How Do Banks Use Low Interest Rates To Take Billions From Savers & Investors?

by Daniel R. Amerman, CFA

For over six years now, one of the greatest redistributions of wealth in the financial history of mankind has been in process.

Vast sums of wealth are being redistributed away from average savers and investors, and are flowing into banks and other financial institutions around the world.

Unfortunately, however, the normal financial education even for a reasonably well-read individual investor does not include how this works. It has instead traditionally been more the province of professionals.

Using a simple to follow, round numbers illustration, this analysis will demonstrate exactly how this hidden redistribution has been working in past years – and how it may continue to work in the future.

An Investor, a Saver & a Bank

Let's consider three different people.

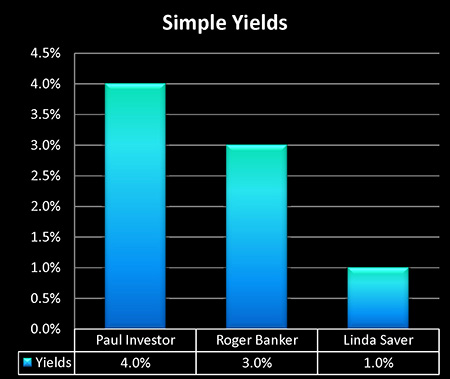

Paul is an investor, and in this low-yield investment market, the best annual return that he's able to achieve through taking a moderate amount of risk is 4% per year. This asset of his could be virtually anything, and in this low-growth economy and multi-year "Great Recession", 4% has generally not been a bad yield.

Linda is a risk-averse saver, so she is keeping her hard-earned money in the bank. We're going to assume that she is receiving a 1% yield on her savings, which is of course very low, but interest rates have indeed been very low for a number of years now as the result of governmental and central banking interventions.

Our third person is Roger, who is a banker. Roger takes Linda's money and pays her the 1% return, and then uses the proceeds to buy the same 4% investment that Paul has purchased. This means he's earning a 3% spread between what he takes in and what he pays out.

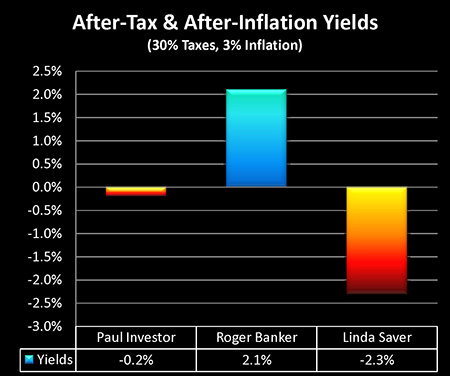

So when we look at the yield that each one of them is receiving, Paul the Investor is earning 4%, Roger the Banker is earning 3%, and Linda the Saver is earning 1%.

Adding Taxes

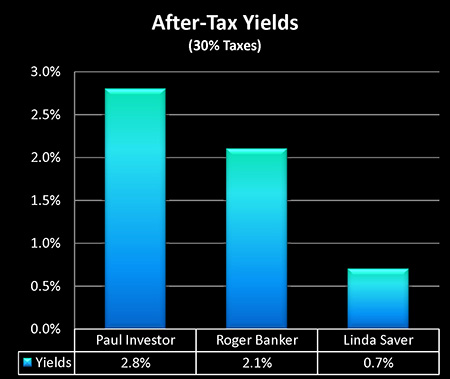

Now of course we don't get to spend all of what we earn; instead we get to spend what we have left after we've paid our taxes.

For simplicity's sake we're going to assume a round 30% tax rate, and this could represent a combination of state and federal taxes, perhaps even with some short and long-term gains mixed in.

Paul the Investor pays 1.2% in taxes on his 4% in earnings, leaving him with a 2.8% after-tax yield.

Linda the Saver pays 0.3% in taxes on her 1% yield, leaving her with a 0.7% after-tax yield on her savings.

