Two Centuries Of National Debt In One Year: Putting 2020 In Perspective

By Daniel R. Amerman, CFA

TweetThe $4.5 trillion increase in the U.S. national debt in 2020 was so large as to be almost incomprehensible for the average person. Yet, every dollar of the new debt was entirely real. It will likely be with us for the rest of our lifetimes, and may profoundly change every aspect of our financial lives, including Social Security, Medicare, stock prices, gold prices, real estate prices, and the value of retirement accounts,

This analysis uses historical comparisons to help put 2020 in perspective, and make more concrete and tangible what really happened last year. It also explores the underlying issues, and shows why the actual situation is even worse than most people realize.

The analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

The Stunning Increase In The National Debt

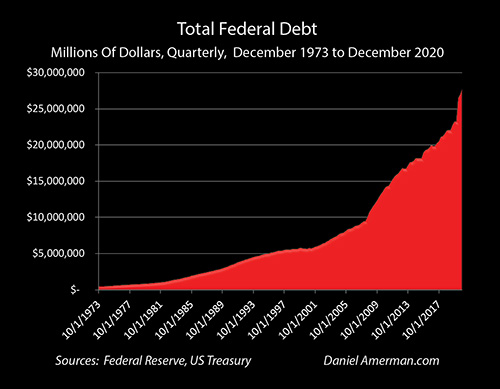

According the to the U.S. Treasury Department, the national debt of the United States reached $27.7 trillion by the end of 2020. There was an unprecedented degree of government borrowing to try to limit the damage from the economic shutdowns that were used to try to slow and control the spread of the COVID pandemic. Paying for the total costs of the many stimulus programs, including the checks to individuals and households, increased the single year deficit to a stunning $4.5 trillion.

While it is too early to know what the total will be for 2021, the current political indications are that the next rounds of stimulus spending will be almost guaranteed to bring the national debt above $30 trillion sometime during the year. Indeed, a repeat of 2020 would bring the total national debt to $32.3 trillion by the end of the year.

As can be seen in the graph above, the rapid increase in the national debt in 2020 was by far the largest that has ever been seen. The next closest was the $1.7 trillion increase in the debt in 2010. The growth in the debt in 2020 was an extraordinary 2.7X time greater than the previous record.

What also needs to be remembered is that the annual deficits associated with the Financial Crisis of 2008 were themselves unprecedented, going far above any previous increase in the national debt. The $1.7 trillion increase in the national debt in 2010 had itself been almost 3X greater than the previous record of $598 billion, that had been set in 2004, as part of the attempt to contain the damage from the collapse of the Tech stock bubble and the associated recession.

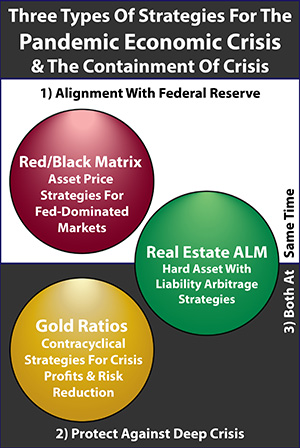

What started in 2020 (and may still have a long ways to go) was the third round of the upwards explosion of the national debt over the last two decades. We saw record deficits in the attempt to contain the damage from the 2001 recession. There was a near tripling of peak annual deficits in the attempt to contain the damage from the 2008 recession. And we are now seeing yet another near tripling of peak annual deficits in the attempt to contain the damage from the 2020 recession.

Two near triplings in a row, with two rounds of major crisis and the containment of crisis, have produced about a 7.5X increase in peak annual deficits during crisis, when compared to the all time record that had previously been set in 2004.

217 Years Of Debt In 1 Year

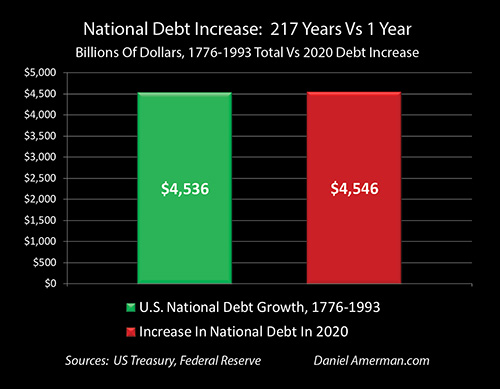

To help gain some perspective on just how historically off the scale the run up in the national debt was in 2020, the green bar on the left in the graph shows the total national debt accumulated by the United States between 1776 and 1993, the first 217 years of the nation. That totaled $4,536 billion, or $4.5 trillion in debt.

The red bar on the right shows the increase in the national debt in 2020 alone, which was $4,546 billion, or $4.5 trillion in new debt in one year.

Many people remember 1993 and the years before. The national debt was considered to be a big deal at that time, as it has been for decades and centuries before that time.

For hundreds of years, financially and economically literate people had been worrying over the size of the national debt, and the very troubling growth in the national debt. They had good, historically sound reasons for their concerns. Very large national debts have economically crippled many nations over the centuries, most often eventually leading to lower rates of economic growth and higher rates of inflation, although there are also episodes of outright default as well when the debt had been borrowed in the currency of another nation (such as Argentina borrowing in U.S. dollars).

