The Money Printing Myth & The Raid On Our Bank Accounts

By Daniel R. Amerman, CFA

TweetWhere the Federal Reserve gets its money is perhaps one of the most misunderstood of all financial topics. It's also vital - because if the Fed is to finance the national debt, it needs to have sources for that money, the Fed doesn't just snap its fingers and will the money into existence.

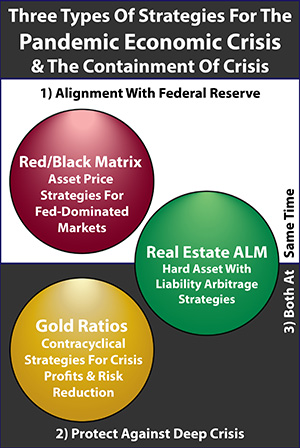

Of perhaps greater importance for 2022 is that when the Federal Reserve conducts massive market interventions - it needs a source for that new money. If the Fed is going to rescue a major U.S. or European bank or hedge fund, it needs a source for getting the money to do so. If the markets start to melt down with rising inflation and interest rates, and the markets turn to the Fed for injecting trillions in liquidity - the Fed can't do that unless it can raise the needed trillions of dollars.

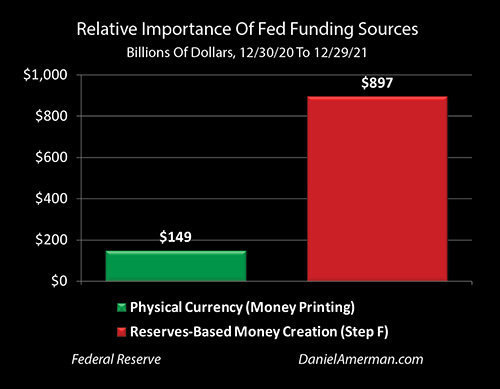

There has been a mass illusion of the Fed printing money without limits. The objective facts can be seen by looking at - and more importantly, actually understanding - the Federal Reserve's balance sheet. The fact is that money printing is only of four core sources of spending power for the Fed, and it was only the third most important source of funds in 2021.

As we will explore in this analysis, the numbers show that spending the money in our bank accounts was about six times as important as a source of funds in 2021, than the actual money printing by the Fed.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Printing The Money

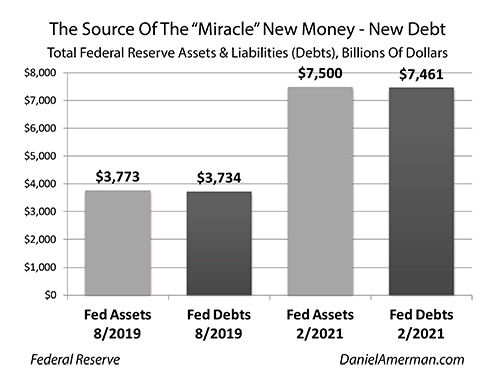

The graph below shows the explosive growth in size for the Federal Reserve between August 2019 and February of 2021.

The assets of the Federal Reserve grew from $3,773 billion to $7,500 billion, which was an increase of $3,727 billion. The debts (liabilities) of the Federal Reserve grew from $3,754 billion to $7,461 billion, which was also an increase of $3,727 billion.

The objective facts are that the Fed bought $3.7 trillion in new assets by taking out $3.7 trillion in new debts. The Fed borrows the money to spend the money. Any beliefs that state otherwise, are opinions that are not based on the facts.

One of the sources of the new debts was, in fact, running a printing press. Every physical dollar is a note, a debt of the Federal Reserve, that appears as a line item on the liability side of the consolidated balance sheets of the Federal Reserve Banks.

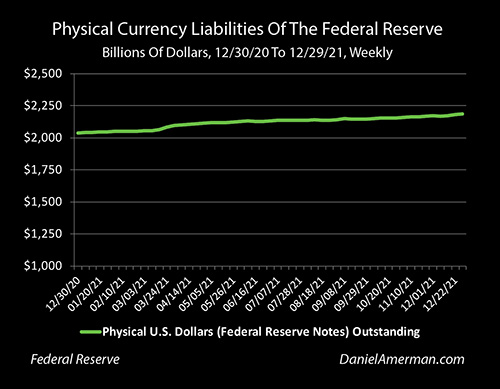

As shown in the graph above, which focuses on what happened in 2021, there was $2,038 billion in physical currency in circulation as December 30th of 2020. There was $2,187 billion in physical cash on the Fed balance sheet as of December 29th of 2021.

This means that the public records show that money printing was a net source of $149 billion in new spending power for the Federal Reserve in 2021.

