National Debt Forces Potential $634 Billion In Money Creation

By Daniel R. Amerman, CFA

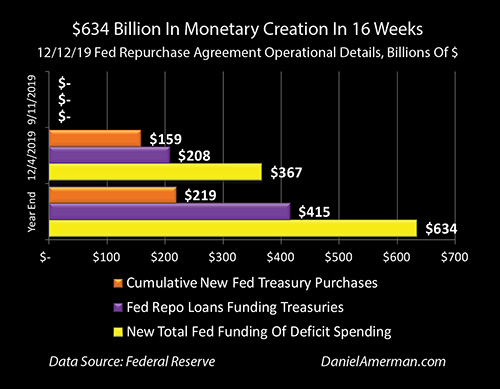

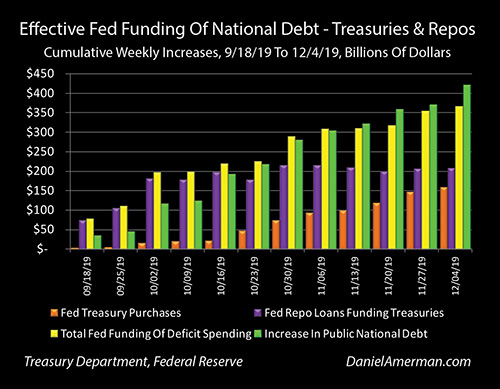

TweetAs of two weeks ago, the Federal Reserve had funded $367 billion of the previous $422 billion in federal deficit spending, by simply creating the money to buy (or fund) the debt. This meant that over those 12 weeks, about 90% of the growth in the national debt was being funded by monetary creation.

This liquidity crisis is far from over, and it could even be escalating. As can be seen in the graph above and as explored in this analysis, the Fed has disclosed plans to bring the cumulative total up to $634 billion in new money over the next two weeks, to prevent a potential year end crisis. This extraordinary situation is still moving fast, and has potentially major implications for financial stability on a global basis.

Funding Of U.S. Deficits By Monetary Creation Reaches 90% In Late 2019

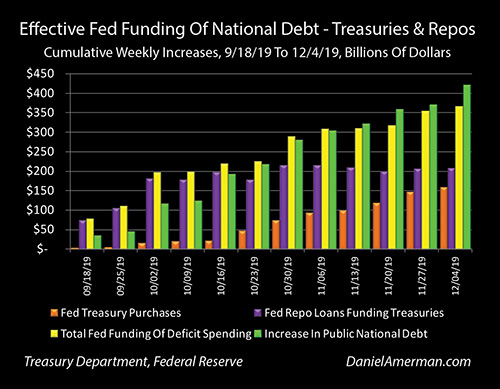

As explored in the previous analysis (link here), there has been a developing problem in the U.S. financial system that has taken the Federal Reserve by surprise. The U.S. Treasury department is pulling staggering sums of money out of the economy and financial system to fund government deficit spending, with a total of $422 billion over just 12 weeks, as shown with the green bars in the graph above.

There was (as described in that and previous analyses) a crisis that occurred in the week of September 16th, 2019, when the Treasury tried to pull $100+ billion in cash out of the system - and the Federal Reserve very briefly lost control over short term interest rates. As explored below, this could send the values of stocks, bonds and homes plunging downwards if it were to persist, as well as potentially creating another round of global financial crisis.

The Federal Reserve has no intention of letting this happen, and it has been taking emergency measures to make sure that interest rates remain at abnormally low levels. To keep the national debt from pulling interest rates upwards, and as shown with the yellow bars above, the Fed has been effectively funding 90% of federal deficit spending through monetary creation. The Fed has funded $367 billion in new government debt through either purchases of Treasury obligations (the orange bars above), or funding the ownership of Treasury obligations via repurchase agreements (the purple bars).