Roger the Banker is receiving a 3% spread between what he is earning on his investment asset of 4% and the 1% he is paying Linda for the use of her money. So 30% of 3% is 0.9% in taxes, which gives Roger a 2.1% after-tax yield.

When we compare earnings on an after-tax basis they've all been reduced proportionately, except that now Paul is only getting 2.8%, Roger is getting 2.1%, and Linda is getting 0.7%.

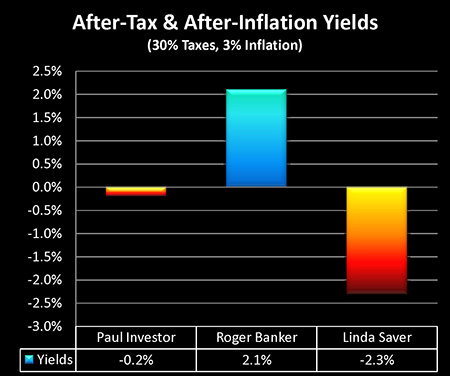

Adding Inflation

When it comes to our savings and investments, what truly matters more than anything else is purchasing power. This means that we need to adjust for the destruction of the value of the currency over time – i.e. inflation – as is the historical norm.

And within this low-yield environment, we're going to assume a very mild rate of inflation of only 3% per year.

For Paul the Investor, his money was worth 100 cents on the dollar at the beginning of the year, but at the end of the year it was only worth 97 cents because the dollar had lost 3% of its value.

So, starting with the ending value of his original investment of 97 cents, we add 2.8% to that for his after-tax yield, and he ends up with 99.8 cents.

Every dollar that he started with is thus worth 99.8 cents at the end of the year in after-tax and after-inflation terms, meaning he is steadily losing purchasing power at a very slow rate of 0.2% per annum. Now while that slow but steady loss in what his investment will buy for him is both entirely real and irrefutable – it will never appear in a brokerage statement or on a tax return. So most of the "Pauls" in the world will likely think they are coming out ahead, albeit not by as much as they would like.

As I have written about extensively elsewhere such as here and here, investments having negative yields in after-tax and after-inflation terms is far more pervasive than most investors realize.

Now let's consider Linda the Saver. Her ending dollar is also worth 97 cents, but she only earned an after-tax yield of 0.7%. So her ending after-tax and after-inflation purchasing power is 97.7 cents.

By going to a very high quality and liquid "investment" of savings in a bank, which she can withdraw at any time, Linda has ended up with an annual negative yield of 2.3% –whether she realizes it or not. Again, this negative after-tax and after-inflation yield is unfortunately very common in this environment of extremely low interest rates.

Now let's look at how Roger the Banker is doing. As with Paul and Linda, Roger's investment is only worth 97 cents on the dollar to him. However, he didn't buy that investment with his money – he bought it with Linda's money.

So if Roger were to sell the asset, he would get a dollar that was really only worth 97 cents. He would take that devalued dollar and use it to pay back Linda in full, even while that dollar's purchasing power for Linda would really only be 97 cents.

Now while Roger takes a 3 cent loss on the asset from inflation, just like Paul – he also has a 3 cent gain on the real value of what he is paying back to Linda on her savings. The inflation loss and inflation gain cancel out, and Roger is left with his 2.1% gain, as if there were no inflation at all.

The effective bottom line is that as a financial institution engaged in asset/liability management, Roger passes inflationary losses through to his depositors on a dollar-for-dollar basis.

So when we simply adjust for what we have left after taxes, and we take into account the change in purchasing power of the dollar because of inflation, then everything that we may have thought was true turns upside down.

We see that Paul the Investor is not making the most money – in fact Paul is not even keeping up with inflation on an after-tax basis.

Linda the Saver is actually incurring substantial losses on an annual basis – even in an environment of quite mild inflation – as a result of the very low interest rate investment that she has.

And because Roger the Banker is able to pass the inflation losses on the asset he purchased through to the person who's providing him the money to buy that asset – Roger retains an extremely profitable investment.

