The Stealthy Raid On Our Bank Accounts, Chapter One

The Greatest "Bank Robbery" In History

By Daniel R. Amerman, CFA, MBA

Tweet(This is the first chapter of “The Stealthy Raid On Our Bank Accounts: How The Government Uses Our Bank Accounts To Fund The National Debt”, the full book is available for purchase here.)

There is currently a mass illusion at work in the United States. The general public is being encouraged to believe that there is an almost limitless supply of money that is available for the government to spend.

In practice, when the United States government needed to come up with trillions of dollars on very short notice to shower the nation with stimulus checks during the pandemic shutdowns of 2020 - there was a real world problem. The government didn't have the money, it was instead already over $20 trillion in debt, and running major annual budget deficits.

So, the government borrowed the money, and its primary source of funds was the Federal Reserve. There was a problem there as well - the Federal Reserve had already invested almost all of its money, it didn't have trillions of spare dollars lying around to loan to the U.S. government.

To get the trillions of dollars, the Federal Reserve created the money and then lent it to the U.S. government, which then sent out the millions of checks.

The words "money creation" are some of the most important but misunderstood words in the English language. For many people, we might as well be saying "shazam!" or "abracadabra!" as all those trillions of dollars just seemed to pop into existence in a more or less magical way. Yet, however mysterious the origins, the new money turned out to be entirely spendable and changed millions of people's lives in the process.

There are many people who are convinced that it was all "money printing". As explored in Chapter Eight, there was indeed some money printing going on - but it accounted for less than 10% of the new money creation during the crisis.

The facts are that the overwhelming majority of the new money - came right out of our bank accounts. Using the Federal Reserve as its intermediary, the U.S. government reached into the bank accounts of the nation, took out trillions of dollars, and then sent those dollars back out to the nation in redistributed form. Indeed, this was the largest, fastest redistribution of wealth in U.S. history, and to this day, almost all of the people whose wealth got redistributed - still don't realize that it happened.

Ordinarily, when money is taken from someone's bank account without permission, then two different words are used to describe this process: "bank robbery". So, when we look at unprecedented amounts of this very mysterious "money creation", what has really been happening beneath the surface has been something much more readily understandable, which could be called the biggest bank robbery in history.

Of course, if the government takes our money, this is not usually referred to as robbery - because the government passes the laws that say it is legal. However, this new form of money creation did in fact used to be illegal even for the government to do. Until the laws were changed in 2008, with the exception of specified regulatory reserves the Federal Reserve was unable to tap into the bank accounts of the nation and to use that money for purposes including funding the growth in the national debt. As a matter of design, the money in our bank accounts used to be protected from the government coming in the back door and helping itself.

Another distinction between this new form of money creation and bank robbery is that the government does promise to pay us back. A good portion of the money in our bank accounts has been taken and spent, and we as the savers of the nation can be comforted by the knowledge that we will get our money back when our overwhelmingly indebted government makes good and actually repays its near $30 trillion (and rising) national debt.

As explored in this book, the enabling legislation was passed as part of the Financial Services Regulatory Relief Act of 2006, the same year that Benjamin Bernanke was appointed Chairman of the Federal Reserve (this was not a coincidence). This back door access to the bank accounts of the nation was in place, but was not supposed to be effective until October of 2011. During the height of the financial crisis of 2008, emergency legislation was passed to make this back door access to our money effective as of October of 2008.

The world changed. Since 2008, the nature of money itself has changed, and the centralized control of spending by the Federal Reserve and U.S. government has been replacing the former decentralized spending and money creation across all the states of the nation. Effectively, Washington and Wall Street insiders have been using the Fed's back door access to the money in our bank accounts, to concentrate and steer ever more of the wealth of society to themselves, meaning our own money is being used to fund their taking an ever greater share of the wealth of the nation.

Following The Dollars

There are a lot of opinions about where the money has been coming from, most of which seem to be mistaken. The best way to separate widely held but mistaken opinions from reality is to determine the underlying facts.

To determine those facts, we will use a methodology of following the dollars, that is somewhat like that used in a forensic audit. Now, this is of course a book rather than an actual audit, and this information will not be going to a court of law (although whether it should be is a matter of opinion). Instead, we will be gathering the evidence - the dollar amounts and the dates - from the publicly availably financial reports of the U.S. banking system and the Federal Reserve. Using this financial evidence, then like a forensic audit we will reconstruct what happened, and track the path the dollars traveled on a step-by-step basis, thereby determining where the Federal Reserve has actually been getting the money to fund the United States government.