This is a critical development, the previous analysis explains it, and if anything is not making sense, I would highly recommend following the link and reading that analysis. These analyses are part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

$634 Billion In Deficit Funding

The 90% funding shown is not an ending point - but a starting point. Within the next few weeks, the Federal Reserve has announced plans to vastly increase its rate of monetary creation, as shown in the graph repeated below.

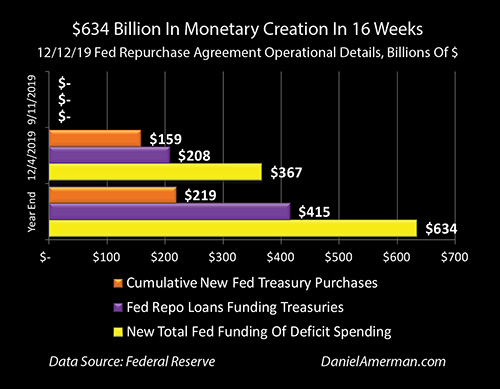

In an extraordinary document titled "Repurchase Agreement Operational Details" released on December 12th (link here), the Federal Reserve announced plans to offer at least (those are the key words, at least), $415 billion in repurchase agreement lending during the crucial year end period of 2019. The Fed intends to make available at least $225 billion in two separate "overnight operations" repo lines, and at least another $190 billion in five separate "term operations" repo lines that span the year end period.

As shown above - none of this money even existed the week of September 11th, before the repo crisis began. It took 12 weeks for the Fed to create the money to fund $208 billion in repurchase agreements - that funded the ownership of $208 billion in new Treasury obligations. And the Fed has announced plans to offer to approximately double that funding over about the next four weeks, to $415 billion.

Separately, the Federal Reserve reversed its plans to gradually unwind its vast portfolio of Treasury obligations, via which it had already been funding a big portion of the national debt, and instead began in October to buy $60 billion a month in Treasury obligations, with the source of funding also being monetary creation. Adding another month's purchases in, that would take the total purchases of Treasury obligations up to around $219 billion by the first week of January.

Putting it all together - the numbers are astonishing. The Federal Reserve is standing ready to create $634 billion in new money in the span of 16 weeks. All of that monetary creation is going to the purchase and/or funding of deficit spending and the national debt, either through Treasury obligation purchases, or funding the repo loans, which are collateralized by Treasury obligations, meaning the Fed is effectively funding the ownership of those Treasuries at a very low interest cost.

When we look at the sum total of monetary creation, the Fed stands ready to fund more than 100% of the deficit spending of the U.S. government - and they are doing this on an emergency basis.

Emergency Maneuvers

One way of phrasing the situation is that the world has gone bonkers, and risk is off the scale compared to where it was a year ago or three years ago.

Now that may sound a bit hyperbolic, but I'm not the one saying it - the Federal Reserve is and they are saying it through their actions which are illustrated above. Those actions speak far louder than their official words.

The amount of money that is being created, and that we are being told is ready to be created if needed - is insane. For perspective, keep in mind that the total assets of the Federal Reserve at the beginning of 2008, after about 95 years in existence, was less than $900 billion. The Fed is ready to create an amount of money that is not all that much less, $634 billion, in the space of a little less than four months as part of their emergency maneuvers to prevent crisis.

That is in no way, shape or form "normal", nor is it some sort of obscure technical adjustment.

None of this was even on the radar of the Federal Reserve at the beginning of September. They were caught completely by surprise. Oh, they knew about the 1-2 combination of the Treasury pulling over $100 billion in cash out of the markets on September 16th between tax collections and the settlements of Treasuries sold to finance deficit spending - but they thought it was a non-issue. Their models indicated there was ample liquidity in the system to handle government spending pulling that amount of cash out, while not increasing interest rates.

The Fed's models turned out to be wrong. Then they thought a few days of emergency repo operations would deal with this unexpected technical issue - but they turned to be wrong about that too. They couldn't withdraw their lending - and indirect Treasury funding - without potentially crashing the systemically important repo market.

