The ABCs Of Popping A Third Asset Bubble

by Daniel R. Amerman, CFA

TweetMovies can have quite predictable plot lines that we know in advance - but we love them anyway. It could be a romance, where the girl is going to end up with the right guy through a series of improbable events, even though that looks impossible to begin with. It could be an action movie, where our tough and underestimated hero overcomes seemingly impossible odds to just barely win in the end, after all.

There are movies that play over and over again in the financial markets and the economy as well, and while the particulars change, the plots can repeat themselves.

In this analysis, we are going to take a look at a market "movie" that has played out twice in the modern era, and follow the A-B-C-D plot line that was followed in each case. We will then take a look at more recent events, see if A-B-C have been occurring, and ask if D could be coming after C for the third time in a row?

The First Movie: The Tech Bubble & The Fed

![]()

The above is a graph of the effective Federal Funds Rate from 1954 through March of 2018 (that final data point for March is not yet actual data, but is projected from the recent Fed meeting). Our starting point is the economic recession of 1990.

A. The Fed responded to the recession by using its primary economic weapon for rescuing a hurting economy - rapidly decreasing interest rates. The effective Federal Funds Rate was pushed down from 8.20% in September of 1990 to 2.92% in December of 1992.

As can be seen in the graph, that was the lowest interest rate in 30 years, interest rates had not been that low since they were at 2.90% in October of 1962.

B. The stimulus of lowering rates worked. The economy exited recession, and began to grow again.

There was an acceleration a few years into the recovery. The economy was booming, and stock market prices began a rapid rise, particularly with the early tech stocks. A tech stock bubble was created, as many market pundits proclaimed a new era of unending prosperity, with far higher stock prices on the way.

C. The Fed initially responded to renewed economic growth by moving interest rates to a more historically normal range of around 5-6%, give or take.

However, by 1999, the Fed grew concerned that the economy was overheating, and that inflationary pressures could build. So the Fed deployed its primary tool for slowing down an overheating economy - increasing interest rates. The effective Federal Funds rate was pushed up from 4.76% in June of 1999 to 6.53% in June of 2000. That was an increase of about 1.75% in about a year.

D. The asset bubble collapsed, with crippling losses for investors. This collapse produced an immediate recession in 2001.

The recession of 2001 was not a normal business cycle recession. Yes, a falling stock market is associated with recession, but this was something larger, a bubble popping, and the rapid and catastrophic collapse of wealth changed behavior, decisions and the economy.

The Second Movie: The Real Estate Bubble & The Fed

A. The Fed responded to the recession by using its primary economic weapon for rescuing a hurting economy - rapidly decreasing interest rates. The effective Federal Funds Rate was pushed down from 6.40% in December of 2000 to 0.98% in December of 2003.

As can be seen in the graph, that was the lowest interest rate in almost 50 years, interest rates had not been that low since they were at 0.84% in November of 1954.

B. The stimulus of lowering rates worked. The economy exited recession, and began to grow rapidly.

In the process of pushing interest rates to the lowest levels seen in almost 50 years, the Fed also helped create the lowest mortgage rates most people had seen in their entire lifetimes. Low mortgage rates meant real estate prices could get much higher, without needing a higher income to qualify.

A real estate bubble was created. Many market pundits proclaimed a new era of unending prosperity, with a miracle formula for the creation of wealth by buying real estate.

C. By 2004, the Fed grew concerned that the economy was overheating. So the Fed deployed its primary tool for slowing down an overheating economy - increasing interest rates. The effective Federal Funds rate was pushed up from 1.00% in May of 2004 to 5.24% in July of 2006. That was an increase of about 4.25% in two years.

D. A sky high real estate market ran into rapidly rising mortgage rates (along with a host of other issues), prices stopped climbing, and then they started falling. Numerous ill-considered risks in the financial markets also started to blow up, and the markets and the economy went into free fall.

