How High Proposed Tax Rates Can Lead To Effective Gold Confiscation (2020 Election Edition)

By Daniel R. Amerman, CFA

TweetBernie Sanders and Elizabeth Warren are two of the leading candidates for the Democratic nomination for President. Each are also advocating for 1) massive increases in government spending; and 2) much higher tax rates, including raising capital gains tax rates to 52%.

Many people are skeptical as to whether even the much higher tax rates will be sufficient to pay for the spending promises. Long term history indicates that massive increases in social spending by politicians making promises for freebies, such as forgiving all college loans or free healthcare for all, eventually leads to high rates of inflation (and sometimes quite quickly). This would seem to strongly increase the case for owning gold or other precious metals.

However there is a basic problem that is explored in this analysis, and that is that high rates of inflation and high tax rates can act in combination to effectively confiscate much or even most of the starting net worth of gold investors in after-inflation and after-tax terms.

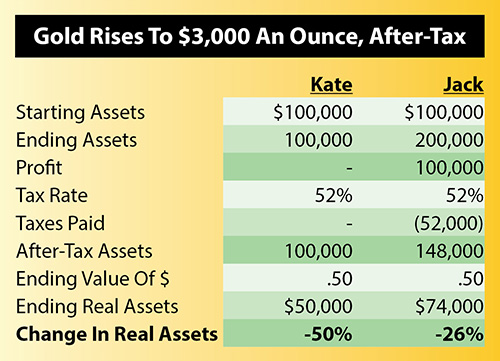

As shown in the chart above, and explained step by step in this analysis, if the dollar were to drop in value by one half, and gold were to act as perfect money or a perfect store of value, doubling in price to an even $3,000 an ounce, then with a 52% capital gains tax rate, not only would the gold investor fail to keep up with inflation, but 26% of starting value of the gold would effectively be confiscated by the government (at the time of sale).

Now if things were to get really bad, and the U.S. were to go to hyperinflation over the 2020s with the dollar becoming worth only a penny on the dollar - well, that is the exact kind of scenario which explains why many people keep at least a portion of their portfolios in precious metals.

However, even while gold entirely keeping up with inflation and going to $150,000 an ounce would generate what would seem to be a fantastic degree of profits - once a 52% capital gains tax is paid on those profits, then the math of hidden gold taxes shows that not only would gold investors fail to keep with inflation on an after-tax basis, but a full 51% of the value of the gold they started with would be effectively confiscated if they sold their gold.

So, if the extraordinary amounts of spending that have been promised by Sanders and Warren were to occur in practice, and high rates of inflation were indeed the eventual end result along with the promised much higher tax rates, then the end mathematical result could indeed be an effective government confiscation of 25% to 50% of the purchasing power of the gold currently held by investors.

Of course, at this stage we have no idea who will win the coming primaries, who will gain the nomination, and who will win the fall elections. But it is worth noting that all of the major Democratic candidates are promising much more spending and higher taxes, with Biden and Buttigieg each proposing raising capital gains tax rates to almost 40%. It is also worth noting that Trump is proposing running $1+ trillion annual government deficits into the indefinite future - which can also eventually lead to high rates of inflation. So, this is not just about two Democratic candidates, but about all the top candidates from both parties promising high future rates of government spending - for a government that is starting out $23 trillion in debt.

Please note that we will be using some big, bold numbers (which could happen), but the same principles of hidden wealth redistribution also apply with much lower rates of inflation, particularly over time. So a movement to a capital gains rate of over 50% will indeed absolutely change the fundamental mathematics of using gold to protect against inflation, even if the differences are not as dramatic as the examples shown, and they take longer to manifest.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the free book and an overview of the series are linked here.