When we follow the numbers from the Federal Reserve, then the big picture becomes very clear. The Federal Reserve is a particular kind of bank, a central bank.

How do banks get money, whether they are normal banks or central banks?

They borrow the money.

There are those who seem to believe that money creation is just that - pure creation, where the Federal Reserve somehow snaps its fingers and as many trillions of dollars come into existence as the Fed desires.

Reality is much simpler - and much scarier. The reality is that the Federal Reserve had about $8.5 trillion in assets as of late 2021. The flip side of that reality is that the Federal Reserve had borrowed about $8.5 trillion in order to get the money to spend.

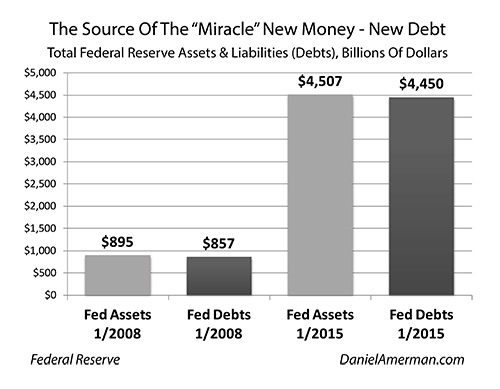

As one example, before the laws were rewritten to give back door access to our bank accounts, the Federal Reserve only had $895 billion in assets at the start of 2008. These assets were almost entirely funded by the Federal Reserve being $857 billion in debt.

Once access to the cash in our accounts was opened up, then over the next seven years the Federal Reserve exploded upwards in size, growing to $4,507 billion in assets. The Fed financed this growth by increasing its debts up to $4,450 billion.

The Federal Reserve spent far more money than it had ever spent before, in a series of what would be called quantitative easings. The additional approximately $3.6 trillion in assets were paid for by the Fed going about an additional $3.6 trillion into debt.

They borrowed the money.

This is a matter of objective fact, that can be determined by looking at the evidence, the financial information that the Federal Reserve publicly provides regarding its assets and debts.

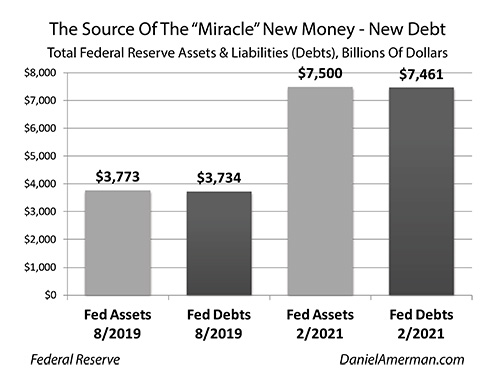

The "mystery" of how the Federal Reserve came up with the trillions of dollars to fund the stimulus checks and the other massive government spending in 2020 can in a broad sense also be solved simply by looking at publicly available information on assets and debts.

In August of 2019, the Federal Reserve had $3,773 billion in assets and $3,734 billion in debts. By February of 2021, the Fed had $7,500 billion in assets and $7,461 billion in debts.

The financial facts clearly show that the Federal Reserve got an additional $3,727 billion to spend and lend, by going an additional $3,727 billion into debt.

The Federal Reserve borrowed about $3.7 trillion, most of which it then lent to the United States government. The government then spent the money as part of the biggest spending spree in U.S. history, showering the nation with trillions of dollars in money. The government ran up a larger increase in the national debt in one year than what the United States owed after its first two centuries of existence.

This was not free money, it wasn't printed money, and it wasn't created via a few keystrokes on a computer. The money was borrowed by the government, and the government is legally obligated to pay it back. The money was borrowed by the Federal Reserve, and the Fed is legally obligated to pay it back.

We had better hope that they do so - because ultimately, as a nation, the value of the cash in our bank accounts depends on the government repaying the Fed, and the Fed then repaying our banks.

Using Complexity To Hide The Heist From Voters

Did the Federal Reserve A) borrow those trillions of dollars, or did it B) create those trillions of dollars?

The correct answer is C) both of the above.

While this is little understood by most of the general public, new dollars are created every day in the United States via a process of what is known as "debt-based money creation". The new dollars come into existence as the new debts are taken out.

Understandably, this can be very confusing to non-economists. "Money creation" sounds like money just popping into existence, when generally speaking with our modern system, what it actually means is that money is being borrowed into existence via creating new debts. Those with formal training in economics generally learned about this as "fractional reserves banking", which is one form of debt-based money creation.

