Facebook's Libra vs Bitcoin: Five Key Differences

By Daniel R. Amerman, CFA

TweetFacebook has just released the first description of its planned new cryptocurrency, the Libra, that has been the subject of much discussion and speculation. One of the points that Facebook is stressing, however, is that despite using the Libra for transactions on Facebook, the Libra will not belong to Facebook but to the Libra Association.

The Libra Association has many other participants, with some of the bigger names including Mastercard, Visa, PayPal, Ebay and Uber. They have released a white paper which describes their intentions for the rollout of Libra in the first half of 2020.

Many people have been comparing the new cryptocurrency with Bitcoin, and thinking that the Libra will have a lot in common with Bitcoin. As explored in this analysis, the Libra will be quite different from Bitcoin in at least five major ways, and will indeed be close to the direct opposite of Bitcoin in some of the areas that matter most for many cryptocurrency investors.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

#1 Permanent Recording & Tracing Of All Transactions

What some people really like about Bitcoin - and what most governments hate - is the anonymous nature of the transactions, and the potential for moving money between people and between nations with complete secrecy. The Libra white paper is quite clear that will not happen with Libra.

"But the existing blockchain systems have yet to reach mainstream adoption.... Some projects have also aimed to disrupt the existing system and bypass regulation as opposed to innovating on compliance and regulatory fronts to improve the effectiveness of anti-money laundering. We believe that collaborating and innovating with the financial sector, including regulators and experts across a variety of industries, is the only way to ensure that a sustainable, secure, and trusted framework underpins this new system."

So, right from the beginning, Libra is stating that they intend their new cryptocurrency to be the direct opposite of Bitcoin. It will be set up for regulatory compliance, and they intend to work together in an innovative manner with regulators to find the best ways to defeat such things as using Libra for money-laundering, or tax avoidance, or any other potential nefarious purposes that involve personal privacy when it comes to money.

Some people might really like this aspect, others may dislike it intensely - but it appears that Libra will be more or less the direct opposite of Bitcoin in this regard. Indeed, the Libra Association is careful to emphasize just how comprehensive their tracking will be.

"In order to securely store transactions, data on the Libra Blockchain is protected by Merkle trees, a data structure used by other blockchains that enables the detection of any changes to existing data. Unlike previous blockchains, which view the blockchain as a collection of blocks of transactions, the Libra Blockchain is a single data structure that records the history of transactions and states over time. This implementation simplifies the work of applications accessing the blockchain, allowing them to read any data from any point in time and verify the integrity of that data using a unified framework."

This gets technical (and readers with the technical expertise to correct me are welcome to do so), but with other crypocurrencies that use "hash trees" or "Merkle trees", you can have blockchain verifications that are more less independent branches off the main tree. So a cryptocurency can be verified and transferred within one branch or collection, without tracing and verifying the complete history of all the cryptocurrencies in all the branches.

In contrast, the Libra Blockchain is a single tree or data structure, where transactions can only occur with the central authorized nodes (more on that below), and with a permanent record being generated at all times. There is no hiding anything, anywhere, anytime, or moving anything in a way that can't be tracked.

Good thing or bad thing? Again, it's all a matter of perspective. This structure could more or less eliminate not only money laundering and tax evasion, but also many forms of theft itself. If there is only a single data tree and it permanently tracks ownership and every transfer of every Libra - there is no way to avoid detection or cover the tracks, once the theft is recognized. Not so long as the money stays in Libra form. The exact path the money took and the ultimate destination can always be found out, there is no hiding.

Indeed - for every Libra spent or received by every person, every place it travels, and when that happened can be determined by the gatekeepers of the single Tree, at any time and for all time.

Sound a bit familiar?

Now, with all the data breaching and privacy scandals that Facebook has been caught up in within recent times, we are of course being assured that that simply won't happen here. There will be pseudonyms for the electronic "wallets" that we will each use to hold our Libras. Since we are assured that our names will not be associated with the pseudonyms for our wallets, even as we use those wallets to increasingly conduct our purchases and sales, we can rest assured that our privacy will be protected this time around (unlike all the previous times around).

