How The Coronavirus Pandemic & Lockdowns May Transform Investing In The 2020s: Four Crucial Analyses

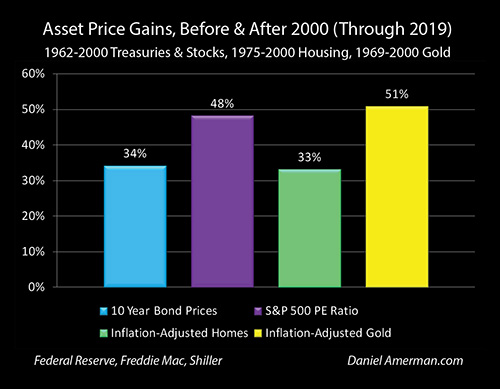

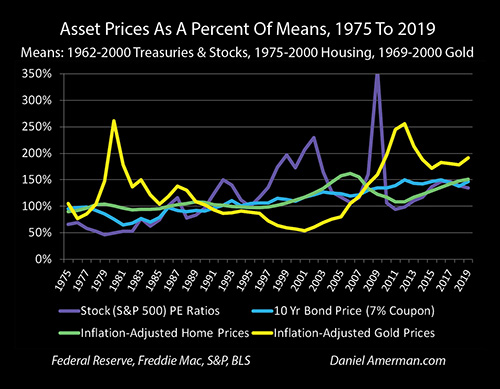

Stocks, bonds and homes account for the great majority of the net worth of most people - and all of these asset values were up by 30% to 50% between 2001 and 2019 when compared to long term averages (even after accounting for inflation).

As explored in this analysis, there is a shared reason for these much higher valuations. There is also a reasonable chance that they could eventually go much higher still, and perhaps persist for many years to come - though the way the pandemic lockdowns could lead to that possible future would be a surprise to most people.

On the other hand, if we at any point merely return to the average valuations of most of our lifetimes, perhaps as a result of the economic shock produced by the coronavirus pandemic - then for many millions of households the long term consequences could be the loss of most or all of their home equity and much of the value of their retirement accounts.

Since 2001, each dollar of earnings for stocks in the S&P 500 is being valued by the markets as being worth almost 50% more, compared to the prior long term average.

Single family homes are worth about 33% more, even after adjusting for inflation and changes in home sizes. Equivalent ten year Treasury bonds are being valued as being worth an average of about 34% more.

And while gold is quite different from the other categories - it shares the dramatic increase in value since 2000, with the inflation-adjusted price per ounce being up by just over 50% compared to prior long term averages.

As explored in this analysis, there is a shared reason for these much higher valuations. There is also a reasonable chance that they could eventually go much higher still, and perhaps persist for many years to come.

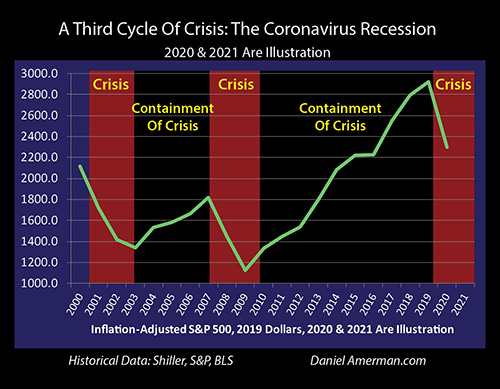

As we will individually explore for each major asset class in this analysis, we now have more volatile investment markets - and, on average, substantially higher valuations. With the arrival of a 3rd cycle of crisis in the form of the coronavirus pandemic, and the Federal Reserve unleashing its most massive interventions yet in 2020 in what will be an attempted 3rd cycle of the containment of crisis, understanding the relationships between those interventions and asset prices becomes even more critically important for the years ahead. This includes seeing how asset prices in each category could eventually travel to still higher places - or what could quickly bring them back down to historic averages or below.

How A Soaring National Debt Can Reduce Retirement Standard Of Living By 77%

One immediate result of the economic damage from the coronavirus pandemic is a quick and almost fantastic degree of increase in the national debt, in order to pay for trillions of dollars in stimulus programs. Now, many people see the soaring national debt as being a political problem that could possibly lead to default or hyperinflation in the distant future - but they don't see the practical impact on their lives or investment decisions today, and they may therefore not see the relevance of these new trillions in debt.

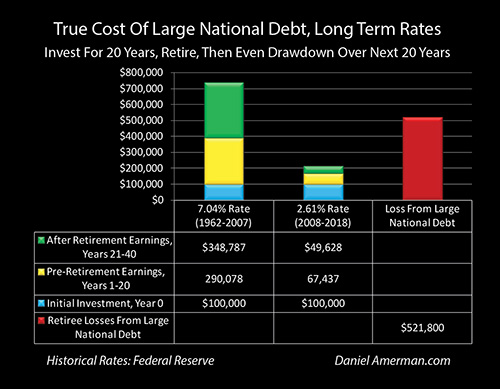

This detailed analysis uses more than 50 years of data about the national debt and interest rates to demonstrate that the first quick doubling of the national debt to pay for the stimulus spending associated with financial crisis of 2008 has already transformed retirement investing and standards of living in retirement.