As explored in more detail in Chapter Four in particular, the Financial Services Regulatory Relief Act of 2006 enabled a new form of debt-based money creation that is quite different from the traditional fractional reserves banking. This new type of money creation is referred to in this book as "reserves-based money creation", with the new dollars now being created at the level of the central bank (the Fed), using the cash reserves of the banking system.

It should be noted that while this book follows the dollars in the United States, equivalent enabling legislation was passed in Europe in 2012, vastly expanding the size and powers of the European Central Bank by giving it access to the bank deposits of the Eurozone. The trillions of euros that the ECB is now freely spending are coming out of the bank deposits of Europe, with German savers, in particular, picking up a disproportionate share of the tab. Similar methods are also being used in many other nations - if a central bank can all of sudden throw around a lot more money than it used to be able to do, there is a good chance that reserves-based money creation is the underlying source.

There is an important difference between the new and old forms of debt-based money creation - the new form is more complicated.

If we start with a consumer depositing their money as the first step, and we end with the government spending that money as the last step, then there are ten steps involved in the money traveling from the consumers to the banks to the Federal Reserve to the United States government.

Most of the steps involve somewhat specialized banking relationships where the average person has no experience or training. Relatively few people understand the relationships between money creation and banks, as well as the relationships between the banks and the Federal Reserve, and also the relationship between the Fed and the Treasury department. This is even more true since the rules were changed in 2008.

As far as the Federal Reserve and the U.S. government are concerned - these multiple layers of complexity are a feature and not a problem. The voters having no idea that the government is spending their bank accounts is what makes the whole thing politically feasible.

Indeed, as explored in Chapter Nine, the extraordinary taking of bank deposits in 2020 was not a spontaneous reaction to crisis, but rather dates back to 18 years earlier, when an economics professor with radical ideas about how the U.S. government could spend a lot more money - without openly raising taxes - was brought to Washington as the newest member of the Federal Reserve Board of Governors in 2002.

This professor, with his deep understanding of money and banking, saw the potential to pull off what could be called the Perfect Crime, the biggest bank heist in history - so long as it was an inside job, with the necessary enabling legal changes and the full cooperation of the government as well as the regulators of the banking system. The best part of all is that the money could be taken and spent in plain sight, by the trillions of dollars, but the steps to follow what was happening were so obscure that the voters were unlikely to ever figure it out on their own!

And so, four years later, the laws were changed, and in 2006 the former professor became the most powerful economist in the world, while also becoming the top regulator for the U.S. banking system.

Shining A Bright Light On The Truth

We will use a combination of tools in this book to shine a bright, factual light on the truth of what the government has been doing with our bank accounts.

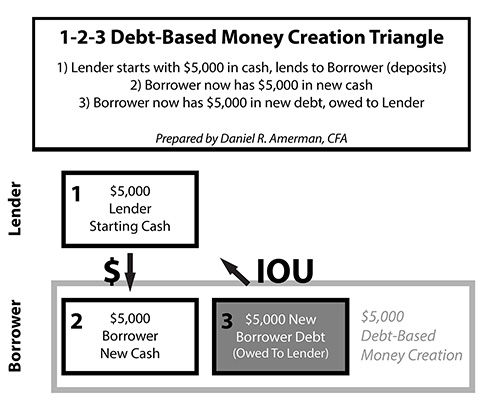

An effective approach to dealing with complexity can be to break it apart into understandable pieces. So, we will break the seemingly difficult to understand first nine steps our money has traveled, down to a single 1-2-3 process, that is repeated three times. Those three processes can then be broken down into their three individual components, each of which is readily understandable.

The three steps are shown in the diagram above of the "1-2-3 Debt-Based Money Creation Triangle", and they and the diagram are explained in much more detail at the beginning of Chapter Two.

The basic three steps are:

1) We deposit our money, $5,000 in this example;

2) The bank now has our $5,000 to spend or lend; and

3) The bank now owes us a $5,000 debt, that it must pay back on demand.

Individually understand each of the simple three steps, put them together into a 1-2-3 process, repeat that 1-2-3 process three times with three triangles - and the layers of complexity and mystery fall away. Even with no prior training in economics or finance, the average person can now track exactly what has been happening with their bank accounts and follow the nine step back door process by which the government has been tapping into our bank accounts (with the actual spending of our money being the tenth step).

The reader will also have a good understanding of how modern money creation actually works, which can be very useful when sorting through the vast amounts of information out there which present somewhat different perspectives. As our financial markets currently depend on Fed money creation, this means that our investments and retirement accounts also depend on Fed money creation, so this is essential information to have.

Once the basic 1-2-3 triangle is well understood, we will use it to follow the actual dollars from the consumers and companies to the banks in Chapters Two and Three.