We can trust them this time, right?

The other interesting feature is that pseudonymous wallets are highly unlikely to be able to withstand search warrants - or perhaps even simple government requests that are phrased in such a way that they comply with the "innovative" partnership that the Libra Association plans with regulators around the world.

So, pierce the pseudonymous electronic wallet (hopefully with the appropriate authorizations from the Justice department, Treasury department or state or local authorities), and then every step the Libra in question has traveled can be tracked, either since leaving the original wallet in question, or arriving at the eventual wallet in question - whether that be the wallet of a criminal, terrorist, innocent private investor, online shopper, political opponent or dissident.

And, of course, if there are multiple pseudonymous wallets that are found along the path, then unmasking the identities of the owners of those wallets can become a very useful way to roll up the entire criminal organization - or the entire political opposition network. Keep in mind that Libra is intended to be the most global currency that the world has seen to date - with numerous types of governments involved.

Some people may like this, some people may hate it, but again - Libra is not another type of Bitcoin in this regard, but could become its direct opposite.

#2 Permissioned Node Verification

Another critical difference between Bitcoin and Libra is that Libra for at least the first five years will be based on "permissioned node verification".

"Blockchains are described as either permissioned or permissionless in relation to the ability to participate as a validator node. In a “permissioned blockchain,” access is granted to run a validator node. In a “permissionless blockchain,” anyone who meets the technical requirements can run a validator node. In that sense, Libra will start as a permissioned blockchain."

So, the verifications for each transaction can only be done by the insiders who set up the network. The insiders who will be the only parties who can verify the transactions will include Facebook, Mastercard, Visa, PayPay, Stripe, eBay, Lyft, Spotify and Uber.

This central, permissioned network could in some ways be called the direct opposite of the decentralized way in which verifications are handled with cryptocurrencies such as Bitcoin. For some people this could be a source of decreased trust, for others it could lead to greatly increased trust, but the central architecture of verification is quite different between Libra and Bitcoin, and is indeed in some ways almost the opposite.

#3 "Stablecoin" Means No Monetary System Hedge Or Independent Investment Status

One of the most interesting parts about Bitcoin is its origins as an alternative to the global monetary system. It was intended for savers who did not trust the integrity of the U.S. dollar or the euro, and who wanted a place to put their money that was not controlled by central banks or subject to inflation via unlimited monetary creation.

Once again, while it shares the name "cryptocurrency", the Libra is intended to be more or less the direct opposite of Bitcoin in this regard. Consider the two quotes from the Libra white paper below:

"Unlike the majority of cryptocurrencies, Libra is fully backed by a reserve of real assets. A basket of bank deposits and short-term government securities will be held in the Libra Reserve for every Libra that is created, building trust in its intrinsic value."

"Libra is designed to be a stable digital cryptocurrency that will be fully backed by a reserve of real assets — the Libra Reserve — and supported by a competitive network of exchanges buying and selling Libra. That means anyone with Libra has a high degree of assurance they can convert their digital currency into local fiat currency based on an exchange rate, just like exchanging one currency for another when traveling. This approach is similar to how other currencies were introduced in the past: to help instill trust in a new currency and gain widespread adoption during its infancy, it was guaranteed that a country’s notes could be traded in for real assets, such as gold. Instead of backing Libra with gold, though, it will be backed by a collection of low-volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks."

The Libra will not be an alternative to the global monetary system, but a creature entirely of the global monetary system. Facebook and the Libra Association are promoting this as being huge advantages to Libras over Bitcoins and other cryptocurrencies: Libras are a "stablecoin" that are fully invested in a basket of global banks deposits and government securities, in nations with currencies from "stable and reputable central banks".