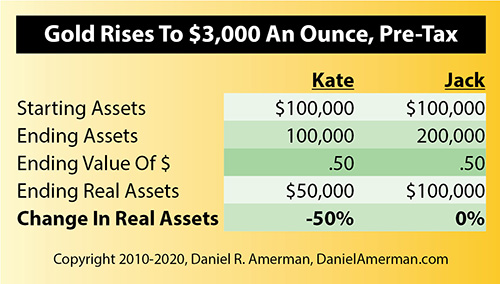

$3,000 An Ounce Gold

In the first step of our illustration, we will consider a situation and how it affects the life savings of two investors. The situation is that 50% of the value of the dollar gets destroyed by inflation. This is not a radical assumption, for with modern symbolic or fiat currencies the value of money is always eventually destroyed by inflation. The only question is one of speed, and if we look at the United States, 80% of the value of the dollar was destroyed by inflation between 1972 and 2007 as measured by official government statistics. For this illustration we will assume a smaller loss in the value of the dollar, but that it happens much faster – because US government finances are frankly in much worse shape right now than they were in 1972 in some key ways.

Kate is well educated, keeps up with the newspapers, and is concerned about the possibilities of another round of global financial crisis. So she liquidates her riskier investments, and to play it “safe”, moves her money into a $100,000 money market account.

For our illustration we will assume Kate's money is safe – but the value of her money is not protected. Inflation destroys 50% of the value of the dollar. Kate still has her full $100,000, but it will now only buy what $50,000 used to. Kate has thus lost 50% of the value of her investments to inflation. (For simplicity's sake we’re leaving out assumptions on interim money market interest payments.)

Jack also reads the mainstream media, but reads more widely as well, and believes that high inflation is the eventual logical outcome of the current financial situation, particularly with what is happening with the national debt and the extravagant promises being made as part of the 2020 election campaign. Jack therefore takes his $100,000 and buys gold at a price of $1,500 an ounce (which of course is not the exact current price, but the numbers in this tutorial are easier to follow with a round number $1,500 an ounce assumption).

We will assume that gold performs exactly like many investors hope it will. That is, it acts like “real” money and maintains its purchasing power in inflation-adjusted terms. Now, if the dollar is only worth half of what it used to be, and gold does maintain its purchasing power, there is only one way for gold to do so, and that is for gold to sell for twice the number of dollars per ounce than it did before.

Therefore, gold goes from $1,500 an ounce to $3,000 an ounce. Since those dollars are only worth fifty cents due to inflation, we multiply $3,000 times 50%, and we end up with $1,500. Thus Jack's initial gold investment of $100,000 will buy exactly the same amount of real consumption, of real goods and services, as gold used to buy for him at $1,500 an ounce. Many might see this as an example of a perfectly successful inflation hedge, where gold has performed exactly like it is supposed to.

The powerful advantages of having your money in an inflation hedge when entering a period of substantial inflation can be seen in the chart below, which compares what happened with Jack versus Kate.

Adding Taxes

Through placing her money in what is conventionally considered one of the safest possible investments during a time of financial troubles, Kate has lost 50% of her net worth. This is terrible, of course, but at least she should be able to get a nice tax deduction out of this $50,000 loss. Except that when it comes time to fill in her tax return, she starts with $100,000 in her money market fund, and ends with $100,000 in principal in her money market fund. So as far as the government is concerned – there is no loss to be deducted. Kate still has every dollar she started with.

Jack decides to lock in his gains by selling his gold investment, redeploy most of his newfound wealth into some new investments, and maybe take a little out to reward himself for having made such a brilliant investment. When it comes time for Jack to fill in his tax return, it shows that he bought his gold for $100,000 and he sold it for $200,000, thereby generating a $100,000 profit. Effectively, the government looks at Jack's having dodged the destruction of the value of the nation's money, and says “Great move, Jack, you made a lot of money! Now give us our share - and it is much larger share than it used to be, because people like you can afford to pay.”

Even in bullion form, gold is currently taxed as a “collectible” in the US, with a 28% capital gains tax rate, which is well above the normal long-term capital gains tax rate. However, the proposal by some leading candidates is to raise the general capital gains tax rate to 52%.

So for Jack, as shown in the chart below, paying a 52% tax rate on $100,000 in profits means $52,000 in required tax payments. Subtracting those taxes leaves Jack with $148,000.