Our particular focus with each stage of our evidence-based financial reconstruction will be on the $4.1 trillion that can be tracked from our bank accounts to funding government spending. We will also follow the dollars for some other key events and times, with an emphasis on the extremely fast movement of cash out of our bank accounts and into funding the stimulus checks in the initial stages of the pandemic shutdowns in 2020.

The second 1-2-3 triangle is very little understood. This triangle is the relationship between banks and central banks, it is the dark heart of the mystery. This is the new form of debt-based money creation triangle that was enabled by the Financial Services Regulatory Relief Act of 2006.

In Chapters Four and Five we will break this enigma down into its three steps, and we will shine a bright light as we follow the $4.1 trillion from the banks to the Federal Reserve - thereby uncovering the mystery source of the trillions of dollars that the Fed now has to spend.

Then in Chapters Six and Seven, we will use a third iteration of the 1-2-3 triangle to follow our $4.1 trillion as it travels from the Federal Reserve to the United States government. With the completion of this third triangle, using publicly available information as provided by the Federal Reserve, we will now be able to follow the dollars continuously all the way from the time that we deposit our money in our bank accounts until our dollars are spent by the government, with the government promising to pay us back along with the rest of the near $30 trillion national debt.

Illuminating An Insider Financial Revolution

Money is power, and this revolution in the nature of money has financed a revolution when it comes to power and wealth in the United States, as well as in much of the rest of the world.

This new access by powerful insiders to the spending power of our bank accounts has changed nearly every aspect of money, savings, government spending, interest rates, the financial markets, retirement account values - and the sources of financial risk.

While those in power never seem to talk about it - the rules have fundamentally changed. In a world of ever increasing regulations, the "Regulatory Relief" that the government provided in 2006 was of a very special kind. The relief was from the regulations that had previously protected the people from the government. The relief was from the regulations that had protected the money of the average person and kept access to the spending power of that money away from powerful insiders.

It is telling that the first use of these new powers of money creation was to take massive sums from the bank accounts of average Americans and use that money to protect the wealthy "elite" of the world from the consequences of their own mistakes. As explored in Chapter Four, there were no "strong banks" during the financial crisis of 2008, Wall Street and the major European banks were all on the brink of collapse because they had used borrowed money to buy toxic assets, and they couldn't pay their short term debts that were coming due.

Neither the Federal Reserve nor the U.S. government had the massive sums on hand to rescue the international investment banks from the consequences of their short-sighted greed. It was almost game over, as it had been in previous historical financial crashes. This time, however, the government changed the rules and rushed forward the effective date of the 2006 legislation, giving the Fed effective access to the nation's bank accounts, which for the first time gave the Fed the money to rescue the big banks.

It was the money from our bank accounts that rescued Wall Street from its own mistakes, allowing investment banks to pay out record bonuses in 2009, even as the rest of the nation struggled with the financial devastation, recession, and high levels of unemployment that were caused by Wall Street and the global banking system.

When we look at much of the current concentration of wealth, with the estates, the skyscrapers of luxury condos, the private jets, and yachts, even while tens of millions of others experience falling standards of living - we need to keep in mind that the reason much of that global wealth exists is not free markets, nor brilliance on the part of bankers, but politicians rushing to make legal what had been illegal, thereby surreptitiously taking money from ordinary American savers in order to rescue the financial insiders of the world.

Now, this is not to say that there is something wrong with becoming wealthy or a billionaire - far from it. There is a major difference, however, between fairly creating wealth through contributing to the world, versus insiders using control of the laws and the government to unfairly redistribute wealth to themselves. A great deal of the current concentration of fantastic wealth in the financial sector has indeed been effectively dependent on this new back door access to the savings of the many millions of average people, whose money is spent but without their sharing in the wealth that is created.

Prior to 2008, the Federal Reserve had a lot less money. It couldn't make use of the money in our bank accounts, and this was a matter of design. The Fed was not supposed to have the money to fund the government. Our money was supposed to stay in our banks, and generally speaking, be invested in our local communities and in our own states, thereby growing our local economies.

The powers of the central bank were intended to be limited. Free markets would only lend to the U.S. government at what the markets determined to be fair rates - which acted as a brake on the national debt, keeping it from growing too large. Because the Federal Reserve lacked the money to do so, it couldn't control medium or long-term interest rates. The government did not control the mortgage market, and so had far less control over the housing market. The Fed also had far less influence over the stock market.