There was another recession, sometimes called the Great Recession - and it was in no way a normal business cycle recession. It was created not by an overheated economy but by the popping of the real estate asset bubble and resulting cataclysmic damage to the financial markets.

The Third Movie(?)

A. Among other extraordinary measures, the Fed responded to the recession by using its primary economic weapon for rescuing a hurting economy - rapidly decreasing interest rates. The effective Federal Funds Rate was pushed down from 5.26% in July of 2007 to 0.16% in December of 2008.

As can be seen in the graph, there was no precedent for that - rates were moved to the lowest levels in modern financial history. And they would stay there for the next seven years, in that unprecedented place.

B. This time there was no quick economic or market recovery, even with the new ZIRP (Zero Interest Rate Policy). Too much damage had been done.

However, slowly, eventually, the economy and the markets began to recover. And then the markets more than recovered. The Dow soared above 15,000, and then 20,000. Then the movement from 20,000 to 25,000 seemed to happen in almost the blink of an eye.

The driver of asset price growth is again tech stocks, but this time around it is much more concentrated in the FANG stocks of Facebook, Apple, Netflix and Google (now Alphabet).

Has another asset bubble formed, and is it perhaps the biggest one yet? It all depends on who you ask. There are plenty of naysayers throwing popcorn at the screen, who have been calling the whole thing an asset bubble for some time now. Just like some were the last couple of times.

But a majority of the audience thinks their wealth is real and enduring this time around, which is why surveys show that retirees and retirement investors have more confidence in their investments and financial security than they had for many years (or at least until the last couple of months). Of course, that was also true in what turned out to be the previous bubbles.

C. The Fed moved very slowly and tentatively when it came to increasing interest rates this time around, for fear of upsetting a fragile economy and markets. The first rate increase was only 0.25% in December of 2015, and it would be a year before there was another 0.25% increase.

Recently, however, the Fed has become quite concerned about issues such as an unsustainable rate of economic growth, very low unemployment, and the potential return of wage price pressure reintroducing one of the most powerful of the fundamental inflationary forces.

So, after an absence of many years, the Fed is once again raising interest rates at a frequent pace, albeit with the increments still being fairly small. A sixth increase just took place in March, six more were previously expected, but now it looks like there may be seven more instead. If that happens, there will be a total of thirteen 0.25% increases between 2015 and 2020, for a total increase of 3.25% from the ZIRP days.

All of those rate hikes are hitting a market at record valuations, with record amounts of debt for corporations, individuals and the federal government. That means increasing interest rates are going to be taking a great deal of cash away from the party, in terms of increasing interest payments.

D. Could A, B, and C once again be followed by D?

Oh, it's not quite the same. The actors and actresses are different, so is the set, and there are a number of individual plot elements that are different. That is true every time around, things don't exactly repeat.

This was a very simplified movie review. There are many, many relevant issues out there including cause and effect. Does the Fed cause crises, or are crises that will happen anyway correlated with the Fed's attempts to mitigate crises?

Instead of getting deep into the details however, this review is intended to ask you a simple but broad question: do you get the feeling that you've seen this movie before? Is there some element of pattern recognition that is kicking in?

Human nature can be fascinating. So many people were chasing wealth in the tech bubble, only to get burned, and they vowed to never get burned again. And then, son of gun, just seven years later many millions of those exact same people were chasing wealth in the real estate bubble and got burned again. Surely, something like that couldn't happen again with another asset bubble a mere ten years later. Could it?

Whether we are in an asset bubble and whether and when D will once again follow A-B-C is something that I will leave for your own movie plot recognition.

But if you are feeling a sense of deja vu, and you think you've seen this movie once or twice before - that doesn't mean that what comes next will be the same as the last two times.

Amplification

The first issue is one of potential amplification.

The first movie involved pushing interest rates down to the lowest levels in 30 years in 1990 through 1992. Now generally speaking and all else being equal, when interest rates go down then stock, bond and real estate asset prices all tend to rise in response. So asset prices got their biggest boost in support from interest rates that they had had in 30 years.

