who are renters (or other), is $6,300. The median is simply the household in the middle, where half of homeowners would have more and half would have less. When it comes to net worth - the homeowner in the middle has a full 40X the net worth of the average renter.

Now, it isn't all homeownership. The median income for homeowners is about $77,000 per year, and the median income for renters is about $36,000. Having a higher income helps a lot. But it doesn't explain the 40X difference, particularly when we look at how much of that difference is based on home equity.

Indeed with today's price levels, a $77,000 per year combined household income is not what it used to be, there is more to it than just the difference in income. Consider two people, a renter and a homeowner, where the rent payment equals the mortgage payment. The renter pays rent - and it's gone for good. The homeowner uses the mortgage payment to access the ability to rapidly build wealth with the Homeowner Wealth Formula - and the average results for the nation can be seen above.

A Natural Flow Of Wealth

When most people think about making money with homes, whether as homeowners or investors, they think about making good purchases. Perhaps finding a particularly good property that is significantly underpriced. Maybe it is finding just the right neighborhood, where housing values are getting ready to take off.

On an individual basis - they are right. It is much better to buy a home in a good location at a low price, than to buy a home in a deteriorating neighborhood at a high price.

However, making good buys has nothing whatsoever to do with the extraordinary national averages for wealth creation that we just reviewed, instead they were the result of a natural flow of wealth.

What is a natural flow of wealth?

It is a matter of positioning, rather than of skill or of luck. So that the natural and average result of choosing to be in that position - of being a homeowner in this case - is to do well. Now, that is not the same thing as a guarantee, if someone turns out to be unusually bad at it, or turns out to be particularly unlucky then they can certainly lose, but a highly positive outcome is the natural and average result.

When we looked at home equity almost doubling in three years, or tripling in seven years, or quadrupling in ten years - those were just the averages, nothing special. There was no great skill, or luck, or working through elaborate financial charts or timing strategies. Those weren't just the good neighborhoods or only the most astute home buyers - those were all the buys, all the above average results and all the below average results combined, over all the decades and the regions of the nation.

Now some people are skillful, some people are lucky, and a fortunate few are both. With good skill or good luck - being smart and picking just the right property, or being in just the right area, or owning during a time when national home prices are doing unusually well - can produce potentially much, much better results than the simple long term national averages shown above.

Another feature of a natural flow of wealth is that it should be forgiving. There should be a wide range for experiencing below average results, and still being just fine. So, if someone's homeownership experience in practice works out to be in the bottom quarter or third of the national averages - as it will for 25% to 33% of homeowners over a long enough time period - it should still be, if not quite as good as average, still pretty good or at least OK. That is the case with homeownership, there is a very strong positive skew, that gets stronger and stronger over time.

Putting Together The Homeowner Wealth Formula

For the average person, homeownership will be the single most important financial or investment decision they will make in their lives.

For the average person, buying a home with a mortgage will be the single best investment decision they will make in their lives.

Those are a couple of fairly strong statements - but the evidence is overwhelming. As introduced in this chapter, and then explained and developed in the rest of the book, the history of homeownership over the decades is one of extraordinary average results when it came to rapid wealth creation and the reliability of that wealth creation.

These historical results can then essentially be confirmed from an entirely different source when we just look at the financial situation of the average (meaning median in this case) American today, as captured in the Federal Reserve's definitive once every three year Survey of Consumer Finances.

Home equity is almost half of their net worth for the 65% of the nation's households that are homeowners. Home equity is almost twice as important as retirement accounts, when it comes to net worth. The median homeowner has an astonishing 40X the net worth of the median renter.

But yet, ironically, the sources of that wealth are generally poorly understood, even by the very people who have financially benefited from 10, 20 or 30 years of homeownership. The bookshelves are full of financial education resources about retirement accounts, stocks, bonds, mutual funds and ETFs, as is the daily media - but there is comparatively little about a source of net worth that will in practice be almost twice as financially important as retirement accounts for the average person building wealth over the long term.

Financial history is quite clear that the best way of building wealth over the long term is not adding money but multiplying money. There are eight different levels of the multiplication of wealth that come as the natural result of owning a home that was purchased with the aid of a mortgage. Each level of multiplication is important. Multiplying money is better than adding money. And eight multiplications is much better than one multiplication.

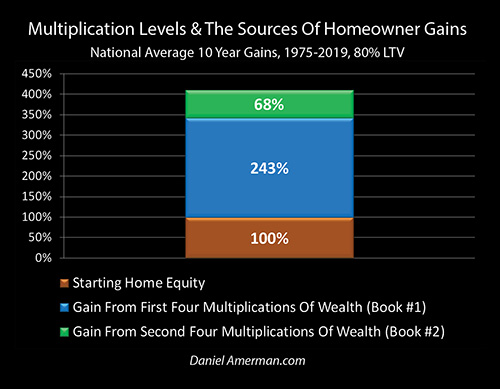

The first four levels of the multiplication of wealth are the subject of this Book #1 in the series. They are the most important, and the most reliable of the multiplications. The national average outcome for ten years of homeownership is to see home equity increase by 4.1X, of which 3.4X are the result of the first four levels of multiplication.