We are quite literally talking about multiple lifetimes of never ending political debates and concerns over how to restrain the growth in the national debt, that after more two centuries of failing to do so, had led to the fantastic level of the United States being $4.5 trillion in debt.

And yet, almost without political or other public debate, that same amount was added again in a single year instead of 217 years. And an equal or greater amount of debt that will be owed by us all may be added again in 2021.

Taking Inflation Into Account

As long time readers know, I often write about inflation, its relationship with the national debt and monetary creation, and also about finding the financial opportunities that are created by inflation (link here).

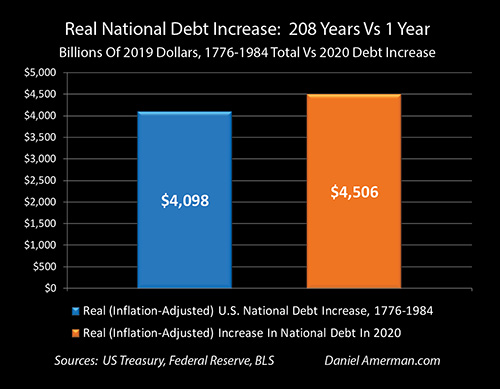

For people who think in inflationary terms - they may be quite unimpressed with comparing simple dollars between 2020 and the decades before. All one has to do is discount for the dollar being worth much less than it used to be, and these kinds of alarming comparisons can often just disappear.

So let's be economic sophisticates, wave our hands by adjusting for inflation, and "poof", make most of that silly comparison of 217 years of debt creation versus the single year of 2020 vanish.

Uh oh.

As can be seen in the graph above, when we fully adjust for inflation and move everything to 2019 dollars, so we are comparing apples to apples, then we've still got a big problem. The national debt in 1984 was $1,663 billion, which is $1.7 trillion, and when we adjust for a dollar in 1984 being worth $2.45 when compared to what $1.00 would buy in 2019, then we have an inflation-adjusted national debt of $4.1 trillion in 1984, after 208 years of the growth in the national debt.

So even after taking inflation into account, the single year increase in the national debt in 2020 was still substantially higher than the entire increase in the national debt between 1776 and 1984.

Instead of reducing concerns, the comparison actually got much worse when we moved to purchasing power, going to "like to like" for the increase in the debt relative to the value of salaries, of savings, of homes and of everything else. In absolutely real dollars, real purchasing power, the United States in a single year did run up a larger increase in the national debt, then the total borrowings over the first 208 years of the nation, combined.

Inflation is not actually the issue here. The real problem is the near tripling of the previous record annual deficit by 2010, and the next near tripling of the previous record in 2020. The new government policies of freely running up impossible debts for short term economic and political advantages without giving a thought to the longer term consequences is truly unprecedented, the nation had never previously been that short-sighted and irresponsible, and the comparison of running up more debt in a single year than over two centuries is indeed fair and real.

If we use 25 year generations, 25 years on average between each generation, then it took eight generations of politicians borrowing from the future to spend in their day, with eight generations of voters and savers being deeply worried and trying to fight the growth in the national debt, to reach the astonishing and depressing place where in current dollars the national debt had reached over $4 trillion. Fully taking inflation into account, the United States did indeed borrow more in the single year of 2020, borrowing from the future to pay for a single year today, than it had in its first two centuries of existence.

And it may do the same again (or more) over the coming year.

Just Because It Seems Surreal Doesn't Mean It's Not Real

The events of 2020, politically, economically and for society, were enough to leave many people dazed, confused and even shell-shocked. So many bizarre things were happening at the same time, developments that many of us never expected to see in our lifetimes, that it was hard to comprehend everything that was happening.

The increase in the national debt was surreal - perhaps even to the point that many people simply could not comprehend it. How could so many dollars possibly be borrowed and spent? How could so many of those dollars just come into existence from what very few people understand, something that didn't even exist before 2008, which is reserves-based monetary creation from the Federal Reserve? For the average person, the amounts are so vast as to be incomprehensible, with the sheer scale of what was happening making some people less likely to think about it than if the numbers had been smaller.

But yet, just because something is so large as to seem surreal - does not in fact make it any less real. Every one of the 4.5 trillion dollars in the new national debt is real, and it is every bit as real as any other dollar, such as the dollars that make up the nation's incomes, savings and retirement accounts.

The problem is perspective when the numbers are so vast. One of the intended purposes of this analysis is to provide that perspective, to give us something to peg it to, something more tangible to relate to in order to make surreal more comprehensible.

All of our futures did change when the national debt jumped by the extraordinary sum that it did in 2020 - it would be deeply naive to think otherwise. These aren't "Monopoly dollars", and as the numbers get ever higher and more difficult to comprehend, it isn't that they start to diminish in importance, but rather they get ever more important when it comes to changing everything else in our lives.

Inflation, the value of the dollar, and the value of savings will change. Stock prices, precious metals prices (link here), bond prices and home prices (link here) are all likely to profoundly change as well over the coming years and decades.