Raiding The Money In Our Bank Accounts

While few people realize it to this day, the primary funding for the Federal Reserve radically changed in 2008 when emergency legislation brought forward the effective date of the Financial Services Regulatory Relief Act of 2006.

The global banking system was teetering on the brink of collapse, and neither the government nor the Fed had the money to rescue them - so the U.S. government changed the law, to give the Federal Reserve unprecedented back door access to the U.S. banking system and the spending power of our bank accounts.

As introduced in the first chapter (link here) of my new book, "The Stealthy Raid On Our Bank Accounts", this new back door access allowed the Fed to quickly grab almost $800 billion from the nation's banks - that are funded by our deposits - and to use that money to rescue the global banking system. If the Fed had not had access to the spending power of our banking system - the system would have collapsed, there were no "strong banks" in practice. This is critical information to keep in mind if there is another major crisis in the banking system.

It was this back door access that was the source of funds for the quantitative easings, as the Fed used its new trillions in spending power to fund the growth in the national debt while taking unprecedented control of interest rates. It was our bank accounts that were the source of funds that the government used to shower the country with stimulus checks, sending us back our own money in redistributed form.

Unfortunately, the process is a bit complicated, particularly for those who do not have formal training in the money and banking area of macroeconomics (hence the book-length explanation for those who don't). The money travels ten steps, between the first step of our depositing our money, and the tenth step of the government spending our money.

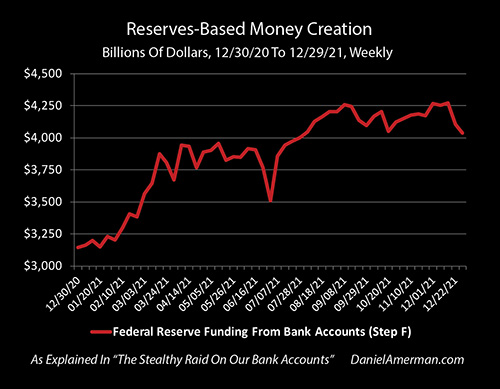

We can, however, find public information for the sixth step our money travels, Step F, when the money appears as a liability line item on the consolidated balance sheets of the Federal Reserve Banks under the obscure sounding name of "other deposits held by depository institutions".

As shown in the graph above, we know that the Federal Reserve owed $3,143 billion as of December 30, 2020. We know that this liability line item increased to $4,040 billion by December 29, 2021.

We, therefore, know that the Fed borrowing from our money on deposit at the nation's banks financed $897 billion of the Fed's increase in assets over the year.

As shown in the graph above, we now have the facts to determine how much of the Fed's asset purchases were funded by money printing, versus how much were funded by the back door access to our bank accounts. The Fed gained $897 billion in funds from the banks, and $149 billion from money printing, so the back door access to our bank accounts provided almost exactly six times as much money as did the money printing.

The money printing did occur. But it was relatively minor when compared to the raid on our bank accounts. So, the idea that it is all money printing is a myth. Indeed, it is a convenient myth for the Federal Reserve and U.S. government. So long as people mistakenly think it is all money printing, then they don't think to look elsewhere for the real source, which is the massive back door emptying of the spending power in our bank accounts.

Limits & Crisis

This is very important information on multiple levels. The first is the simple fact that after having consumed all of our Social Security savings, with the Trust Funds being entirely invested in funding the national debt, the government is now going after our bank account savings as well, which are increasingly being consumed to fund the national debt.

In general, the population has no idea that the government is consuming their bank savings in order to fund the national debt. It is critical that they find out if there is to be any chance of stopping the process before it is too late.

Of at least equal importance is the understanding of limits when it comes to future crises and whether those crises can be contained. There are limits to the Fed's current sources of funding. If those limits are exceeded - then there is no magic rescue, and the degree of financial catastrophe could be much greater than what was seen in 2008. There is also the issue that the Fed approaching its limits could be what triggers the next crisis. Indeed, the Fed being too near its limits even as inflation and interest rates rise could be called the single greatest fundamental risk of 2022.

To understand the limits, we have to understand the actual sources of the Fed's money. Hopefully, this analysis has been helpful in that regard for the reader.

Learn more about The Stealthy Raid On Our Bank Accounts

********************************************

The next in-person workshop has now been scheduled for April 9-10 in the Indianapolis suburbs (Carmel, Indiana). We will be taking an in-depth look at all the Fed's major sources of funding, limits, and the extraordinary risks and pressures that are being created by persistent inflation, even as the Taper ends while interest rates rise. We have never seen anything like this potentially explosive combination before. Look for the new brochure to be released later this month.