Our final step is to adjust for a dollar being worth 50 cents, so we multiply $148,000 by 50%, and we find that Jack's net worth after-inflation and after-tax has fallen to $74,000, which is a loss of $26,000 compared to where he started. When it comes to what matters, the purchasing power of what our money will buy for us, then Jack didn’t double his money, instead he lost about a quarter of what he started with.

Jack just met what are known as “inflation taxes”. And they ran him over.

Turning Gold Into Lead

From a gold investor’s perspective, $3,000 an ounce gold may seem like a dream come true. And when we look at the results of $100,000 turning into $200,000, gold does indeed look like a great investment. Until we remember that the reason gold went to $3,000 an ounce was because of inflation and we adjust our investment results for inflation. We broke even. While not a net improvement relative to today, this outcome is still highly desirable compared to what happened to Kate. Gold did indeed act as “real money”.

Unfortunately, however, we then run into one of the most deeply unfair and little understood aspects of inflation and investing in anticipation of inflation. Government fiscal policy destroys the value of our dollars. Government tax policy does not recognize what government fiscal policy does, and is blind to inflation. This blindness means that attempts to keep up with inflation generate very real and whopping tax payments on what is, from an economic perspective, imaginary income.

These taxes turn gold from a shimmering dream to a lead weight around our neck, and mean that even a successful inflation hedge can lead to a devastating loss in net worth in after-tax and after-inflation terms.

So how do we deal with this lead weight of inflation taxes around our neck, trying to pull us down under the water? Does all of this mean that we just need more inflation creating higher gold prices, to try to overcome taxes?

$6,000 An Ounce Gold

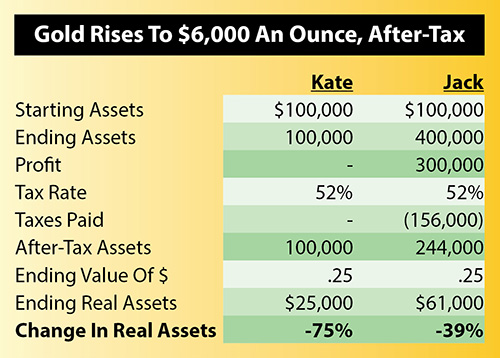

What if gold goes much higher than $3,000 an ounce? What if the dollar falls in value to 25 cents, and we assume that gold again performs as a perfect inflation hedge and keeps its value? If the dollar drops to 1/4 of its value, then the only way gold can keep up is to rise to four times the dollar price, which means $6,000 an ounce gold.

First let's take a quick look at Kate. She still has $100,000 in her money market account, each of those dollars are now worth 25 cents, and the real value of Kate's “safe” investment is now down to $25,000. Kate has taken an 75% hit to the purchasing power of her net worth.

Meanwhile, Jack has enjoyed some fantastic results from his investment acumen. With $400,000 in gold, Jack is now almost half way to being a millionaire!

Jack is ecstatic, at least until he tries to spend some of that near half million dollars, and finds out what it will buy for him after he has paid his taxes. Let's repeat our chart from above, but with gold at $6,000 an ounce. When it's time to file his tax return, Jack now has a $300,000 profit to report. Jack therefore has to write the government a check for $156,000 for taxes due, leaving him with $244,000.

When we adjust for a dollar being worth 25 cents, then Jack's real after-inflation and after-tax net worth – what he can buy in today's dollar terms after paying the government – is down to $61,000.

The difference between gold going to $6,000 an ounce, and gold going to $3,000 an ounce, is that Jack loses more of his real net worth. Jack loses 39% of the purchasing power of his net worth at $6,000 an ounce instead of 26% at $3,000 an ounce.

The lead weight of inflation taxes is still around Jack's neck, heavier than ever, trying to pull him and his net worth deeper and deeper underwater.