As explored in Chapter Seven, the insider financial revolution continued and grew much stronger when Federal Reserve radically increased its control over the markets between 2010 and 2014. Using its new access to our bank accounts, the Fed took in far more money than ever before, and it used our cash to fund the quantitative easings. The Federal Reserve could now directly fund much more of the national debt than it could before, and by tapping into our bank accounts it was for the first time able to buy massive quantities of medium and long term Treasury obligations, thereby effectively taking control of medium and long term interest rates.

There was now (and still is) a new "800-pound gorilla" flush with the spending power of the nation's bank deposits, that had unprecedented influence over the bond, housing, and stock markets. A relatively small group of people, rotating in some cases between the Federal Reserve, the Treasury Department, Wall Street, and the largest institutional investors now had an unprecedented degree of control over how markets moved. Immense amounts of wealth were created, as the financial giants grew much larger relative to the rest of the nation.

Critically - the previous freer markets were fairer markets, as the lack of centralized control kept everyone guessing. In essence, powerful insiders now have the ability to use the cash in the public's bank accounts to move and control the investment markets in ways that the public does not understand, creating a differential advantage when it came to cash, investments, and knowledge itself. This is a fundamentally corrupt process - but it is the heart of the new American financial system. It also had not been legal - until the law was changed and back door access to the nation's bank accounts was opened up by the government.

Once this is understood, then the belief that it is all money printing can be seen as an oversimplification that prevents people from understanding what is actually going on. The reality is more devious and more predatory. Money is governed by a set of rules that are not understood by the general public. By carefully changing the rules, it isn't so much that the supply of money is increased for everyone, but rather, the government and other insiders can take control of other people's money, spending that cash to shape the financial markets while funding government spending, without the person whose money is being used having any idea that this is happening. This is a sophisticated strategy for harvesting money by stealthily exploiting the savings of the public, which is a very different thing from simply running a printing press.

As explored in Chapter Nine, this spending of the nation's bank accounts has necessarily created a hollowed-out banking system. When we reverse directions and move backwards through the three 1-2-3 triangles, tracking the debts instead of the cash, then we find a chain of hollow debts. The government has already spent our money, it's gone.

Yet, on the surface - everything looks fine. We can all seem to spend the money in our bank accounts at any time. To understand how this can be, how a hollowed-out financial system can seem perfectly normal (until it doesn't), we will go beneath the surface and learn "The Secret Of Banking", which turns out to be very similar to "The Secret Of The Federal Reserve", which turns out be remarkably similar to "The Secret Of The National Debt." Once one understands the common underlying mindset - that is not at all understood by the general public - then much of the seeming complexity falls away, even as our views may turn upside down on what money in the bank really is, as well as the real nature of personal financial safety.

Money is debt. Before the rules were changed, almost nobody needed to know that outside of economics classes. Regardless of the underlying theoretical reality of money, one could achieve lifetime financial security by the practical acts of earning money, saving money, and steadily accumulating ever more money.

However, when an economics professor looked deep into the little known heart of money and banking, and saw how to change the rules in order to take the money of the public out by the trillions of dollars so that the government could spend it - the nature of money itself was fundamentally warped and perverted, as was the safety and security of the U.S. dollar.

The dollars may look the same, the bank accounts may look the same, but the "bank robbery" beneath the surface is very real and it is ongoing. The difference will remain a technicality to most - until it ultimately creates what may become the largest financial event of their lifetimes for an unsuspecting public.

The scope of what has been happening over the last twenty years goes well beyond what can be covered in a single book. In this first book in a series, we will focus on following the dollars step by step through the three 1-2-3 debt-based money creation triangles. As each step is explained, we will reconstruct and document how the actual dollars moved, illuminating the source of the money for what has been an insider financial revolution. Along the way, we will revisit the biggest financial events that have happened since 2008, and show how this new back door access to our bank accounts changed everything. We will follow how Wall Street used our money to rescue itself, how the Federal Reserve used our bank accounts to take unprecedented control over financial markets, and how our cash was taken to fund the stimulus checks and other extraordinary government spending in the time of the pandemic shutdowns.

In Book Two of "The Hollowing Out Of America" series, we will turn to the implications for the future, including an unprecedented centralization of power and wealth, as well as reduced economic growth, less wealth creation, and relatively lower standards of living for the rest of the nation. We will look at the new dangers, including potential future high rates of inflation and the potential collapse of a hollowed-out financial system. We will also look at solutions - how to change the rules in order to roll back the dangers while reversing the centralization of power and wealth.

The first step in understanding all of this is to follow the dollars through the basics of the first 1-2-3 debt-based money creation triangle, as explained in the next chapter.