Using that historical information, we will develop the graph above in a step by step analysis. We will look at the example of someone who starts with $100,000, invests for 20 years, retires, and then draws down their savings over the next 20 years in retirement. As will be demonstrated for each $100,000 in savings - the full cost to that retiree of the growth in the national debt could be over a half million dollar reduction in their standard of living in retirement - and that is just for the first doubling, not including the impact of the coronavirus recession.

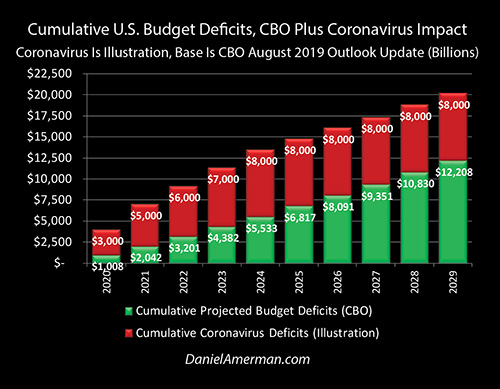

While events are still in the early stages and we don't yet know the full costs of the deficit spending that will be used to try to overcome the staggering economic costs of the coronavirus lockdowns, the somewhat conservative illustration shown above combines the planned cumulative deficits in green from before the pandemic, and adds on the cumulative cost of new stimulus spending in red. Using reasonably conservative assumptions, the national debt effectively doubles to over $40 trillion by the end of the 2020s.

This additional borrowing of close to $200,000 for every above poverty line household in the United States in the next ten years will be far from free. It will instead be one of the most expensive events of a lifetime for not just the nation, but on a very personal level for the citizens as well. This cost will be not be evenly borne, but as developed in the analysis, will instead be disproportionately paid for by reductions in future standard of living for savers in general, with the heaviest costs being paid by long term retirement investors as well for those retirees depending on retirement savings to support their lifestyles.

Using Gold & Stocks As Contracyclical Assets: A 5,000 To 1 Advantage

Extraordinary stimulus spending by the U.S. government and massive monetary creation and spending by the Federal Reserve may be enough in combination to end the coronavirus recession in the next year or two, and eventually create still higher asset prices for stocks, bonds and homes in a 3rd cycle of the containment of crisis.

But, they may not. If the 3rd round of the containment of crisis fails, then the results of the pandemic and economic lockdowns could include a long and severe recession - or even a depression - and a potential secular (long term) bear market in stocks.

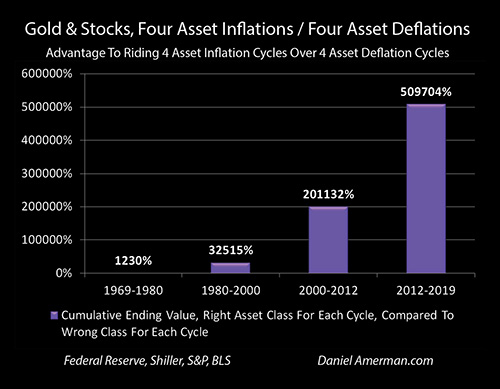

If this were to happen, then history shows that gold has far more valuable uses than if it were just a mere inflation hedge. In this chapter, using six stages of analysis, we will explore a powerful and highly consistent historical relationship between gold and stocks that offers investors the ability to use gold in ways that far exceed the profits produced by just attempting to keep up with inflation.

What historical numbers over 50 years show is that if we get another round of a secular bear market in stocks, then those who understand and invest for the contracyclical relationship between stocks and gold can come out 10X or more ahead in net worth over a 10-20 year period, when it comes to price changes on an inflation adjusted basis. For a 20-30 year time period, correctly aligning oneself with the counter-cycles would have historically produced a 100X or more greater increase in net worth, versus having the opposite alignment.

Indeed, if a 30 year old had bought gold in 1969, switched to stocks in 1980, switched to gold in 2000 and switched to stocks in 2012, just those four investment choices - being completely passive all the rest of those years with national average results in each year – then price changes alone would have produced more than a 5,000 to 1 advantage in the money they would have had at age 80 in 2019, compared to if they had made the four opposite choices.

The Lucrative Profitability Of A Move To Negative Interest Rates

When it comes to the recession that is being created by the pandemic lockdowns - then the U.S. government and Federal Reserve have no intention of just letting the market forces play out. Instead, the intention is to contain a potential deeper round of crisis with the most extreme interventions yet. One very real possibility is for the Fed to follow the European Central Bank and the Bank of Japan, and to spend trillions of dollars to buy government (and corporate) debt while creating negative interest rates.