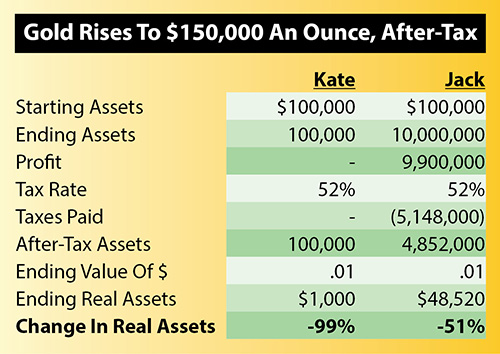

$150,000 An Ounce Gold

Let's explore what happens if there is hyperinflation and a dollar becomes worth a penny. For Kate, the situation becomes even bleaker as the $100,000 in her money market account will now only buy what $1,000 used to. Kate has lost 99% of her net worth to inflation. Instead of a comfortable nest egg for retirement, she is impoverished, as are the many millions of others who were not prepared for hyperinflation (with history in other nations showing us that it is the retirees who are hurt the most by inflation of this magnitude).

If gold (or silver) serves as “real money” and maintains its purchasing power even as paper money collapses, then to offset a dollar becoming worth 1/100th of what it used to, gold must climb to a dollar value that is 100 times greater than what it was. So Jack's $100,000 in starting gold must become worth $10,000,000 in order to maintain the same purchasing power as $1,500 an ounce gold today. Once again, we're assuming that gold acts as a perfect inflation hedge.

Pleased with his investment success, Jack decides to sell his gold, lock-in his profits, and then start enjoying his new status as one of the ultra-wealthy.

As illustrated below, Jack sells his gold for a whopping $9.9 million profit. The government looks at his profit, and demands its $5,148,000 share. This still leaves Jack a millionaire multiple times over, as he has $4,852,000 in after-tax proceeds. Until we adjust for that technicality of a dollar only being worth a penny. And we find that instead of entering the ranks of the ultra-wealthy, Jack's net worth on an after-tax and after-inflation basis has fallen by 51%, from $100,000 to $48,520.

Jack has made one of the most brilliant market timing moves of all time. But the end result is that he loses half of his starting net worth in purchasing power terms. What's going on?

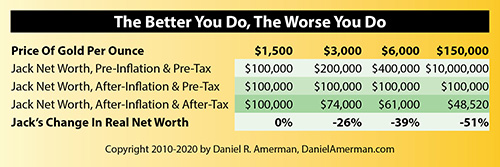

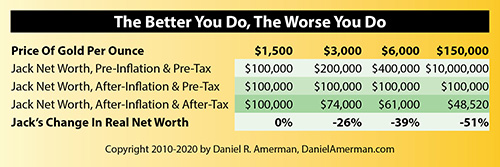

The Better You Do, The Worse You Do

Something seems seriously, seriously wrong here. Jack bets his net worth that inflation will skyrocket, and he buys an inflation hedge in the form of gold. His prediction comes true, a high rate of inflation does occur, and his gold investment does perform as a perfect inflation hedge. Yet the ending bottom-line is that Jack loses a big chunk of the value of his starting net worth. And the better that the gold performs and the more spectacular his returns – the bigger the chunk of his real net worth that Jack loses.

This relationship is summarized in the chart below. When Jack earns a 100% profit – he loses 26% of his net worth. When Jack earns a 300% profit – he loses 39% of his net worth. When Jack earns a 9900% profit – he loses 51% of his net worth.

It Could Be Worse

There are several ways in which the situation could be worse than what is shown herein. The first is that gold is currently taxed at a special "collectibles" capital gains tax rate that is 8% higher than the normal long term investment capital gains tax rate. If this were to carry forward if and when the base rate were raised to 52% - then gold might very well be taxed at a 60% rate instead of a 52% rate. And if a 5% State capital gains tax had to be paid as well - that would be a combined 65% tax rate.

With a 65% capital gains tax rate (assuming the state tax could not be deducted), then $3,000 an ounce gold would lead to a 33% loss, $6,000 an ounce gold would lead to a 49% loss, and $150,000 an ounce gold would lead to a 64% loss in after-tax and after-inflation purchasing power for the gold investor.