The remaining about 0.7X increase in home equity is the result of the second four levels of multiplication, which are the subject of Book #2 in this series.

The starting point for understanding where the multiplied wealth really comes from and why it has been so reliable for so many millions of homeowners over the decades, is that the main underlying wealth creation engine is not real market value changes - but inflation.

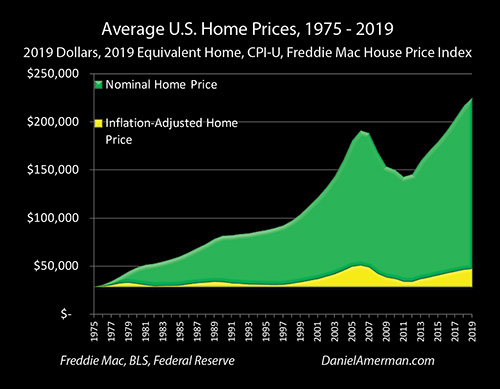

According to the Federal Reserve, the median value of the American home was $225,000 in 2019. Using the Freddie Mac House Price Index, a comparable home in 1975 (same size and amenities as in 2019), would have cost about $28,500.

When we adjust for inflation, then equivalent homes in 2019 were valued about 67% more highly than in 1975, and the real market value of the home would be up to about $47,400.

The other $177,600 increase in the price of the home? It's all inflation. So, the national average over 44 years was for the real price of a home to increase by $18,900, while inflation would increase it by almost ten times that, or $177,600. Over shorter time periods inflation is not as dominant - but it was still by far the largest creator of homeowner wealth when we look at all 395 of the national homeownership experiences.

Everyone focuses on trying to anticipate changes in housing market values, and sure they are important, but the historical evidence is overwhelming that inflation is where the real money comes from for the homeowners of the nation, most of the time. The true primary source of half of the net worth of most homeowners is not based upon the vagaries of changes in market values, but one of the most reliable financial forces in the world, which is the U.S. government's determination to create inflation and thereby destroy at least part of the value of the dollar in each and every year.

Chapters 2 & 3 will explore the close relationship between inflation, home prices and the compound interest formula. Just by themselves, for most people these chapters may be enough to change the way they look at homeownership, how they can rapidly build financial security, what their risks are, and the actual source of what could be half or more of their future net worth.

Turning Inflation Into Wealth

Keeping up with inflation is very good, it is highly desirable in comparison to many other types of investments, and that by itself is enough to place homeownership into the rarified territory of inflation hedges such as gold and silver. However, when a home is purchased with a mortgage, then something much rarer and much more powerful is created.

Homes with mortgages have an outstanding historical track record for turning inflation into wealth. In this case, home equity doesn't just keep up with inflation, instead it turns that inflation into wealth, where new home equity is created at a rate that can be much faster than the rate of inflation.

This powerful source of wealth creation is a very nice source of net worth over time even with quite low 1% to 2% annual rates of inflation. It works much better and more rapidly in creating wealth with moderate 3% - 4% annual rates of inflation. With high rates of inflation - owning a home with a mortgage is arguably the best protection against inflation that an ordinary person can obtain. The higher the rate of inflation, then the more rapidly wealth is created, and the greater the degree to which home equity and financial security grow faster than the rate of inflation.

This is the natural result of owning a home with a mortgage. If we want to understand why the median homeowner has 40X the net worth of the median renter - it is this highly reliable wealth creation engine chugging away beneath the surface, steadily turning inflation into wealth, that has been the primary driver of increases in home equity. As we will be reviewing, this isn't theory or guesses about the future - but is instead what has actually happened in practice for generations of homeowners (possibly including the reader and/or the reader's parents and grandparents).

Even by the time that Chapters 4 & 5 are completed and the first three levels of the multiplication of wealth are understood, the reader will have a good grasp of a very powerful and entirely different way of steadily creating wealth over the years, that is not part of the usual consumer financial education. This new and practical understanding will be reinforced and expanded in each succeeding chapter.

For the average person - choosing to own a home with a mortgage will be the most important financial decision of their lifetime, and this is true whether they understand the underlying wealth creation process or not. By the time this book is completed, readers should indeed understand this remarkable natural flow of wealth that can transform their lives - and hopefully be able to make better life and financial decisions as a result of that understanding.

Let's begin in the next chapter with three different ways of looking at inflation, and learn why the approach that is the least followed by the general public - is the foundation for what history shows us may be the single best investment that the average person will ever make.