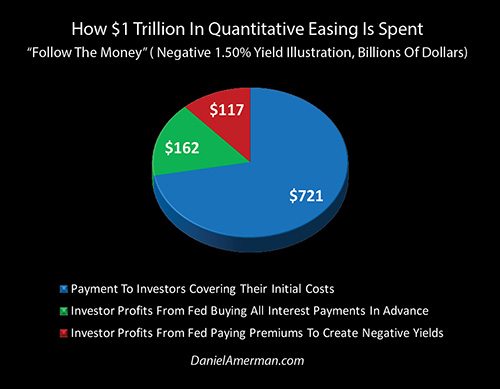

In this analysis, we will explore how the Federal Reserve could create one of the largest redistributions of wealth in U.S. history, with hundreds of billions of dollars in profits going disproportionately to insiders - at the expense of the general public (never let a national emergency go to waste). As illustrated with a step by step example, when we follow the money - $279 billion out of every $1 trillion in newly created money could end up going straight into the hands of organizations and individuals who make up a relatively small percentage of the nation.

To contain and exit recession, the Federal Reserve intends to engage in what could become the largest round of monetary creation in U.S. history. Those dollars will be quite real, and the reason for their creation is to spend them. A big chunk of that spending will become profits going straight into the pockets of investors. This won't actually be a closed game - anyone can try for a share of those new Federal Reserve dollars, but first they have to understand that the game exists, and then they need to learn how it is played.

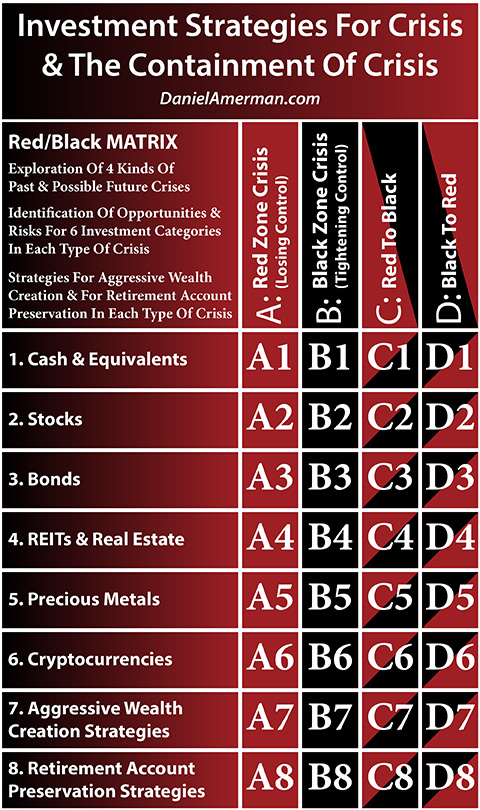

Using A Matrix Framework To Identify The Cyclical Risks & Opportunities Created By The Coronavirus Pandemic

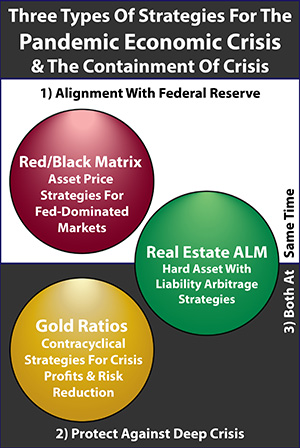

The United States has been moving through cycles of crisis and the containment of crisis, with an unprecedented degree of heavy-handed interventions by the Federal Reserve feeding the cycles and deeply distorting investment results.

These cycles are not over, but are ongoing and are amplifying as a result of the coronavirus pandemic lockdowns. This means that some of the biggest losses which we have seen to date are likely still ahead of us, and possibly within the next few years. These losses could be devastating for many millions of investors following traditional strategies.

However, when we take not a "gloom & doom" perspective, but a cyclical perspective, then we can understand the many logical reasons for why a new cycle of some of the highest asset prices and largest profits of our lifetimes for 1) stocks; 2) bonds; 3) real estate; and 4) precious metals could also still be awaiting us in the coming years.

In combination, the cycles and the extraordinary degree of Fed interventions create more volatile markets, with higher highs and lower lows than have existed in the past - and they do so in a rational sequence, much of which can be understood in advance by investors.

Using a matrix, with the cycles as the columns and the investment categories as the rows, we will introduce a new framework for seeing and understanding the many investment implications of the cycles in an environment where the economy and markets are still dominated by heavy-handed Fed interventions. This framework can be systematically applied to identify the logical sequences of nontraditional risks and heightened opportunities for each of the individual major investment categories at each of the different stages in the cycles, as well as in each of the transition points between the cycles.

Learn more about the rest of the free book.

***************************************************

Read Chapter One Of "The Homeowner Wealth Formula"

Read Chapter One Of "The Eight Levels Of Homeowner Wealth Multiplication"