(The actual math for all three is multiplicative rather than additive, but this gets us very close and is much easier to follow. In order to focus on core differences between Roger, Paul and Linda, we are in addition leaving out Roger the Banker's expenses, which reduce his spread, and also his return on equity, which radically increases his percentage returns from his asset/liability management strategy.)

Misunderstanding Inflationary Dangers

Like many investors, Paul has a "high drama" view of inflation. He understands hyperinflation just fine, and gets that 10% to 20%+ annual rates of inflation can devastate the value of the purchasing power of his portfolio.

But this mild stuff that is currently officially reported? It just demonstrates to him that inflation isn't a danger after all. It seems like a casual footnote, when he looks at the monthly headlines reporting the government's latest inflation calculations.

What Paul fails to understand, however, is that in reality he isn't making money – but instead he is experiencing a slight annual loss in purchasing power.

Low growth rates and artificially-suppressed yields, with mild to moderate inflation and moderate tax rates within a seemingly stable financial environment may seem like a harmless investment environment to most people, even if somewhat frustrating when looking at the slow rate at which their nominal (pre-inflation) wealth is growing.

However, when we look to what we can buy after we pay our taxes – we see that this is in fact a toxic environment, not a harmless environment. Year by year, millions of savers and investors are denied the benefits of the long term compounding of wealth, and instead face a long-term slow bleed when it comes to the value of their savings and investments.

Unless they are willing to sharply increase their appetite for risk, which might not turn out to be the best idea in a world where large risks remain, even as central banks manipulate markets to keep investors from getting adequate compensation for either the risks or the inflation.

On the other hand, by using both assets and liabilities in combination, Roger the Banker is able to access opportunities that are simply impossible for individuals following asset-only investment strategies. Roger takes the same losses that Paul does with his assets, but passes those losses through to Linda with his liabilities – and creates a profitable return in an otherwise impossible market.

Reality-Based Inflation

Something many people don't understand is that there is no naturally independent concept of a rate of inflation like there might be let's say for calculating the boiling or freezing point of water.

There are no natural laws or fixed equations involved here. A rate of inflation is instead an enormously complex theoretical construct that changes depending on the specifics of a huge variety of assumptions.

Now when many of us look at things like the cost of food, the cost of clothing, the cost of utilities and energy and gasoline, and the cost of healthcare, we've been seeing annual increases in what it costs for us to support our standard of living that may seem to be significantly in excess of the official inflation rate that's reported.

And as I've written about extensively elsewhere, when sorting through the enormous number of possible ways of calculating inflation rates, the government does indeed have powerful motivations to choose methods that consistently report a lower rate of inflation than what many of us are experiencing in our lives.

So let's say that Paul, Linda and Roger are all actually experiencing personal inflation rates not of 3% per year, but of perhaps a more reality-based 5% per year.

What does that do to our results?

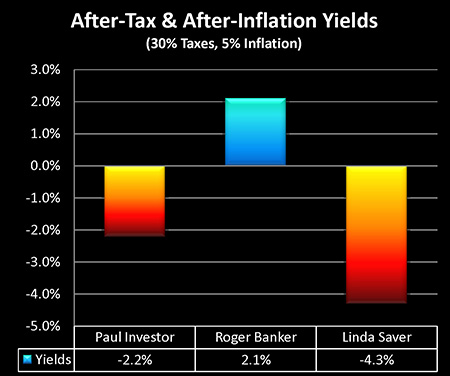

Well, Paul the Investor's money is now worth only 95 cents at the end of the year. So if we take the value of starting principal of 95 cents and add in his after-tax yield of 2.8%, then he's got 97.8 cents on the dollar, which means he lost 2.2% of the value of his investment in after-tax and after inflation terms.

If we take a 5% rate of inflation and we compare it to the paltry 0.7% that Linda the Saver is earning in after-tax terms, we see that she is taking a 4.3% loss per year.

In the attempt to protect her investment through keeping her money in what she believes to be very safe and accessible form, Linda is locking in significant annual losses.