Another possibility that is being floated is that of annual asset taxes on the "wealthy" in the name of "fairness". With a 2% annual asset tax, then the investor would have 81.7 cents left of each dollar invested after ten years. If the asset was sold at that time at a 65% combined state and federal capital gains tax rate, and if a dollar was then worth a penny while gold had perfectly kept up with inflation, then the investor would be left with 29% of their starting purchasing power, and a 71% loss to the combination of inflation taxes and asset taxes.

There is also the issue that unless other money would be brought in, inflation taxes would have be to be paid each year on the gold sold to pay the asset taxes. Now, it is true that this would somewhat reduce the 71% loss shown, since the gold sold in earlier years at lower prices would pay less taxes. On the other hand, unless more money is brought in, this would eliminate the option of avoiding taxes by just not selling, and would instead mandate paying annual capital gains taxes on the gold sold to pay the annual asset taxes on the gold.

A Pervasive & Difficult Problem

Inflation taxes are a basic fact of life which investors pay every year when there is inflation. These taxes are entirely real, and are deeply painful when we look at the world in terms of what really matters – which is not the dollar amount of our savings, but what our savings will buy for us.

Real as they are, however, inflation taxes are not a line item on our tax returns. There's no box that we check that says go to form “30236 IT” to calculate our inflation taxes. There is no check we write that’s specifically made out to inflation taxes. There's never any discussion in the newspapers or magazines about how much money the average investor pays every year in inflation taxes.

So if almost nobody sees inflation taxes or talks about them – do they really exist? This may be a good time for a pop quiz of sorts. If you are skeptical, the examples of Jack and Kate were kept very simple for a reason. Go back through the basic illustrations, and try to disprove them. Now, you can change how the price of gold moves relative to the destruction of the dollar, and you can change the tax rate – but there’s no room for anything else.

Do you agree that the numbers work? This “quiz” is self-graded, but your “score” could be essential for your future. Because if our future is one of inflation, then whether and how you deal with inflation taxes may be one of the biggest determinants of your personal standard of living for decades to come.

Also keep in mind that while very high rates of inflation are both a real possibility and made the examples easier to follow – the exact same principles apply with lower rates of inflation. It takes longer to get there, but there is still the same steady taking of wealth from investors by the government through the use of this little understood tax.

Inflation taxes are irrefutable. Whenever you look at investment results on an after-tax and after-inflation basis in an environment of inflation, then inflation taxes make their ugly appearance.

However, while this step-by-step tutorial was very carefully constructed to make it readily understandable through using characters, round numbers and pulling the usual professional jargon out, the concepts involved are nonetheless sophisticated enough where they are rarely understood or acknowledged in conventional personal finance.

There were three factors "in play", simultaneously: (1) precious metals, (2) inflation and (3) taxes, and without integrating all three of those – the truth can't be seen. That three-way combination, along with never explicitly appearing on a tax return, means that likely in excess of 99% of the general population is blissfully unaware of inflation taxes.

Let me suggest that a big whopping tax which 99% of voters are blind to represents a major opportunity for the government. An opportunity that has been fully taken advantage of by governments, even if the average senator, representative or member of parliament may have no better understanding than the general public.

History is bad enough, but as illustrated with Jack and Kate, the higher the rate of inflation – the worse inflation taxes get.

This is true for such traditional inflation hedges as gold and silver. It's also true for real estate. As it is true for stocks. Indeed, almost any traditional inflation hedge has difficulty in reaching the break-even point on an after-inflation and after-tax basis when we take into account the pervasive problem of hidden inflation taxes.

There are some well-known investment categories for surviving inflation. However, there is a problem with almost all of them - most can't handle the example we just walked through.

From a sophisticated financial perspective, keeping up with inflation is actually the easy part. Keeping up with inflation AND coming out ahead after paying inflation taxes is where it gets difficult. Indeed, this is such a difficult issue that the full extent of the problem is almost completely ignored by most financial advisors and writers.

To have a chance of beating inflation taxes, we not only have to realize they exist, but we need to thoroughly understand our opponent.

