Counterfeiters, Con Men, Mass Illusions & Funding The National Debt

By Daniel R. Amerman, CFA

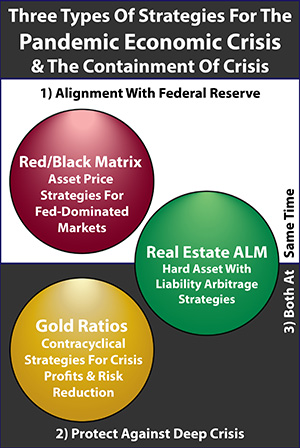

TweetThere is a mass illusion at work, with the general public being encouraged to believe that there is a limitless supply of free money. Indeed, the markets and financial stability of the nation have come to depend on something that most people do not understand, which is the seeming existence of a bottomless wallet at the Federal Reserve, that can fund unlimited amounts of new federal debt. For those who do think about where that money is coming from, the usual belief is that the money comes from running a printing press, like a counterfeiter would do.

As explored in this brief outtake from my upcoming workshop, these people are watching the wrong crime drama. Oh, it is a crime drama, but it is about con men, shell games and Ponzi schemes - not counterfeiters. The purpose of this analysis is to help the reader to see through the illusion, and to identify what is really happening.

Gross Fed Funding Of The National Debt

The stock and bond markets had a close call earlier this year. If free market forces had determined where the markets went - there is a very good chance that the stock and bond markets would currently be plummeting.

The issue is the problems that the United States has been having with funding not just the national debt in general - but the stimulus spending in particular that occurred in early 2021. In order to prevent market chaos, the Federal Reserve had to resort to drastic actions - indeed the level of interventions needed was about three times as great as what the Fed did in October of 2008, in order to hold the financial system together at that time.

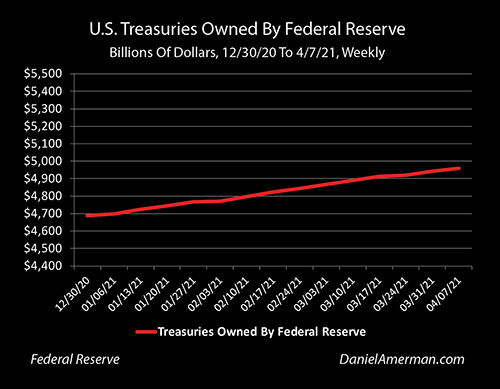

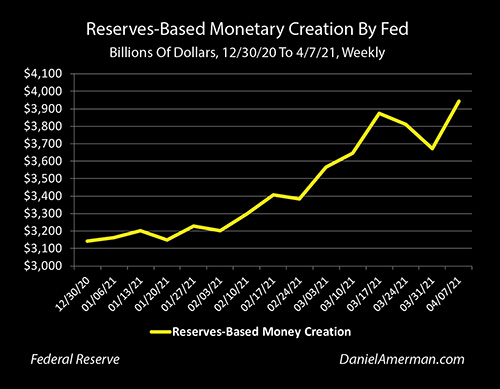

The graph above is of the $270 billion increase in the Federal Reserve's ownership of U.S. Treasury obligations between the end of December and the first week of April. By historical standards, what is shown is surreal, as the Fed's funding of the national debt reached almost $5 trillion. However, once the unprecedented and surreal is accepted - the graph does not look all that exciting, just a reasonably steady climb in the Federal Reserve financing a massive increase in the national debt.

Where things get interesting is when we go down one more level, to a place that almost no one is talking about or that most people are even aware exists.

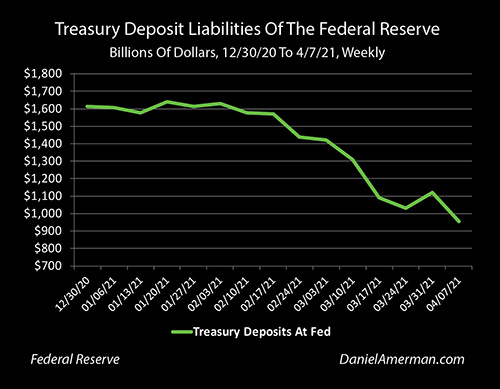

The U.S. Treasury often does not immediately spend the money once it sells new debt. Instead, it deposits the money at the Federal Reserve, much like an individual might borrow money and then temporarily deposit the loan proceeds at their bank, prior to spending the money. Over the five years or so before the pandemic, the amount that the Treasury kept deposited at the Fed had generally been running somewhere between about $100 billion and $400 billion in any given week or month - this was essentially the U.S. government's "checking account".