If we look at Roger the Banker, he is now losing five cents per year on the value of his asset – but at the very same time the true cost to him of repaying the liability that was provided in the form of Linda's savings is also going down by 5% per year.

Because he is passing inflation losses through dollar for dollar to his depositors, Roger continues to earn a 2.1% margin.

So let's add everything up. Paul appears to be making money every year but in reality he's not – he is at best close to break-even. And he may be losing significantly more than that if the real rate of inflation is higher than the officially reported rate.

Linda is losing a substantial amount of money each year regardless of whether we're using the official rate of inflation or a somewhat higher rate.

And because Roger is able to 1) pay an artificially-low interest rate to Linda as a result of pervasive governmental interventions, and 2) pass his inflation losses through to Linda while keeping his asset yield, he is doing extremely well each year, earning outsized profits thanks to governmental interventions, even while both Paul and Linda see the value of their savings steadily consumed in after-tax and after-inflation terms.

Understanding this is to understand the massive redistribution of wealth that has been going on in the US and other nations for many years now, as the wealth is effectively stripped away from individual savers and investors who are following asset-only investment strategies, and passed through to institutional investors who are following asset/liability management strategies.

How The World Works

Now from the perspective of the average well-read intelligent investor who does not actually work in the financial area, this simple illustration that we have just gone through could be considered radical and highly controversial, and subject to vigorous challenge.

However, what we just went through is not the slightest bit controversial. It's just how the financial world works.

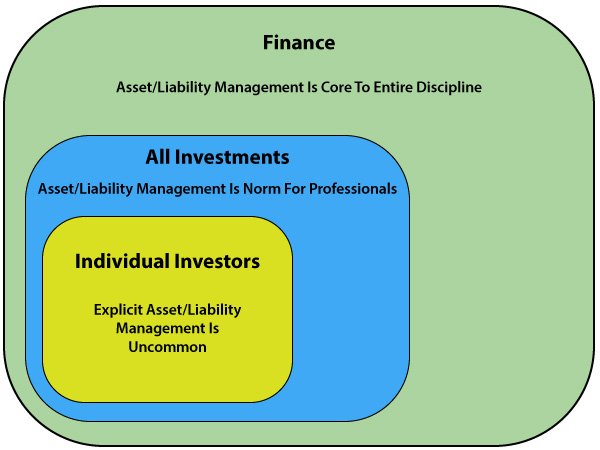

As shown in the above diagram, asset/liability management is absolutely routine for most of the financial world. After all, what is a bank, and what is an insurance company? They are entities that engage in asset/liability management.

What does the chief financial officer do in almost any major corporation? They are engaged in asset/liability management. Even with major corporations that have substantial cash flows and thus wouldn't appear to have any need whatsoever for debt – many still borrow large sums of money. That is because it is well-established and accepted knowledge that after-tax and after-inflation yields can be substantially increased through the use of asset/liability management strategies.

The only major sector of the financial world that considers the use of asset/liability management strategies controversial is what is on average the least sophisticated portion, which is that of most (but certainly not all) individual investors.

It is only in this part of the financial world that investors are taught to get rid of all debts and to focus exclusively on assets.

In other words, to do everything possible to emulate Paul or Linda, while doing everything possible to steer clear of strategies like Roger's.

Indeed one could say that the training within the individual investor world, the most common paradigm, is effectively to feed the dollars to Roger so that Roger can make the money from them, as illustrated herein.

Now it is true that there are times in financial and investment cycles where an asset-only strategy can bear substantial returns.

However, in an environment of moderate inflation, low growth and manipulated interest rates that are held to very low levels – which result in relatively low investment yields – then arguably to follow an asset-only strategy is to assume victim status relative to the financial institutions of the world who are thriving in this current environment.

Now this does not need to be the case. Indeed, there are ways to not only protect ourselves, but to actually flip this to our advantage. But to do so requires opening up the mind to a much wider set of possibilities than is usually presented to individual investors in their planning.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.