However when rates rise, most asset prices go down (in rough terms). When rates were pushed back up in 1999 and 2000, instead of a normal business cycle recession, the nation saw a resulting recession that was amplified by the destruction of wealth created by the popping of a major asset bubble.

In the second movie, this amplification in the 2001 recession was matched by an amplification of the Fed's primary recession fighting tool - lowering interest rates. Interest rates moved to their lowest levels in about 50 years, instead of 30 years. In other words, the Fed intervened in the markets to give asset prices their biggest boost in 50 years.

The resulting surge in real estate prices going far above historic norms, then created a real estate bubble that when it popped - created a further amplification in the depths of the recession and the financial market damage.

In our third movie, besides introducing quantitative easing, the only way the Fed knew how to deal with the amplified recession of 2007-2009 was to further increase the amplification of its primary response - and move interest rates to their lowest levels in the modern era. In other words, the Fed intervened to artificially give asset prices their biggest boost in the modern era. It took a while for asset prices to reflect this, but they eventually did.

As A-B-C are again being repeated and that intervention is currently being withdrawn as part of C, the natural question then becomes, if it turns out that D is once again the way the movie ends - will we see a third amplification of the resulting economic and market damage as a result of the third amplification of lowering rates?

If the end result of the lowest interest rates in 30 years was a major asset bubble popping, and the end result of the lowest interest rates in 50 years was a much more catastrophic asset bubble popping, what will be the end result of the lowest interest rates in modern history?

And if so, how will the Fed respond this time around?

A Holistic Perspective For Retirement Investors

Whether D is next again may turn out to be the single most important question that many retirees and retirement investors will face. The issue is not just recession and it is not just market values, but it is the two in combination.

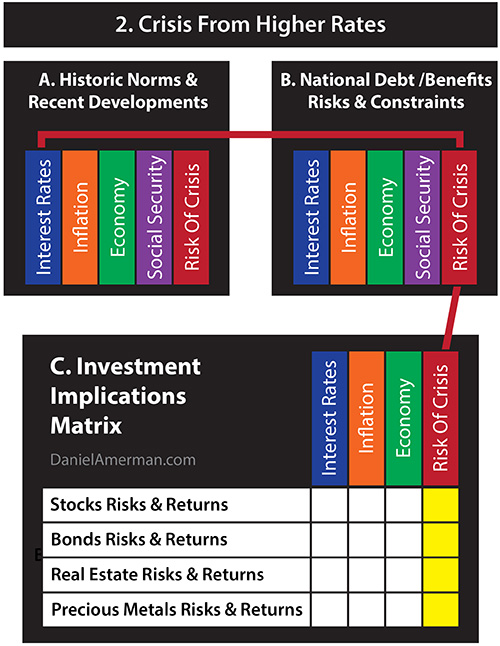

The issue is the connection that we have between current economic events (the "A" box), the national debt and future Social Security and Medicare payments (the "B" box), and the future performance of the major asset categories of stocks, bonds, real estate and precious metals (the "C" box). (Sorry for any confusion, but I do try to keep things understandable, and in this case that has led to two sets of ABCs. More information on the usage of the "Investment Implications Matrix" is linked here.)

There are many projections for deficits, the national debt and future Social Security payments, as well as for long term investment returns. In most cases they require ignoring the end of our last two movies. Indeed, you might even say that the normal approach is that reasonable people should exclude by definition the possibility of asset bubbles popping or recessions hitting - despite what has happened twice in practice in the last 20 years.

If we go to D and it is a recession / market plunge for a third time, then none of those consensus projections are likely to work out. There were quite a few consensus projections from the most respectable authorities about the national debt and Social Security solvency before 2007 as well - and they all quickly became completely obsolete.

The possibility of a severe recession which was followed by very low growth economic rates was excluded by reasonable people as a matter of definition. When it happened anyway, the national debt went down an entirely different path than expected, and quickly doubled. Even as the lack of economic growth meant that past and likely future payroll tax collections were much lower than expected - which changes the future of Social Security.