This is usually pretty obscure stuff - but it's also the kind of thing that can take down on already overburdened financial system in times of high stress. As we've been reviewing at this workshop, in a world that is completely dominated by massive financial interventions by the Federal Reserve, we can't understand anything at all about what the actual risks are - and the actual opportunities - without understanding where the Fed really gets its money. The little understood answer is that the Federal Reserve borrows the money.

When the Treasury deposited the proceeds from the early run up in the national debt at the Fed - it became the largest single lender to the Federal Reserve. The Treasury deposits soared up to an unprecedented almost $1.8 trillion by the summer of 2020, and were still over $1.6 trillion by the end of the year.

What this mean is that much of the growth in the national debt was being temporarily funded by the U.S. Treasury itself, in a self-funding loop of sorts. The broker dealers bought the $1.6 trillion in debt as issued by the U.S. Treasury. The Treasury deposited the $1.6 trillion in its general account at the Federal Reserve. The Fed took the $1.6 trillion - which was a debt that it now owed the Treasury - and used those borrowed funds to buy the new debt from broker dealers. So, the Fed was the using the money borrowed by the Treasury to finance a big chunk of the growth in the national debt. Temporarily.

I know, I know, it sounds obscure and thinking through those loops can give a person a headache. But it matters, because it is a very dangerous and unstable way of funding the national debt.

The problem and the danger is that the Treasury borrowed the money in order to spend it. The Fed doesn't have the money anymore - it already spent it all on the funding the national debt. So, when the Treasury wants its money - the Fed either has to borrow the money from someone else, or we have a BIG PROBLEM.

Indeed, that dangerous situation is exactly what just happened in the first part of 2021, with no coverage from the media. The Treasury needed the cash to flood the nation with $1,400 "stimmy" checks for (almost) everyone, as well as for other purposes. So the Treasury wrote the checks on its account at the Federal Reserve and drew that balance down by $675 billion between February 3rd and April 7th.

Ordinarily, a bank (and the Fed is a very special kind of bank) could deal with that situation by selling the assets it had bought with the borrowed money, i.e. sell $675 billion of the national debt to the markets, and get the cash to cover the check writing by the Treasury Department.

Small problem - the stock and bond markets would likely have been sent into deep bear markets as a result.

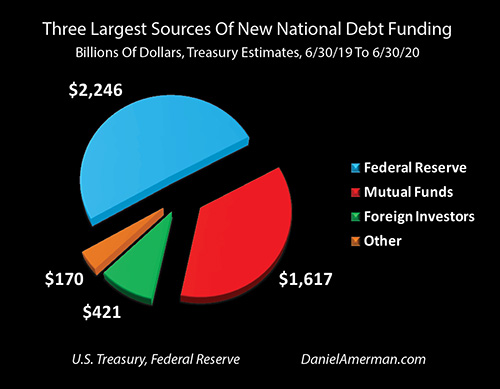

As explored in the analysis linked here, the funding for the national debt was already very unstable. Almost all of the initial $4.5 trillion run up in the national debt had come from one of two sources, either the Federal Reserve or mutual funds. The mutual fund money was not permanent funding, but "hot money", money that had moved into Treasuries either as part of a flight to safety, or in search of long bond trading profits. That money was just there temporarily, and if it was to be kept there - or replaced - then yields needed to go up.

Ten year Treasury yields spiked up as result, and the stock and bond markets started to get nervous. Very nervous.

Now, what would have happened if the Federal Reserve had sold $675 billion in Treasury bonds in the open markets at the same time, in order to give the Treasury its money back?

The lesser implication is recognizing that finding another $675 billion in new investors in a matter of three months is likely to have caused 10 year yields to move well above 2%. That is above the level that some observers believe would cause corrections in the stock markets.

The much bigger implication is that if the markets saw the Fed as moving from being a buyer of the national debt to a seller - the bottom drops out. There is no way the free markets fund the fantastic growth in the national debt by themselves, at such paltry interest rates.

If the Fed had actually sold the bonds it had bought with the Treasury Department's money in order to give the money back and fund the stimmy checks - then stocks, bonds and real estate might all be plunging together as interest rates soared upwards. Almost every retirement account in the country could be dropping like a rock. And gold and bitcoins might be setting new at records, at prices far, far above where they are today.