Our opponent is an enormously powerful government that is deliberately blind to the effects of inflation. Government fiscal policy destroys the value of our money. Government tax policy is officially blind to inflation. So a crushing hidden tax is created that keeps us from maintaining the purchasing power of our savings, with our attempts to survive the deadly effects of inflation merely acting to increase government tax revenues.

And the higher the tax rates go, because the "wealthy" can afford to pay them, then the greater the degree of the effective confiscation of savings that occurs.

Placing This Analysis In A Series Perspective

This analysis is very different from many of the previous analyses. It's inclusion in this series is not meant to imply that high rates of inflation are inevitable, let alone hyperinflation.

However, as explored in the analysis shown above and linked here - the Federal Reserve has recently been effectively funding 100% of U.S. government deficits via monetary creation. That is a situation that has always eventually ended very badly indeed when it has occurred in other times and other nations, and some of what is shown herein has to be considered a reasonable possibility. At least at some future point, and if things don't change.

That is not currently the case - because rather than literally running a printing press, the Federal Reserve has been following a carefully controlled process of reserves based monetary creation, that allows the Fed to create and spend money - including using it to fund government deficits - without triggering inflation. Indeed, how it can do that could be called one of central mysteries of the 2010s for many gold investors.

Crucially, the specific and carefully controlled monetary creation process used to fund the debt recently, and QEs (quantitative easings) in general - is not unlimited, not by any means. There are limits - and if those limits are exceeded, then yes, high rates of inflation are indeed likely to be the end result of a government creating money on an unlimited basis to pay its supporters.

The reason I thought this analysis was important is that we have three developments happening in combination right now, that we hadn't seen before, and they could change everything.

The first development is that at least on an interim basis and as covered in recent chapters and analyses, the Fed is struggling to find a way to keep the growing national debt funded while keeping interest rates artificially low. This forces the Federal Reserve to rapidly use up significant portions of its limited ability to create money without triggering inflation, while it seeks solutions.

The second development is that we have the major candidates of each party planning to spend much more money in the future. Particularly with some of the Democrats, including Sanders and Warren, some of the election proposals being currently floated drastically increase government spending far beyond anything that we have ever seen before in the United States.

The third development is potentially much higher tax rates, which does increase money for spending. However, many independent analyses are questioning if even the major tax hikes being proposed will be sufficient to cover the increased costs of such things as universal free health care, free college and loan forgiveness programs.

This then creates the potential combination of both drastically higher taxes - and drastically higher government deficits nonetheless. This shortens the time period that reserves based monetary creation can be used to fund deficits without triggering both higher inflation rates and higher interest rates (which wraps back around to the discussed effects on stock and home inflation-adjusted prices in previous analyses).

Importantly, higher inflation rates and higher tax rates are separate issues, but if they go up at the same time, then as explored in this analysis, the combined effects are much more toxic than most people understand. These issues are important, they do need to be more widely understood, and hopefully this analysis has been helpful for you in that regard.

Learn more about the free book.

********************************************

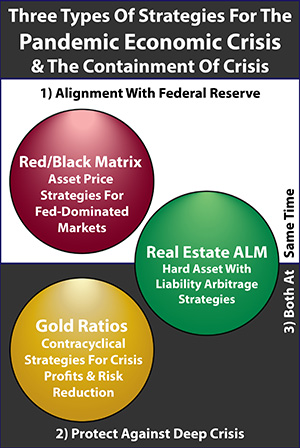

My newest set of DVDs will be "Gold Out Of The Box, 2020s Edition". Video Chapter One is about the common perspective of gold acting as a stable store of value, and Chapter Two is an uncommon examination of hidden gold taxes. Uncommon approaches for outperforming inflation by enough to come out ahead of those taxes? Those would be among the subjects of video Chapters Three though Twelve of the 2020s edition, as well as the red DVD from the 2010s edition in the right corner. More about the DVDs and the prepublication savings can be found in the brochure, linked here.

Uncommon explorations of how gold can outperform inflation are also the subject of six of the topics and one of the categories of the "Eighteen Solutions In Three Categories" that will be a crucial component of the April two day workshop in Minneapolis (brochure link here).