At this point, the Federal Reserve realized they had a truly major problem. They thought they were fine, based on the models, but they were clearly experiencing model failure. And making matters much worse, was that they knew the U.S. Treasury Department was planning to pull another $300 or so billion of cash from the system over the next few months to finance deficit spending - and they were now realizing that the money wasn't there from private investors for that happen, not without triggering a potential major increase in interest rates that could bring down the stock, bond and housing markets.

With model failure and systemic risks in two interrelated areas - funding the growth of the national debt, and the repo market (which effectively funds a large portion of the national debt) - the Federal Reserve and the nation could have been in an enormous amount of trouble. If this situation had occurred at any time before 2008, it would have been very difficult to prevent to prevent a major national crisis being caused by just plain running out of the cash to fund government deficit spending at below market rates.

However, the Fed had already crossed a formerly almost sacred barrier, something no responsible modern central bank would previously do (with the exception of the Bank of Japan), when it resorted to quantitative easing and monetary creation to contain the crisis of the 2008. Then Fed chair Bernanke told the world and the financial community at the time that this was a one time emergency measure that would be quickly reversed. But the world didn't end, and the Federal Reserve really liked the new major and enhanced powers for intervening in markets and interest rates that was provided by just creating the money on a massive scale. So the Fed decided this was a great tool, and kept right on using it.

Naturally, when a major emergency spun up out of nowhere and threatened to go out of control - the Fed just went straight to their favorite new tool: creating money on a vast scale and just throwing it at the problems until they (hopefully) went away.

Is the repo market short $75 billion in cash because of the money withdrawn to fund the national debt? Just create the $75 billion and throw it in the market! That turned out not to be enough, so they just tripled the amount of money to throw at the problem and contain it, creating $200 billion and pumping that in while effectively funding the national debt, as can be seen in the purple bars of the graph repeated below.

But then there was also the issue of making sure that those massive amounts of money that had to come out of the markets on a weekly and monthly basis to fund the government's deficit spending were going to be there, and not lead to liquidity problems in other markets. So, the Fed just created almost another $150 billion in new money as shown in the orange bars above, and threw that at the problem as well, buying Treasury obligations.

Then there were fears that these new liquidity shortfalls would interact in a very bad way with the (relatively) new bank rules on reserve requirements, and trigger a crisis of a different sort at year end. Not being sure what would happen since they were clearly experiencing model failure, and wanting to be cautious, the Federal Reserve then made sure the banking system knew that it stood by ready to throw a minimum of yet another $200 billion in newly created money into the repo markets at year end, if needed.

Start creating a hundred billion dollars and throwing them at the markets here, and then creating another hundred billion dollars and flinging them at the markets there, and next thing you know, we're talking about some reasonably fantastic sums of money being created - and spent - in a very short period of time, just the keep the system from potentially flying apart.

(And yes, of course, I am greatly oversimplifying here when it comes to the mechanics of monetary creation, including: the intersecting roles of excess asset reserves, interest on excess reserves (IOER), Basel III, the role of liquidity coverage ratios (LCRs) and high quality liquid assets (HQLAs) in both monetary creation and funding the debt, the underlying fundamentals of using the classic macroeconomic tool of mandating the funding of the national debt by financial institutions at below market rates in the name of "safety", and so forth. But while those factors are extremely important when it comes to understanding the actual risks and limitations associated with the monetary creation process that is arguably all that is holding the financial system together at this point, it ultimately boils down to creating money on a fantastic scale to directly intervene in markets while effectively funding deficit spending.

That said, while I had been previously avoiding going too deep into the mechanics of how the Federal Reserve creates money for interventions in recent years - which is quite different in the aftermath of 2008 and under Basel III than with prior decades - we are unfortunately reaching a place where it could be called mandatory, if we want to understand the limitations, the pressure points and the risks. For regular readers, I will be substantially modifying the content of the January 2020 workshop (and the 2020 Overview DVDs) to explore these issues in depth, as covered starting on page 3 of the brochure linked here.)