So the Federal Reserve didn't have the money, it had all been spent, getting the money back would collapse the markets, the Treasury was sending out the stimmy "checks" (mostly electronic deposits), the Fed needed the cash to make good - what to do?

Seeing The Money Printing

Many people would say that the answer is obvious - they believe the growth in the national debt is being financed by money printing, so it just needed to crank up the printing presses, and print an additional almost $700 billion in fresh new dollars.

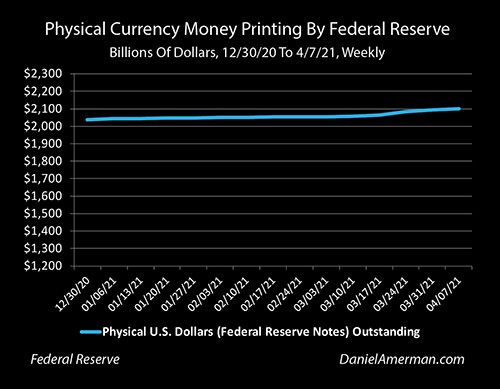

Now the Fed does have printing presses, it does print dollars, and it did slightly turn up the money printing speed at the same time that Treasury was increasing its own spending. The problem with the money printing belief is one of scale. I've kept the vertical axes at a common scale of $1.1 trillion for the flow of funds series of graphs, and the actual dollar increase is quite small in comparison to the need.

The Federal Reserve printed $51 billion in (net) new dollars between February 3rd and April 7th - which was only enough to cover about 7.5% of the $675 billion of the Treasury cash outflows.

We also need to keep in mind that the Federal Reserve needed to come up with the money to both give the Treasury its money back to cover the stimmy checks, AND enough money to keep buying new Treasuries as they were issued.

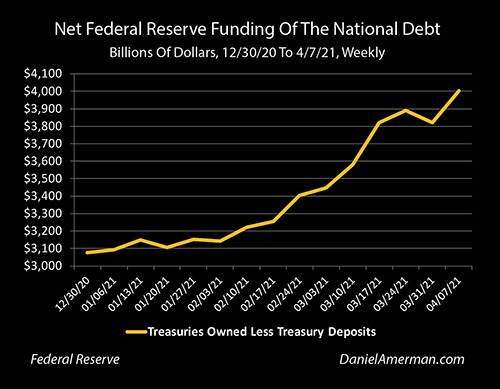

In other words, we need to measure the net Federal Reserve funding of the national debt, which is the Treasuries that are purchased and owned, less the Treasuries that were purchased using the money in the Treasury Department's account at the Fed. When the Fed buys new Treasuries, it needs to get more money from somewhere. Separately, when the Treasury draws down its account at the Fed, the Fed needs to get the money to repay the Treasury from somewhere.

When the Federal Reserve owned about $4.7 trillion of Treasuries on December 30th, but about $1.6 trillion of that was actually being funded by Treasury money on deposit at the Fed - the Federal Reserve was on net funding about $3.1 trillion of the national debt. When the Federal Reserve owned just shy of $5 trillion in Treasuries on April 7th, and the amount being funded by Treasury had dropped to $955 billion, the net funding of the national debt had increased to about $4 trillion.

In other words, the Federal Reserve had to come up with about $929 billion in new money between the end of December and early April, in order to fund the growth in the debt and to pay for the stimmy checks - while still keeping the markets from flying apart.

The net new money printing over that time period was $63 billion, which was less than 7% of the money needed. The other $866 billion in new cash needed to come in from somewhere else, and the Fed had to find a way to get it in just over three months.

Reserves-Based Money Creation

If that situation had occurred at any time before October of 2008 - it would have been game over. The Federal Reserve could not come up with that much money, it simply didn't have it. It would have had to sell assets to get the money, interest rates would have shot up, the markets would have gone down.

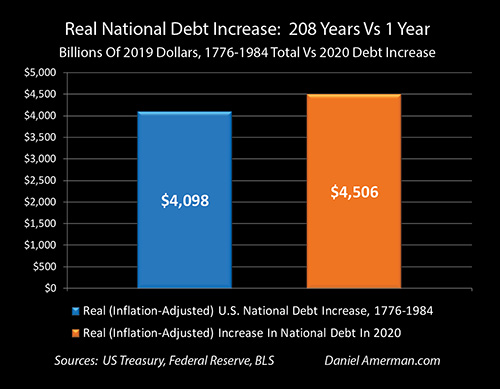

People forget, but the government or the Fed simply couldn't come up with a trillion here or trillion there seemingly at will over the course of almost the entire history of the United States. Those were huge sums of money - and there were real limits on what the government could do. The government couldn't borrow $4.5 trillion in a year, even in inflation-adjusted terms.