This goes to the heart of the earlier chapters of this book, and the cycles of crisis and the containment of crisis. The pandemic is what set off this round, but it isn't the underlying cause. This is the third crisis in a row to be contained using the combination of very low interest rates and major increases in the national debt. The debt is never paid back, the monetary creation by the Federal Reserve is never fully unwound, and all that is done is that a new and more fantastic base is set for the next round.

That's how it works - until it doesn't.

The truly unfortunate part of this is that many people have no idea what is going on, but they do see what appears to be massive sums of "free money" being created and spent, and instead of disaster, are seeing record stock, bond and home prices. As far as they can tell, there is no real danger here.

As explored in earlier chapters in this book, the reality is that we have all been going down a path with no realistic exit ramp, no way to get off with sound money and the value of investment assets preserved. Instead there is a series of crises, and a series of the containments of crisis, with the increases in the national debt and the increases in the creation of money by the Federal Reserve increasing by an order of magnitude with each round.

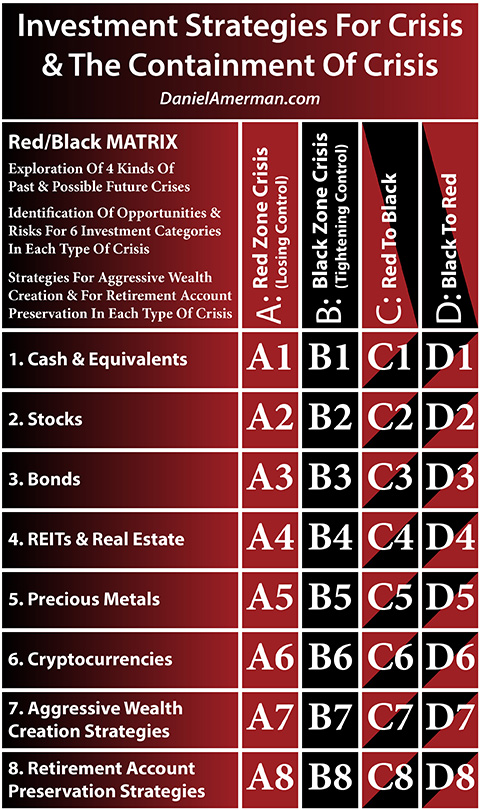

That is not the same thing as gloom and doom thinking. As explored in detail using the Red/Black matrix shown above (link here), in chapters written well before this crisis, record stock prices, record bond prices and record home prices are the logical consequences of the massive monetary creation and lower interest rates that would be the results of the next cycle of the attempted containment of crisis. We studied in this book what the Fed said it would do in advance, then the Fed actually did it, and the expected increases in stock, bond and home prices did then in fact follow, for the reasons explained in advance.

However, even while prices went up as expected - the eventual Destination also just got quite a bit closer. A huge chunk of the limited ability to keep this all going just got used up in 2020, and a large part of what safety margin there was is no longer there. We still can't know the specific year at this point, but what is coming afterwards just got substantially closer (and more inevitable) for all of us, as the necessary downstream effect of running up more than two centuries of national debt in a single year.

Learn more about the free book.

**********************************************

The actual mechanics of how the Fed creates the money to fund the national debt without triggering high rates of inflation, the very real limitations on reserves-based monetary creation (it isn't actually money printing or "brrrrrr" at all), the unprecedented dangers created by that process, the explosive eventual consequences, and how to use gold, gold ratio and gold rebalancing strategies to benefit from that knowledge are the subjects of chapters 7 to 14 of the "Gold Out Of The Box, 2020s Edition" video course.

There are some major ironies here. The value of every share of stock in the country, as well as bonds, gold and real estate are all dependent on the ability to the Fed to create the money to fund the rapid growth in the national debt and thereby keep the economy from collapsing. Yet, almost nobody understands the specifics of how this is done without triggering high rates of inflation, or the limitations of the process, particularly since this form of money creation had never been used in the U.S. before 2008.

For the average investor, it is almost as if they are watching some sort of "magic show", where it doesn't matter how badly the economy craters, or how many businesses close for good, or how many jobs are lost, or how high the national debt goes, because somehow the money just keeps magically coming into being in seemingly endless quantities while sending stock, bond and home prices ever higher and higher. However, there is no magic - although there is an exceedingly clever "trick" that can make it look that way, for a while ("Benjamin Bernanke's Magic Money Trick", i.e. reserves-based monetary creation, video Chapter 9).

The assets built up over the decades by many millions of people are truly at risk, they have no idea what can collapse those prices, and the great majority won't learn until after they have already lost the money. There is little that can be done for most investors, but individuals do have a choice. After watching the video course, you will understand how reserves-based monetary creation works, why there is no such thing as "free money", where the money has actually been coming from to fund the national debt, and will have a better idea for how to use this knowledge to take advantage of the flaws in the system, instead of being a victim of the system.

Watch The 2020s Edition Online

Learn more about the contracyclical strategies for gold and stocks, brochure link here.