If we get hit with another major recession, and particularly if there is another amplification, then the consensus projections become almost instantly obsolete, the national debt may soar, and lower payroll tax collections mean that financial problems can hit Social Security and Medicare much faster and harder than what is currently being projected.

New research from the International Monetary Fund (linked here) shows that this problem could be much worse then what economists formerly thought. Instead of being a brief dip, all recessions are now believed to each create more or less permanent damage relative to what growth would have been without that recession. That in turn means less funding for Social Security and Medicare.

Sequence Risk

At the same time, after pulling away for a number of years, there are many millions of retirees and retirement investors who are once again effectively betting their financial futures on the reliable creation of wealth from their stock investments.

Hopefully A-B-C will not be followed by D this time, but if that movie does finish the same way for a third time - millions of lives will be changing as a result.

"Sequence of Returns Risk" for retirement investors is a much more publicized investment concept than it used to be. The basic idea is that if an investor takes a sufficiently severe hit at the wrong time, either shortly before retiring or shortly after, then even if they earn expected returns thereafter - they never recover. The financial damage is so bad it can't be recaptured during the remaining lifetime of the investors.

"Sequence of Returns Risk" has a lot of example scenarios to work with and is much better understood now specifically because ABC has been followed by D twice before in the last two decades. Many millions of people have lived every day with what happened to their personal financial situations after the tech asset bubble burst, and after the asset bubbles of the 2008 crisis burst.

It wasn't part of their 1990s financial planning. It wasn't part of what reasonable people thought, or what the experts talked about in advance. But it happened anyway. And if A-B-C are followed by D for a third time, even while the stress on Social Security gets substantively worse - it could indeed be one of the most important financial events in their lives for many people.

This could particularly be the case if the risk of amplification were to feed into sequence of returns risk.

Conclusion

As my long-time readers know, I am no "perma-bear" or "gloom and doomer". Yes, as an expert who wrote an early reference book on mortgage derivative securities for McGraw-Hill in the mid 1990s, I did spend much of 2007 and 2008 warning of the risks of crisis, and why such a derivatives driven crisis could be far worse than most people had any idea.

But since the 2009 to 2010 period, I've spent most of my time analyzing other subjects. A particular focus has been explaining why crises weren't occurring, the unusual and extraordinary tools that were being deployed to maintain stability, and the investment implications of how stability was being maintained.

However, the times are changing. The mechanisms that maintained artificial stability are being rapidly removed, even as risks are multiplying. The pace of change is accelerating, we have not seen anything like what is happening now for many years.

For long-time readers, I will note that this is a material change in perspective. For many years, the Fed wasn't raising rates or was barely raising them, and asset prices were much lower. So, all we had was A, and there was no particular reason to be concerned with A-B-C-D in the near term. Yes, I've been warning about the danger of the Fed blowing asset bubbles with record low interest rates for some years now, but that was more a concern for the future as an unintended consequence of financial stabilization efforts.

With the explosion upwards of the stock markets, B is now back in play, and with the Fed not just sticking with raising rates but actually continuing to signal still higher rates - C is back in play too. We've gone from A to A-B-C, and as of last week, C is still accelerating.

As I watch events unfold, and I see the Fed continuing to raise interest rates even as the Dow remains well above 20,000, there is a part of me that keeps asking: "haven't I seen this movie before?"

I can't answer that question with any certainty, nor am I predicting that the (financial) world is about to end. There are still many other possible paths.

But I can say that we've seen the A-B-C parts of the movie three times now - and D eventually followed both previous times. That means that it is reasonable to believe that there is a significant chance that this round of interest rate increases will also end in recession (possibly severe) and in a major and possibly sustained plunge in the markets.

In my opinion, the chances of such an outcome occurring for a third time are sufficiently high that any prudent individual investor or financial professional should be aware of it and actively considering it as a reasonable and realistic possibility.