The government wasn't borrowing more money in a year than it previously did in two centuries - because even if they had wanted to, even if they had been so crazily irresponsible as to want to do so, the money wasn't there in the free markets to do it, not without paying prohibitively expensive borrowing costs.

Because the laws were changed in 2008, however, to give the Fed new monetary powers, the Fed was able to raise the money by using its powers of reserves-based monetary creation.

It is really fairly simple - just follow the dollars.

The Federal Reserve needed $929 billion to fund $270 billion of new national debt purchases while coming up with $659 billion to give the Treasury its money back (December 30th to April 7th), so the government could send its stimulus (and other) checks.

The Fed printed $63 billion in new currency, and it raised another $801 billion using its relatively new powers of reserves-based money creation. Put the two together, and they add up to $864 billion. Now, there are some other more technical factors involved, but that is where the overwhelming majority of the money came from, and where it went.

To put this in perspective, when the Federal Reserve first used its awesome new powers of reserves-based monetary creation in 2008, it raised $247 billion in the four weeks from October 1st to October 29th. That first quarter trillion literally saved the global banking system. Without that emergency cash infusion from the Fed, it is unlikely that Goldman, or Morgan Stanley, or JP Morgan, or the major European banks would have survived the institutional bank run that was then in process. Think back to the screaming daily headlines of that time, the mass fear.

In comparison, the Federal Reserve just raised and spent more than three times the money that it did in the darkest heart of the Financial Crisis of 2008. Effectively, every month for the first three months of 2021, the Fed on average exceeded its desperate interventions in October, 2008 - for the same purpose of keeping the financial system intact. In this case is it is a matter of keeping the national debt purchased, the Treasury with the cash to spend, and interest rates under control.

But where are the headlines? Where is the fear?

An Information Void & Monetary Misinformation

In some ways, the lack of discussion about the extraordinary events that are still unfolding could be called the economics equivalent of the old question about "if a tree falls in a forest and no one is there to hear it - did it make a noise?"

If some of the wildest and riskiest gyrations in the history of economics are underway for the short term benefit of insiders, but neither the Fed, the government, the newspapers or the television networks are talking about it - is it happening at all?

From the perspective of the average person, we now know the answer - which is that it is clearly not happening.

Oh, it is all public information. All of the dollars are there in plain sight, and they can be followed by anyone who understands central banking and knows what they are looking for.

But yet, the average person has no idea that any of this is happening. It is a complete non-event. And it will remain a complete non-event right up until the time when they potentially get the blindside of their lives with regard to value of their retirement accounts, the value of their money in the bank, and even the value of their Social Security benefits. The financial pressure that is ratcheting up every month that the shell game continues is likely to be life changing for all of us when it is finally released, and that applies whether we are being told about the ratcheting pressure or not.

There are many other people who are aware that the funding for the debt and the stability of the financial system are dependent with upon the Federal Reserve's ability to continuously and seemingly endlessly come up with the additional trillions of dollars to buy Treasury obligations.

These people can likely be broadly split into two groups. One is conventional investors who are least somewhat informed. They know that the staggering deficits are being primarily funded by the Federal Reserve. They are at least somewhat aware that if the Fed were to stop doing this, then the consequences would be bad for the economy, stocks and bonds (although I would argue that most have no idea of just how bad and potentially long lasting it could be).

Now, I meet a lot of people, I read very widely, and here's the thing: I've never once met someone who falls in that generic category and who knows what the Fed is actually doing or how they are getting those trillions of dollars. Even if they would never use the particular terms, the Federal Reserve's ability to spend trillions of dollars from a seemingly bottomless wallet could be viewed as a "mystery" or even "magic". These are often highly intelligent and successful people, but when we come right down to the essence, they are effectively betting much of what they've built on what could be called magic, the existence of a new kind of bottomless wallet that through some mysterious process can buy everything indefinitely.

There is another large group, and they understand very well that the markets, the economy and the value of the dollar all hinge on the Fed's ability to come up with trillions of dollars, one trillion after another. They mistakenly believe that it is all money printing - and that makes a kind of sense, money printing is very easy to understand, very easy to write about, very easy to read about.

