The Hidden 95% Of The Risk

By Daniel R. Amerman, CFA

TweetThere can sometimes be a very high price for engaging in groupthink, or going with the herd. The risk is missing important information because of a factor, perhaps a critical complication, that is outside of the usual groupthink.

The current very popular groupthink is that the Federal Reserve gets its money by printing the money.

The slightly more complicated reality is that money printing is not the primary source. The Fed gets its money by borrowing the money.

Now the distinction is ordinarily unimportant for the average person, unless we are in times of high risk - as we are. The problem comes when much of the risk itself is coming from how the Fed is getting its money - as it is. But, we can't see the risk - it is literally invisible to us - if we go through the popular groupthink of believing it is all money printing.

The current fast-rising risk - that is, indeed, invisible to most people - is the Federal Reserve's increasing dependence on the high-risk strategy of using massive amounts of overnight reverse repurchase agreements (reverse repos) as the long-term source of funding for the national debt. As we will explore in this analysis, the unhealthy reliance on this last ditch source of funds is reaching record heights, even as market volatility risks continue to rise with regard to the Taper and the likely near-term increases in interest rates.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Reverse Repos - A Third Source Of Funding

In a previous analysis (link here), we definitively proved that literal money printing has not been the primary source of funding for the Federal Reserve in recent years.

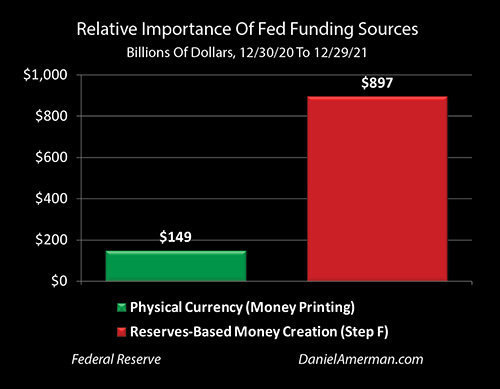

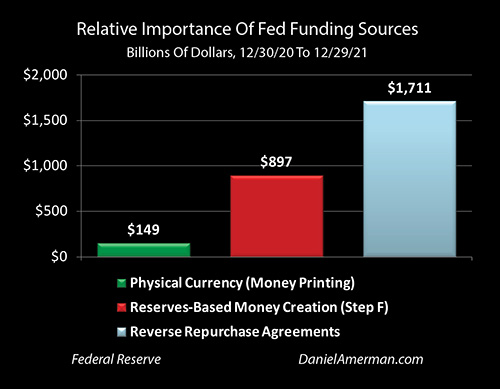

Comparing the balance sheets of the Federal Reserve at the end of 2020 and the end of 2021, we showed that "only" $149 billion of the Fed's funding for the year came from printing physical dollars, while $897 billion came from the increase in the cash reserves of the banking system being held at the Fed.

As explained in detail in my book, The Stealthy Raid On Our Bank Accounts (first chapter link here), the Fed was given back door access to the spending power of our bank accounts in 2008, and our bank accounts have been the primary source of Fed spending power since that time. It is our money in the bank that is being used to fund the growth in the national debt. It is our savings that are being used to rescue Wall Street and global insiders from their speculative excesses.

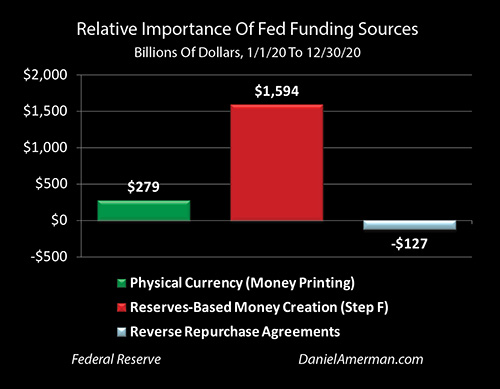

To see the extraordinary changes with the funding for the national debt, we need to move back a year, to 2020. The Fed used a much larger amount of the spending power of our bank accounts, using about $1.6 trillion of our own money, to fund the U.S. government sending us back our money, in redistributed form. This allowed politicians to take a huge amount of credit for their unprecedented generosity with the stimulus checks, while hiding that we were the real source of that money.

Total money printing was higher in 2020, with a net $279 billion in freshly printed bills going out into circulation. So, compared to the funding from money printing, our bank accounts were the source of almost six times the funding for the Federal Reserve in 2020. This is a very similar bank accounts / money printing ratio to what we saw in 2021.

Repurchase Agreements (repos) and Reverse Repurchase Agreements (reverse repos) are little known to the general public, but they are a critical part of the liquidity system that the stability of our financial system relies upon. For a much more detailed explanation of reverse repos, please read my July of 2021 analysis linked here.

When the Federal Reserve borrows via reverse repos, it is essentially pawning its ownership of the national debt, pledging the US Treasuries that it owns to get cheap, overnight borrowing rates. It then borrows the money again the next day, to repay the money it had borrowed the day before. And if that sounds like a much flimsier, high wire act method for funding the national debt than just "printing the money" - that is exactly right, and this is a potentially life-changing systemic risk to us all.

As can be seen in the graph above, in 2020 the Fed was not relying on reverse repos to fund its increased purchases of the national debt. The amount of outstanding reverse repo borrowings fell by $127 billion.

That radically changed in 2021, as the Federal Reserve changed its preferred new source of money from our bank accounts to massive borrowings via reverse repos. The Fed borrowed $1.7 trillion from net new reverse repos - the most money that it had ever borrowed from a single source in one year.