It is also interesting that the Libra Association very explicitly uses the word "fiat" in describing the currencies that will be backing the Libra, and then uses the analogy of introducing a gold-backed currency, while explicitly rejecting any gold backing for the Libra.

The idea then is to create an anti-Bitcoin of sorts, a "stablecoin" in two of the areas that have been the biggest draws for many Bitcoin enthusiasts - the alternative to the global monetary system of fiat and inflation-prone currencies, and the wild price fluctuations that have characterized Bitcoin pricing to date.

In other words, there will be no point to trading or investing in Libras. Their value is intended to exactly track with the Libra Association's portfolio holdings of bank deposits and short term government securities in a number of developed nations. Because anyone can enter or exit at the value of the Libra on any day, there is no point in buying or selling at a different value.

#4 Complete Tracking Of All Minting & Burning

Libras will not be mined - but "minted" through an entirely different process. A Libra is created - or minted - when a normal national currency is spent to buy one. That currency (less any transaction fees) is taken by the Libra Association, and used to buy part of the pool of global bank deposits and government securities that form the Libra Reserve.

"The Libra Association also serves as the entity through which the Libra Reserve is managed, and hence the stability and growth of the Libra economy are achieved. The association is the only party able to create (mint) and destroy (burn) Libra. Coins are only minted when authorized resellers have purchased those coins from the association with fiat assets to fully back the new coins. Coins are only burned when the authorized resellers sell Libra coin to the association in exchange for the underlying assets."

So there is more or less a dollar for dollar (or local currency for Libra) exchange. If the Libra Association takes in a trillion dollars worth of Libra, it "mints" the Libras, and uses that money to buy a trillion dollars of global bank deposits and government securities.

Once the system is stable, the intent is undoubtedly that on most days inflows will at least more or less equal outflows, so there is little need to mint. However, when people are cashing in Libras faster than they are buying them, the Libra Assocation will "burn" the Libras, and sell sufficient Reserves to raise the cash to pay the money.

Again, this is 180 degrees different from Bitcoins - and the difference is entirely intentional.

It is also worth noting that the entry and exit of normal currencies in and out of the Libra wallets is entirely trackable, and this ability is very much built into the design of the system. Money has to be spent to buy the Libra, the Libra is then entirely trackable throughout its existence (albeit with the partial protection of being held in pseudonymous electronic wallets), and the wallet from which the Libra leaves the system and becomes a normal currency again can also be established. All it takes is the satisfaction of the protocols needed to pierce the pseudonym of the entry and exit wallet owners.

And of course, there is the alternative of the big data tracking of the online participants associated with each sale or transfer, as in the knowing the details of the associated Facebook account, even without knowing the pseudonyms, per se. Except they are saying they won't do that.

#5 Interest Income Goes To Association - Not Consumers

The Libra Association is not a non-profit association.

"Interest on the reserve assets will be used to cover the costs of the system, ensure low transaction fees, pay dividends to investors who provided capital to jumpstart the ecosystem (read “The Libra Association”here), and support further growth and adoption. The rules for allocating interest on the reserve will be set in advance and will be overseen by the Libra Association. Users of Libra do not receive a return from the reserve."

As an example, let's say that there were a trillion dollars of Libras outstanding once the system were fully established, and assuming that it had succeeded in its goal in becoming the global payment system, particularly for the "unbanked". For simplification, let's assume that the trillion dollars were invested at the U.S. overnight Fed Funds rate at about 2.40%. (Rates are much lower or even negative in many other nations.)

The annual income from interest income would be about $24 billion, to be split among the members - none would go to the people whose money that was. From that amount, expenses would need to be deducted, and transaction fees would be added in.

So the Libra Association would in essence become the world's largest bank depositor in that scenario - they just wouldn't share any of the interest. This reinforces the separation of Libras from the more investment-oriented cryptocurrencies. Owning a Libra is like buying a global basket of bank deposits and government securities, except that if you bought them directly, you would get the interest, and with a Libra - you don't.