The problem is that while money printing does exist, it is only a relatively small part of the big picture. The Fed printed a net new total of $63 billion between the end of last year and early April. That's significant - but it only funded about 7% of the emergency $929 billion that was needed to hold the system together.

Some people will say that is not physical money printing, but electronic money printing. They believe a button on a keyboard is pressed and a new billion comes into existence, unconnected to anything before it and ready to be spent. That would be wild if it were true – but it isn’t (or not yet anyway).

The Simple Truth

The truth about what has actually been happening in plain sight is very simple.

The Federal Reserve is a particular kind of bank, a central bank.

How do banks get money, whether they are normal banks or central banks?

They borrow the money.

How the Federal Reserve could somehow will enough money into existence to fund the stimulus checks and all the other spending for the nation is hard to wrap our minds around, it is very difficult to understand.

As we've been exploring this morning, reality is much simpler - and much scarier. The reality is that the Federal Reserve has about $7.5 trillion in assets, with about 2/3 of that, or $5 trillion, having been used to fund the national debt. And the simple reality is that the Federal Reserve has borrowed $7.5 trillion in order to get the money to fund the national debt.

When the Federal Reserve needs another billion dollars it doesn’t generally run a printing press, and there is no button pressed on a keyboard that makes another billion dollars pop into existence out of nowhere. Instead, it finds someone to lend it a billion dollars. In the process, a billion dollars in new money is indeed created, but it is debt-based money creation, and the Fed only gets the billion in new money to spend by taking on a new billion dollar debt that is now owed to a lender. There is no magical bottomless wallet, the mystery goes away, and we are down to simply borrowing the money to buy something.

For every dollar of the five trillion in the national debt the Federal Reserve has purchased, there is a corresponding dollar of debt, the five trillion in debt that the Fed itself took on in order to fund its purchases of the national debt. When the Fed needed $929 billion to buy new government debt while giving the Treasury its money back in about the first three months of 2021, there was no just hitting a button on a keyboard, or $929 billion in free money falling from the sky – it had to go out and borrow those 929 billion dollars. Or else.

This is all freely available public information – although the Fed itself is careful to avoid connecting the dots for the public in a simple to understand manner. There are a lot of myths out there, and a huge amount of misinformation, which is understandable given the surreal sums of money involved, the unwillingness of the government to explain what it is doing, and the initial apparent complexity for those without training in economics. However, when we understand the basics of the underlying “borrow a dollar to buy a dollar” relationship, then a lot of the seeming complexity disappears. The mass illusion falls away, and the biggest financial story of our lifetimes, something that is likely to change the lives of everyone in this nation – particularly savers and retirement investors - comes into view.

Once we get this clear insight into reality, then a "catch" appears. Almost all of the Federal Reserve's borrowings are overnight money, the Fed has to pay it back on demand. In theory, almost the entire whole $7.5 trillion would need to be repaid in single day if needed. (Currency is a special case, but it is actually an outstanding debt of the Federal Reserve, a "note", and if currency is deposited at a bank, the bank can deposit it at the Fed and then ask for their money, i.e. the repayment of the outstanding debt on demand.)

The problem is that the Fed doesn't have the money. It spent most of it on long term investments, Treasury bonds and mortgage-backed securities, that were purchased at below market rates and above market prices in order to fund the Federal government while controlling the markets. As we have just explored - the Fed can't sell these assets in any large quantities without undoing their market manipulations, and thereby likely triggering sharply higher interest rates and potentially plummeting stock and bond prices.

So the Fed is fantastically in debt - but it can't pay the money back. And there are limits to how much it can borrow via reserves-based monetary creation.

For a bank - even a central bank - to be in a position where too many lenders want their money back at the same time, but they don't have the money, is to be facing an existential danger. True, central banks have vast powers that ordinary people and ordinary banks do not, but the fundamental danger is still there, particularly when there is $7.5 trillion in borrowed money involved.

When we understand this, then what just happened with the Treasury getting its $675 billion back that it had lent to the Federal Reserve, can now be properly understood.

This wasn't a technical or accounting development, but a near extinction event for the financial system. If we were to view the financial system as a planet, well, we just had a rogue moon just go zipping past our planet, and it would have been game over for the existing order if it had hit.

To avoid the collision, to give the Treasury its money without risking destabilizing and possibly collapsing the markets, the Federal Reserve had to engage in emergency maneuvers, borrowing and immediately spending more money each month (on average) for three months in a row, than what was borrowed and spent in the single darkest month of the Financial Crisis of 2008. With all of the newly borrowed money that replaced the former borrowed money - also being impossible to repay.