Understanding The Risk

The Federal Reserve's actions show that it is currently in emergency mode. To understand why, we need to explore what would happen if the Fed were not intervening.

If the Fed were not creating money by the hundreds of billions of dollars and executing emergency maneuvers to contain the liquidity and repo market crises that have been triggered by government deficit spending - then much of the net worth of most of the people reading this could be in freefall, right now. We could be facing surging interest rates, there could be a loss of faith in the institutional markets that the Fed has the situation under control, we might even need to add in the collapse of a couple of major global banks - and stock prices and home prices could be plunging fast right now, even as the next recession and financial crisis kicks in.

This acute exposure of asset values to major changes in interest rates has been true every single day since the financial crisis of 2008 - and this is the core of the free book, and the related materials.

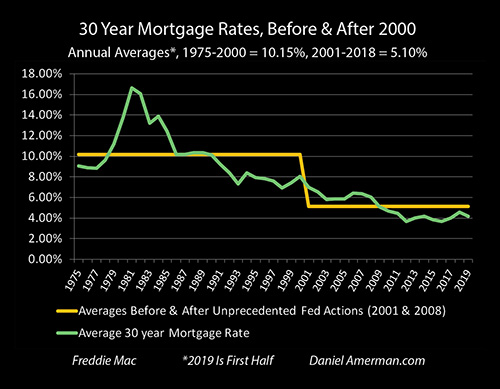

What has held the system together and in the process laid the foundations for record high stock, bond and home prices has been the Federal Reserve's ability to override free market factors, and force abnormally low interest rates on the United States for a period of more than ten years (with this ability being heavily dependent on the unprecedented monetary creation).

We have been in a continuous process - every day - of not normality, but the containment of crisis. This can be been seen by testing an assumption, that of normality, by taking away the abnormally low interest rates - and seeing whether the whole thing falls apart.

Now, I realize this could sound a little extreme, particularly for someone who has not read the previous chapters. So, let's try a little thought experiment using some graphs from Chapter One (link here), and see if you agree.

The annual average mortgage rate from 1975 through 2000 was 10.15%. A return to that average rate would almost double mortgage payments nationwide. What would happen to the value of your residence if the monthly cost of paying for it were to almost double for new buyers? What would happen to housing prices in high cost areas, such as San Francisco? What would that do to the economy? (And if the economy goes into a recession even as mortgage payments almost double - what does that do to housing prices nationwide and in high cost areas in particular?)

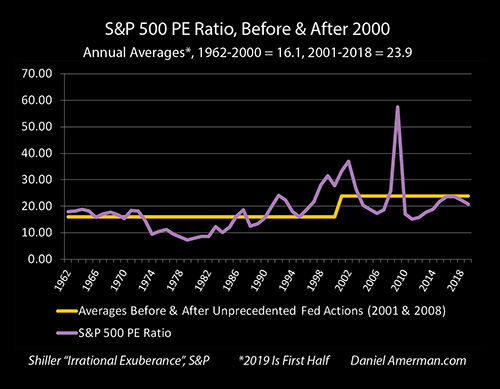

As developed in previous chapters, price/earnings (PE) ratios are up by almost 50% as a result of abnormally low interest rates. Investors are paying about 50% more for each dollar of corporate earnings, than what the long term shows us is average.

How would your retirement account do if stock prices dropped by 33% - and stayed there? What would happen to the nation, if as developed in Chapter 15, stock prices were to merely return to long term averages relative to corporate earnings, and household net worth - including retirement account savings - were to take a near $12 trillion hit? What would that do to the economy?

A really interesting and important consideration is how most people define "normal". Relatively few people look at the mathematical or economic foundations for why interest rates are what they are, or why home prices are what they are, or why stock prices are what they are.

Instead, most people look at what they have been experiencing in recent years, and accept that as the natural and normal course of things. If interest rates are extremely low for a long enough period of time, that becomes natural and normal. If very low interest rates create historically abnormal stock and home prices - prices that are far above historic averages - well, then those too become the natural and expected normality for most of the population, given enough time.