The Association's members would also have some of the most valuable information in the world, in the form of an unprecedented understanding of global commerce right down to the individual level - they would just promise not to use it.

Or is the promise just not use the data on a personally identifiable level? And is the promise enforceable?

The Broader Context

The above analysis was rather quickly compiled in the first few hours after the release of the Libra Association white paper. It is based on a reading of that twelve page white paper. Far more information is likely to come out, and the nature of Libra itself is likely to rapidly evolve based on input from governments and participants, as well as the public. So, some of these initial interpretations may change as more information comes out, and when Libra does roll out in 2020 there could be material differences from the white paper.

What is happening with the Libra is fascinating, and it is a good fit for what we have been discussing in the workshops that some readers have been attending over the last several years. Cryptocurrencies are still in their infancy, and central banks around the world are fascinated by blockchain currencies - but not the same type of cryptocurrency as Bitcoin.

Libra could be seen as the first real world example of the "Fedcoin" crypto alternative, that is being researched by the Federal Reserve and other central banks. Like Libra, a national blockchain currency could be verified not by independent computers, but by the central bank's own computers - which then allows the creation of a single and comprehensive data tree. This would give the central bank or government an unparalleled degree of knowledge and control over its currency - and its citizens.

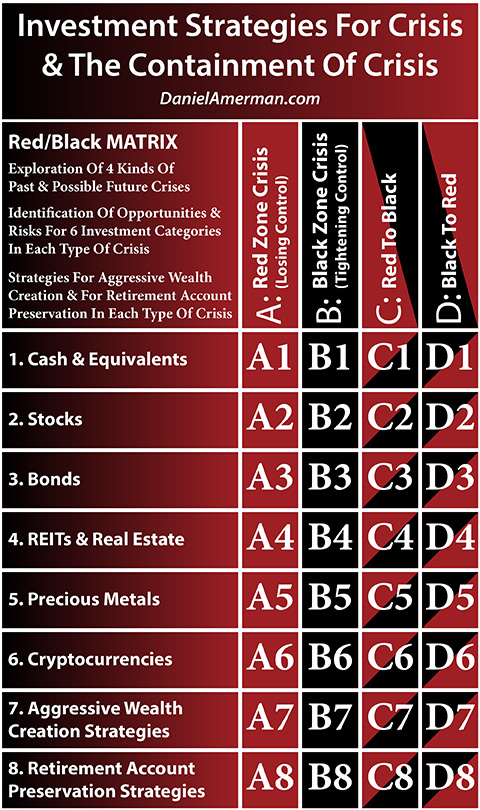

There are also very important implications with regard to the issues that will be faced by the Federal Reserve, European Central Bank and Bank of Japan if there is another round of recession in the near future. If we move back to a cycle of crisis as shown in the framework below, the central banks will aggressively move to another cycle of the containment of crisis, and there is a significant possibility of negative interest rates in the U.S., or more deeply negative interest rates in other nations.

An explanatory analysis for the matrix is linked here.

Focusing on row six above, if we look at a cryptocurrency like Bitcoin, then as a contracyclical asset, it could be an extraordinary beneficiary of another round of potential monetary crisis.

But, if we take the same crypto technology, and invert it, turning it to the opposite purpose, as with a Libra or Fedcoin - then what we get is enhanced corporate and governmental control over money and all savers. There has been some speculation that the power and efficiency of negative interest rates could be greatly increased if all currency were blockchain based, which could eliminate physical currency hoarding and other methods for avoiding negative rates.

Now, Facebook and its Libra Association partners likely have no plans or interest in becoming a mechanism for enhancing the power of central banking monetary interventions.

But the thing is, once the nature of things fundamentally changes - where that will lead to can be entirely different destinations than what was intended on the front end.

Bitcoin was to some extent an exercise in monetary idealism - that has given rise to its direct opposite, Libra. What Libra could give rise to, how it could be used, or what could replace it - can't be known with certainty now, but fundamental change does seem to be on the horizon.

*******************************