And nobody noticed. Nobody noticed! That is the most ironic part of all when it comes to currently fantastic situation, is that the Federal Reserve, the Treasury, the White House, and the media all said nothing at all. And the average person therefore knew nothing at all, about what could have been a life changing event for all of us.

What is perhaps even more ironic is that for the many millions of people who are deeply concerned - most of them are watching the wrong movie. They think they are watching what could be a ring of counterfeiters, running the printing presses endlessly.

However, the actual crime drama (or so it would be if it weren't the government) is a group of con men (and women) running a shell game, a swindle, a form of a Ponzi scheme where what appears to be a magical bottomless wallet works perfectly - right up to the moment when they run out of suckers, too many people want their money back, and the whole thing blows up.

Again, this is not that difficult, and it is also all a matter of public information, as we've been reviewing. Trillions are being borrowed in plain sight, they promptly spend the money which means they can't pay it back, they know they can't pay it back, and they apparently don't care so long as system holds together and the billions keep flowing to them and their fellow insiders. The ultimate financial damage to the citizens of the nation does not seem to be a consideration. (There are really, really good reasons why central banks paying interest on excess reserves in order to use reserves-based money creation used to be illegal in the U.S. and Europe.)

What both types of "crimes" have in common is that they likely have bad endings. However, as we will be going over this weekend, the path and the dangers are very different between running a printing press and running a shell game or a Ponzi scheme. Indeed, Ponzi schemes can go through very dangerous periods that do not need to include high rates of inflation - but those dangers simply can't be seen by someone who thinks they are watching a printing press. The investment implications and the financial defense implications are very different.

As one example, someone watching a counterfeiting drama might completely ignore Treasury deposits at the Federal Reserve as an obscure technicality, a non-event. Just step to the back room, run the presses, crank out the trillion, and give it to the Treasury, no problem.

On the other hand, someone watching a con man drama might look at the almost trillion dollars that the Treasury still has parked at the Fed - which the Treasury does plan to spend as mandated by Congress - and their eyes might get very large as they realize another potential extinction moon could be coming at us again at any time. One of the marks just asked to withdraw a huge sum of money and the con men don't have it! Different movies, different paths, different risks, and different opportunities.

When we understand the difference between the two "crime dramas" then the heart of the mass illusion, what could even be called a mass hypnosis, can be seen. The public has been encouraged to believe in the child's fairy tale of limitless free money. Whether it is (implicitly) a magical bottomless wallet creating an endless series of record stock index highs, or a vast array of printing presses, trillions can be created without end, with the only danger being found in the debate about whether it will create high rates of inflation sometime down the road.

In the meantime, people believe the government can just create and spend trillions at will, with the money effectively coming from nowhere - but nothing bad happening to them individually as a result. The eyes glaze over and people even stop paying attention. Another trillion dollar deficit over the course of a few months? So what, big deal. The Fed just funded $3 trillion, and then $4 trillion, and then $5 trillion of the national debt? Who cares, they can obviously do it and nothing bad is happening.

The simple act of following the dollars, as we are doing this weekend, and seeing that there is no magic flow of free money but rather every dollar is being borrowed - is enough to shatter the mass illusion for any reasonable adult. There are no limitless dollars, or even a limitless printing press. It is a new risk every time a new fifty or hundred billion dollars is needed, and getting every additional hundred billion is riskier than the hundred billion before it. The victims (that's all of us) do take another entirely real additional hundred billion dollar round of damage every time a new hundred billion is borrowed and then locked away in the national debt, never to be repaid.

Now, as discussed in the analysis linked here, the "crimes" can merge. If a government is running a shell game, and the moment comes when the game is about to end, then as a government it can indeed flick on the printing presses (or the electronic version thereof) and move to just straight up pure monetary creation to repay the debts. If that happens, then the move to running a printing press will indeed change all of our lives - with the irony being that the people watching printing press dramas may never realize what just happened, when it finally does happen.

Whatever the direction - there is no path back to where we were, too much has happened and too fast. The old normal no longer exists, so much has changed in the last fifteen months that there is no path back to the old normal, or at least not while keeping the current nature and value of the U.S. dollar. This also means that any financial plans that are dependent on the continuance of the former normal - may not fit with what is happening now and what is on the way.

Learn more about the free book.

**********************************************