There can also be a great deal of stability to what would otherwise be abnormally high prices, and they can in fact just get higher and higher - so long as the underlying source remains stable. This means that so long as the Federal Reserve remains in full control - which is fully priced into current stock, bond and home prices - and interest rates remain artificially low on a stable basis, then prices can be artificially high on what will seem like a very stable basis, potentially for years at a time, until they become the unquestioned natural and normal for almost everyone.

As stable as this new normality might seem, to the extent it is based on an underlying abnormality - the indefinite continuation of artificially low interest rates - these elevated prices are in practice always at risk. Because if the normal ever returns for interest rates, then the normal should also return for stock, bond and home valuations.

However, if someone - or a nation - has truly internalized abnormally high stock, bond and home prices as being the natural state of things, and values then abruptly return to normal averages, then from their perspective, they would not see this as a mere regression to the mean, or return to averages. Instead, they would view a simple return to average as being a financial catastrophe arising out of nowhere that would turn their lives upside down, with potential grave harm to their financial security and future standard of living.

The National Debt Wrecking Ball

What has shaken the Federal Reserve and led to what could be $634 billion in emergency monetary creation is the pressure of an outside force slamming into its artificially low interest rates, threatening those rates - and thereby stock, bond and home prices for all of us.

As covered in much more detail in Chapters 17 & 18, the source of this pressure is the enormous rate of growth in the national debt. Over time, $23 trillion has been taken from the economy, money that could have gone elsewhere. While that historical total is bad - what is dangerous right now is the rate of deficit spending. The government is spending far more than it is taking in - and it is taking that money out of the rest of economy in the form of weekly borrowings.

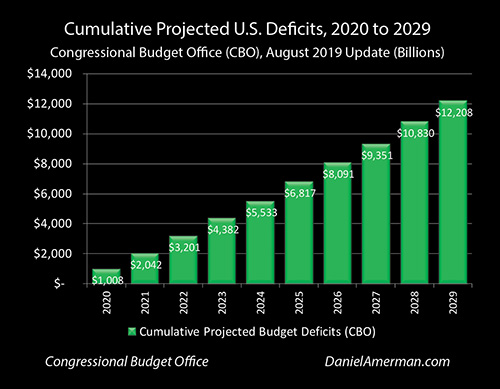

When we look at the Congressional Budget Office budget projections for the next decade, the government is planning on taking another $12 trillion in actual cash out of the financial system in the form of new government borrowing, on top of the $23 trillion that has already been taken out. And the intention is pay abnormally low interest rates on all of that $12 trillion in new debt. This is the underlying source of the current emergency maneuvers, and the $634 billion in new money that the Fed has created and used to fund Treasury obligations, at the abnormally low interest rates that retirement accounts and home values are dependent upon.

Understanding A Crisis Within The Containment Of Crisis

This next part is one of the most important parts, and it may be the hardest part for some people to follow, because it just isn't how most people think about money, investments and home values.

The way that most people see the world, for there to be an actual crisis - there has to be something bad happening, something that they can see the importance of in their personal lives, such as fast rising unemployment or fast falling stock or home prices. Then they totally get the government going into emergency maneuver mode, throwing vast sums of money around to try to stop or contain the crisis, just as happened in 2008 and 2009.

But, none of that is actually happening now. There is no surge in unemployment, but quite the reverse. Stock prices aren't plunging, but are rather continuing to set new records. Home prices are also not plunging, but are staying at record highs. There is no crisis at all from the perspective of the average person, who has no idea what a "repurchase agreement" is (and who probably doesn't care, either).

Now, in point of fact - the Federal Reserve is in full blown, emergency maneuver mode - and this can be clearly seen regardless of their public statements by the sheer number of very unusual and large steps they are taking in close succession.