The Federal Reserve got about 11.5X more money from reverse repos than it did from money printing. The Fed took in 91% more money from pawning its ownership of the national debt than it did from using its back door access to our bank accounts.

Someone who thinks it is all money printing - then only understands 5% of where the Federal Reserve got its money in 2021, $149 billion out of $2,757 billion. As we enter what could become some of the most volatile markets of our lifetimes - there is a case to be made that having no idea where 95% of the money is coming from to potentially rescue markets or to pull us out of recession, might be a less than optimal approach to maximizing financial security.

For those who attended my May of 2021 workshop, I had warned that the Federal Reserve still had another "big gun" in its arsenal besides the spending power of our bank accounts, and that if the Fed turned to large scale reliance on reverse repos to fund its asset purchases, then look out, because the situation would be getting much riskier.

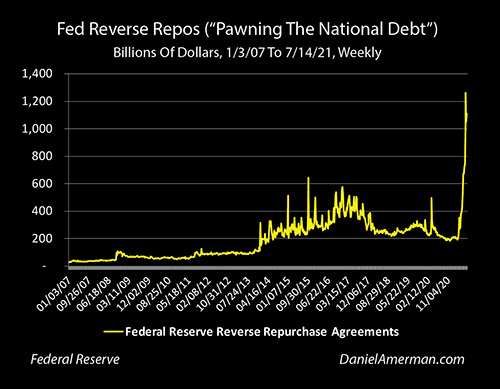

That is exactly what happened, and as can be seen in the graph from my (previously linked) July of 2020 analysis, the spike was almost straight upwards, as the Federal Reserve took in money at an unprecedented rate.

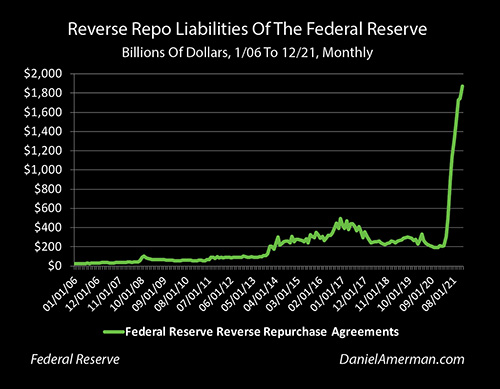

When the numbers are updated through the end of 2021 - the almost straight up spike is still very much there, even as the amount borrowed increased by almost 50% between July and December, rising from over $1.2 trillion to over $1.8 trillion.

Anytime a spike like this appears, and particularly on that scale - something major and unprecedented is underway. This is exactly what is happening with the Federal Reserve relying on what is now close to $2 trillion in (mostly) overnight money being borrowed to fund long-term investments in U.S. Treasuries, as well as being the go-to source of money in the event of financial instability.

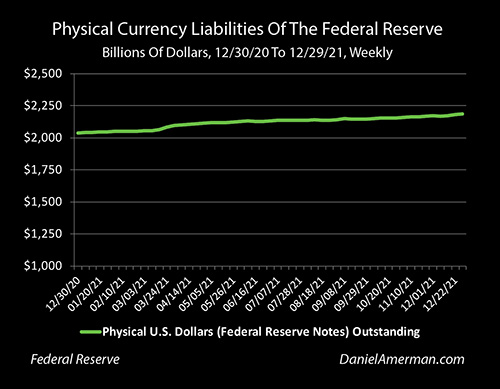

In contrast, when we look at Fed funding via money printing - we get a quite boring graph, with a very slow increase in funding. The money printing is simply not where the action is, and to see that action - as well as the associated risks - we need to move beyond the money printing.

Hopefully, this and earlier analyses have been helpful to the reader in understanding what the true sources of money have been for the Federal Reserve, as well as the unprecedented recent nature of much of that funding.

Learn more about The Stealthy Raid On Our Bank Accounts

********************************************

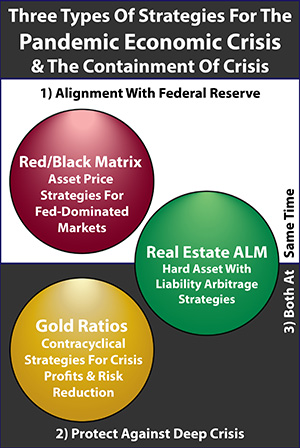

As we will be exploring in detail at the April 9-10, 2022 workshop (brochure link here), the heavy reliance on reverse repos has substantially changed the risks relative to where we were in early 2021. Looking at the brochure topic outline, on Saturday morning reverse repos will be a critical component of section 1B, Other Fed Funding Sources, and section 1C, Funding Limits & Risks Assessment.

However, as we will be covering on Saturday afternoon and part of Sunday morning, the bigger issues are not reverse repos in isolation, but how this unprecedented reliance on nearly $2 trillion in overnight funding from the markets changes the risks for crisis, as well as how it changes the ability of the Fed to control inflation, to get out of recessions, and to rescue (or fail to rescue) markets and the financial system. There is a potentially explosive relationship between reverse repos, the Fed ending its funding of the national debt, and rising interest rates that we will be exploring in section 2C, The Liquidity Conundrum. As described on page 4 of the brochure:

"The stability of the entire U.S. (and global) financial system - and the value of retirement assets - are arguably primarily based at this time on something that very few people understand, which is the limits on the sources of funding for the Federal Reserve, as well as the interrelationships between the sources of Fed funding, inflation, interest rates, investment prices, financial stability, and the funding for the national debt."

There are also strong implications for sections 2A and 2E, as well as sections 2H and 2I.