The Fed hadn't done any major repo lending since the 2008 financial crisis - and they are now doing record amounts of repo lending to rescue the systemically important repurchase agreement market. The Fed hadn't reduced interest rates since the 2008 crisis - and they abruptly reversed course and dropped them three times in quick succession. For years the Federal Reserve had been pledging that they would eventually be reducing their holdings of assets purchased with created money, they had started to do so, and they have abruptly reversed course, and have been effectively funding 90% of the growth in the national debt

But what the Federal Reserve is frantically trying to accomplish, is to keep what the public would recognize as a crisis, from starting in the first place. And if they succeed - the average person may have no idea that any of this happened, or that a close call occurred at all.

We have currently very elevated stock, bond and home prices when compared to long term averages. These prices are based upon abnormally low interest rates. The ability to fund the national debt and other liquidity issues are currently placing these prices at grave risk. If the Fed succeeds, then rates will remain abnormally low, and prices are likely to remain abnormally high, else being equal.

Where the current existential crisis exists is in the ability to contain crisis. If the containment is lost, then we go from a cycle of containment of crisis, which few people understand, to an actual crisis itself which everyone would understand quite well. However, it would be too late for most people at that point.

So long as the containment succeeds, then the starting point would be what much of the public now accepts as being normal and natural, a very low level of interest rates along with elevated asset prices, and the ending point would the same place. Since the situation starts looking normal and it ends up looking normal, it could look like nothing happened at all.

Four Ways The World Has Changed

In this holiday season, and for the sake of all of us, I very much hope that is what ends up being the case - there is no publicly recognized crisis or system failure. With luck, the average person will wake up three months from now, be quite satisfied with the value of their retirement account and home, will continue to think of the national debt as a theoretical abstraction that has no relationship to their day to day life, and will have no idea that any of this ever happened. However, even if that hoped for outcome does occur, and the Fed does successfully calm things down - the world has still changed, whether it is immediately obvious to all or not.

1. The Federal Reserve is creating up to $634 billion in new money and using that money to buy Treasuries and pump liquidity into the markets for a really good reason - they're scared. If the Fed is scared, and goes into emergency mode in multiple areas for the first time since 2008 - something major is going on like we have not seen for a number of years, and we all need to be paying very close attention.

2. We are inside of a highly complex and untested system, with the Federal Reserve trying to stabilize the financial system through injecting newly created money into the system at about the same rate as the Treasury is pulling money out of the system, while it manages an untested new banking regulatory system, even while multiple other pressure points such as trade disputes and the potential for a recession are still out there. What we know for a fact is that the complexity of the demands exceeded the capabilities of the Federal Reserve in managing this system for at least a time, this took the Fed completely by surprise, and the Fed is currently in scramble mode in the attempt to recover.

While it may seem subtle - this could be called the biggest concern of all. Tens of millions of Americans as they make long term financial plans, are essentially betting that an organization they don't really understand, the Federal Reserve, using tools they don't understand at all, is going to pull off the high wire balancing act of funding staggering deficits while keeping interest rates very low, and not triggering inflation. The Fed just made an unforced, fundamental, early stage error, and this is not a confidence builder - particularly if we do run into major stresses, such as the historical normality of going through another recession.

3. The merger has occurred, and the funding of the rapid growth of the national debt is now directly interfering with the efforts of the Fed to maintain stability. This means that the rapid growth in the national debt is now directly threatening artificially elevated stock, bond and home prices, in real time.

4. As we prepare to enter the new decade, we are closer to the edge than the Federal Reserve thought we were - much closer. As we look ahead to the next decade, and the planned deficit spending that is now built into the markets and the economy, this materially shifts the odds.

Learn more about the free book.

********************************************

A fantastic degree of monetary creation by the Federal Reserve is arguably what is holding the U.S. financial system together as 2019 ends and 2020 begins - and it might or might not work. How does this crucial process actually work and how stable can it be? How is deficit spending funded, what are the risks, and what are the implications for stock, bond, home and gold prices?

A very timely workshop on January 11-12, 2020, will explain these vital issues and much more, in a manner that is intended to be understandable for those without formal training in economics or finance. Read the brochure.